Are fintechs the key to achieving Zambia’s financial inclusion targets by 2022?

By Ali Akram

For more information on our work in the fintech space, please contact

Ali Akram

Digital Financial Services Expert ali.akram@uncdf.org

or visit mm4p.uncdf.org

Tags

Zambian National Financial Inclusion Strategy (2017 – 2022) targets an overall increase in financial inclusion (formal and informal) from 59% to 80% and in formal financial inclusion from 38% to 70%, by 2022.

In November 2017, the Ministry of Finance in Zambia unveiled the country’s first National Financial Inclusion Strategy (2017 – 2022). The strategy targets an overall increase in financial inclusion (formal and informal) from 59% to 80% and in formal financial inclusion from 38% to 70%, by 2022. The strategy highlights four drivers that would be key to achieving this including:

- Widespread and accessible delivery channels - Agents, branches, ATMs, points of sale and mobile phones.

- Diverse, innovative customer-centric products - Digital financial services, savings, credit, payments, insurance, pensions, etc.

- Finance for small-medium enterprises (SME) for agricultural sector growth - SME finance, agricultural finance, etc.

- Financial consumer protection and capability - Disclosure, dispute resolution, business practices, financial education, etc.

Zambia has broken through the “sub-scale trap”, with the percentage of the adult population actively using digital financial services growing from 4% in 2015 to 18% in 2016 and 60% being financially included. However, even with this growth, there is still a need to improve among new and existing customers. This presents a unique opportunity for fintechs to bring innovative solutions that better meet the customers’ needs and drive regular usage.

With this opportunity in the market, UNCDF undertook an exercise to find answers to the following questions:

- What does the fintech landscape in Zambia look like?

- What are the capabilities of the existing fintechs?

- What challenges do they face and what kind of support do they need to overcome these barriers?

Here are some of the insights we uncovered.

The fintech space in Zambia is small, but growing rapidly

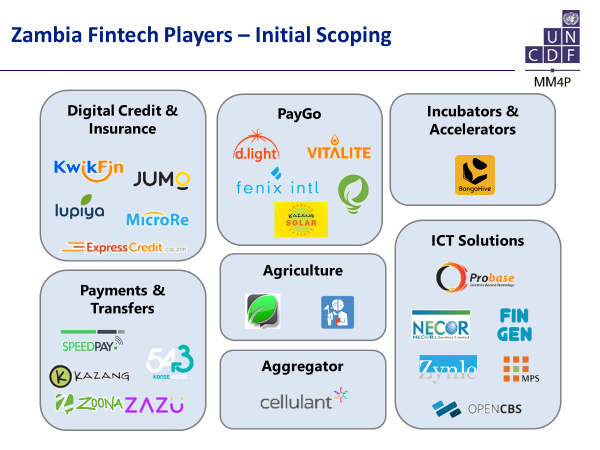

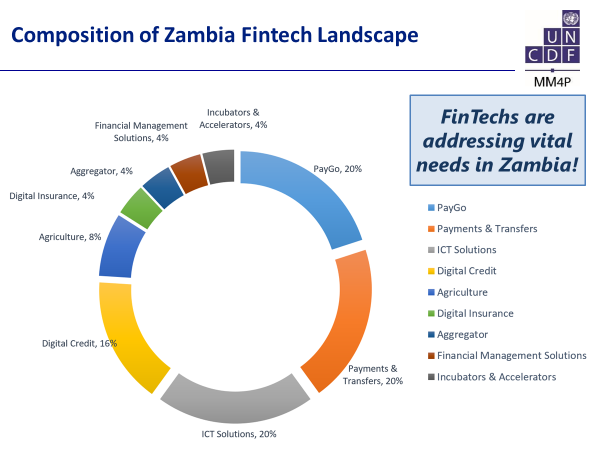

The preliminary scoping revealed that there are at least 25 fintechs developing solutions across sectors, ranging from financial services, Pay-Go Solar, health, education to agriculture. The chart below shows the local fintech industry and specific focus areas.1

