Financial Education Supports Garanga Community to Bring Back Life Into its School Canteen

Tags

Saving is no easy task. It takes goal setting, planning and discipline. When properly motivated and with the right tools, an individual can gradually improve his or her standard of living.

A bank account is one such tool that helps people to save, store their money safely and can also earn them interest. However, for many in the Garanga community in Isabel province in Solomon Islands, banking can be an expensive exercise costing up to SBD 50 (USD 6.20) to travel to the nearest bank branch. This usually means a two hour bumpy ride on the back of a truck through rough terrain to Buala town. For that reason, most people in Garanga prefer to save in money boxes or under the mattress at home.

Motivated to do something about this issue, a group of tertiary teachers and students of the Anglican Church of Melanesia’s (ACoM) Garanga Rural Training Centre (RTC) got together to start a savings club. Their inspiration for the savings club was born out of their learnings from an Australian Government funded – Pacific Financial Inclusion Programme (PFIP) financial education (FinEd) curriculum recently introduced at the school.

A savings club or group, is a simple financial service that caters to underserved communities around the world much like Garanga. Members meet regularly and contribute savings to a pool of funds. Payouts to members are often scheduled to coincide with planned yearly expenses such as seasonal planting, payment of school fees, or holidays, giving members access to funds when they are most needed. Unlike a bank account, the club does not charge any fees but requires periodic savings to be made by its members. Applying the financial management skills taught in FinEd, the club appointed a Treasurer to ensure proper record keeping and accounting of each members contributions.

Reviving the school canteen

Seeing the great discipline and enthusiasm of the savings club, the school’s management decided to move the financial management of the school’s canteen to the savings club. Previous mismanagement of the canteen had led to inconsistent opening hours, limited stock supplied, or sometimes no stock at all. This made the community of almost 200 people distrust its services and forced them to travel to Buala.

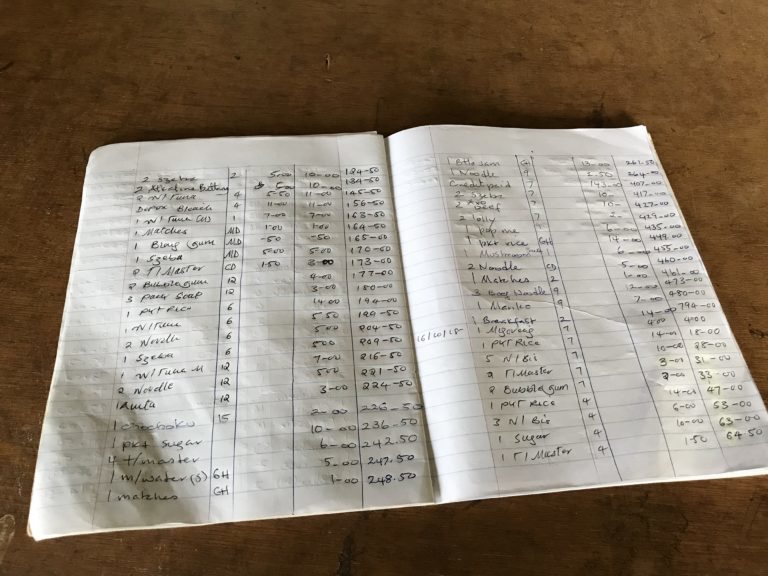

The savings club Treasurer also took on the responsibility of keeping track of the financial flow of the canteen in a transactions book. FinEd lessons have instilled stronger values around proper book keeping, investing and saving techniques, which helped the canteen progress.

However, upkeep of the canteen does not solely rest on the savings club. Each department of the school has been tasked with certain responsibilities to contribute to its upkeep and cash flow.

For example, each department must try to earn income from the items that their students make or plant during their classes. Items sold range from furniture, vegetables, cakes and clothing or the offer of their skills like carpentry. These items/services are sold to the surrounding communities and money made is used to purchase wholesale items for the canteen from a merchant store in Buala. Advantages of this initiative is that it encourages saving, investment, entrepreneurship, and the circulation of money within the community.

To drive ownership and to ensure that departments take their delegated responsibilities seriously, the school management has also offered shares in the canteen as an additional incentive for staff and savings club members.

Mr Reisa Misael, recently retired Principal of Garanga RTC says FinEd had brought new life to the school canteen and he has seen an increase in the canteen’s growth over the past couple of months. “Students and teachers now trust and feel safe to join the canteen savings group, because they know that FinEd is the reason behind its transformation. It has made us realize that proper budgeting and record keeping is important. Our teachers and students are really working hard to put into practice their learnings, especially on wise spending habits and how to save,” he added.

By December 2018, the total savings recorded by the savings club was SBD $12,446.00 (USD 1,220.00), all of which was fairly distributed to each member accordingly. Student boarders used the money to return home for the Christmas holidays.

Following the successful completion of the pilot, ACoM intends to roll out FinEd across all ACoM-run RTCs in the Solomon Islands, a move that is expected to impact close to 800 tertiary students annually.

This pilot FinEd project in Solomon Islands is part of an on-going PFIP FinEd regional initiative aimed at producing labour market-ready graduates who are better equipped to deal with financial decision-making.