Rwanda: Expanding Financial Access & Digital And Financial Literacy For Refugees Programme (REFAD)

Uloma Ogba

Programme Coordinator

uloma.ogba@uncdf.org

Refugees from Nyabiheke camp engaging in a tablet-based finance training

Refugees from Nyabiheke camp engaging in a tablet-based finance training

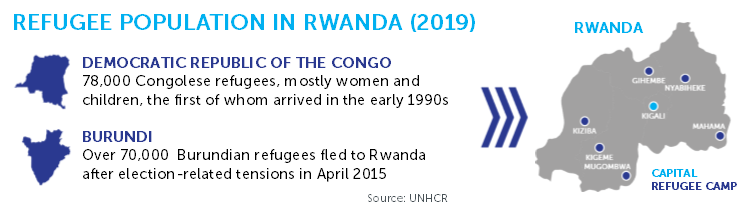

The world is currently witnessing the highest levels of displacement recorded in history. UNHCR reports that globally, 70.8 million people have been forced from their homes (2019). In Rwanda, the UNCDF ‘Expanding Financial Access & Digital and Financial Literacy for Refugees’ (REFAD) programme supports refugees and host communities by improving their access to finance and strengthening their digital and financial literacy.

Among all forcibly displaced persons (FDPs) are nearly 25.9 million refugees, over half of whom are under the age of 18. Sub-Saharan Africa hosts more than 26 percent of the world’s refugee population, partly due to ongoing crises in the Central African Republic, Nigeria and South Sudan and new conflicts erupting in Burundi and Yemen.

Mugombwa refugee camp at the Burundian border in southern Rwanda

The lack of access to a broad range of beneficial financial services exacerbates problems faced by refugees and limits their opportunities for economic growth and self-reliance. In Rwanda, over 150,000 FDPs remain “thinly” financially included and do not yet use available financial services regularly or to their greatest benefit. Both formal services and informal services, such as savings groups, have yet to reach a large number of refugees, particularly women and youth.

In January 2019, UNCDF Rwanda launched the ‘Rwanda: Expanding Financial Access & Digital and Financial Literacy for Refugees’ (REFAD) programme to enhance financial access and improve digital and financial capability for refugees and host communities.

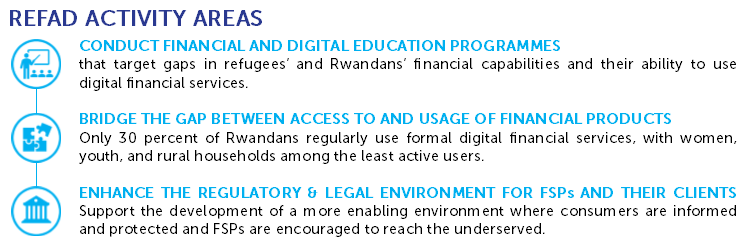

UNCDF partnered with Comic Relief and Jersey Overseas Aid to expand access to finance to refugees and host communities in Rwanda. The REFAD programme addresses the demand side of financial inclusion for the FDPs and their host communities by developing, testing, and rolling out innovative financial products and educational tools to build refugees’ and host communities’ financial and digital capabilities.

UNCDF partnered with Comic Relief and Jersey Overseas Aid to expand access to finance to refugees and host communities in Rwanda. The REFAD programme addresses the demand side of financial inclusion for the FDPs and their host communities by developing, testing, and rolling out innovative financial products and educational tools to build refugees’ and host communities’ financial and digital capabilities.

The programme further provides technical assistance to the supply side of Rwandan institutions, by building local capacity through strategic partnerships with financial service providers (FSPs), non-governmental organizations (NGOs), and community-based organizations.

Between 2019 to 2021, the REFAD programme seeks to reach 12,000 beneficiaries through savings groups and 37,000 beneficiaries through digital and financial literacy trainings to enhance access to and the use of beneficial financial services in Rwanda, with a focus on women, youth, and refugees.

Between 2019 to 2021, the REFAD programme seeks to reach 12,000 beneficiaries through savings groups and 37,000 beneficiaries through digital and financial literacy trainings to enhance access to and the use of beneficial financial services in Rwanda, with a focus on women, youth, and refugees.

It will further contribute to the achievement of the Sustainable Development Goals, in particular the Goal of Ending Poverty (Goal 1); Achieving Gender Equality and Empower all Women and Girls (Goal 5); Promoting Inclusive and Sustainable Economic Growth, Full and Productive Employment and Decent Work for All (Goal 8); and Partnerships for the goals (Goal 17).