Case Study: Credit Union Revitalization in Liberia

Tags

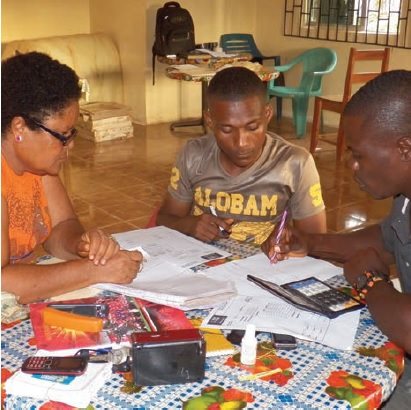

In post-civil war Liberia, the credit union system faced a multitude of challenges: a lack of basic infrastructure, a culture of aid dependency, and a population with little faith in institutions.

And then the Ebola epidemic struck.

In spite of the outbreak and resultant curfews, WOCCU-affiliated credit unions kept their doors open for members to access financial services.

Learn how WOCCU and four regional credit unions rebuilt community trust and expanded access to finance by leveraging mobile money, old-fashioned brick-and-mortar expansion, and savings groups in the case study, Credit Union Revitalization in Liberia, from UNCDF/MicroLead.

Download the case study by clicking the box below.

About MicroLead

MicroLead is a UNCDF-managed global initiative challenging regulated FSPs to develop and roll-out deposit services which respond to the rural vacuum of services. With the generous support of the Bill & Melinda Gates Foundation, The MasterCard Foundation and the LIFT Fund in Myanmar, MicroLead works with a variety of FSPs and technical service providers to reach rural markets, particularly women, with demand-driven, responsibly priced products offered via alternative delivery channels such as rural agents, mobile phones, roving agents, point of sales devices and group linkages. This is combined with financial education, so customers not only have access but can effectively use quality services.

Follow us on Twitter @UNCDFMicroLead