There are many stakeholders critical to the success of fintechs in Zambia

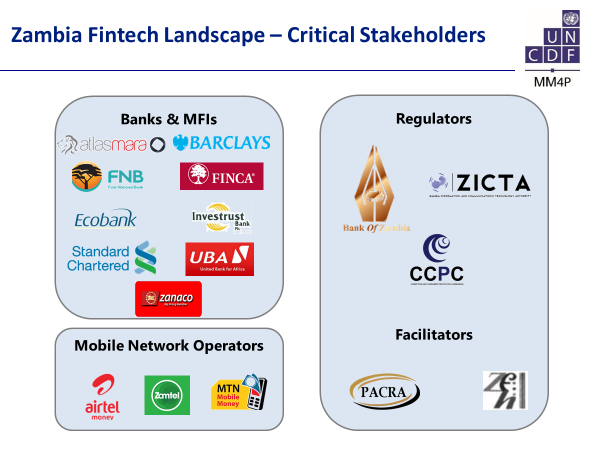

From banks and microfinance institutions to mobile network operators, fintechs in Zambia depend on partnerships with other institutions to function and remain sustainable. Regulators, particularly the Bank of Zambia and the Zambian Information and Communications technology Authority (ZICTA) are key to fostering the expansion of the fintech sector.

The Zambian market is ripe with opportunities

Research into user groups like farmers, refugees and mothers indicates opportunities to develop tailored digital finance products. There is no shortage of opportunities for fintechs currently in or potentially entering the financial inclusion sector to solve some of country’s infrastructural problems and bring financial services within the reach of all Zambians.

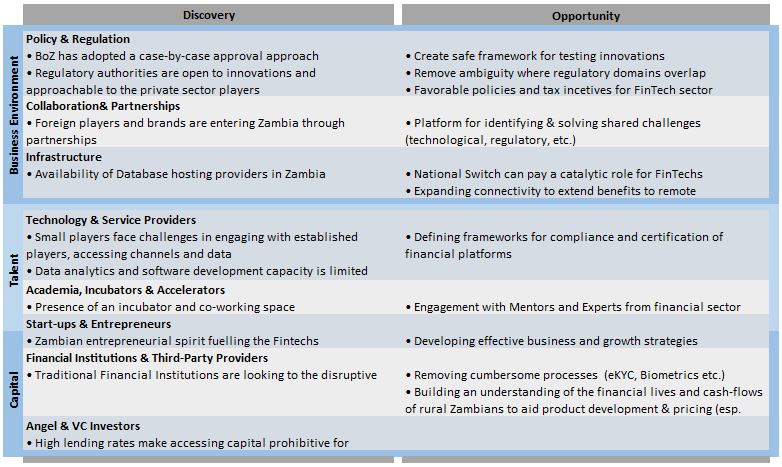

The biggest challenge fintechs in Zambia face is access to credit

To harness the opportunity, fintechs will have to overcome some of the following barriers that were identified in joint discussions between the them and other financial service providers.

Financial inclusion efforts will be hindered, and innovation limited, unless more financial service providers are willing to provide open APIs

Application programming interfaces (APIs) allow seamless communication between different platforms that can aid players overcome limitations of their traditional systems to leverage the innovative and data-driven approach offered by fintech companies. A concern expressed by fintechs was that the big players have been hesitant to integrate.

Discussions uncovered that for fintechs to integrate with digital and not-yet-digital finance providers, they need to prove that their platforms are secure and meet minimum industry standards. Fintechs also need to demonstrate a sustainable and mutually beneficial business case for their proposed solutions to encourage collaborations and investments by existing financial service providers.

Similarly, the financial service providers need to develop an internal API strategy that enables to capitalize on their existing customer base while opening to fintechs to create new business opportunities as well as improve existing products, systems, and operations.

Although still nascent, the fintech sector in Zambia offers the potential of removing constrains of established business models, specifically to help address the challenge of low financial access by creating new tech-enabled solutions that improve the availability, accessibility, convenience and security of financial services.

As UNCDF continues to drive digital financial inclusion in Zambia and support the Ministry of Finance’s efforts to achieve its financial inclusion targets, we look forward to engaging with fintechs to bring to life innovative solutions that address some of the pressing concerns facing the sector.

1.The chart is the result of a preliminary scoping and does not pretend to be exhaustive.↩