Driving fintech innovation to promote greater financial inclusion and development in Rwanda

Aneth Kasebele

Digital Financial Services Policy Consultant, UNCDF

aneth.kasebele@uncdf.org

Tingting Li

Project Development and Communication Intern, UNCDF

tingting.li@uncdf.org

Tags

The fintech ecosystem in Rwanda has developed rapidly in the last 10 years. Numerous fintech start-ups have entered the market, offering a wider range of services to financial institutions, government entities, individuals and other business customers. While some start-ups are struggling to scale up and some are pivoting into other businesses, many others are looking to enter the market.

The fintech ecosystem in Rwanda has developed rapidly in the last 10 years. Numerous fintech start-ups have entered the market, offering a wider range of services to financial institutions, government entities, individuals and other business customers. While some start-ups are struggling to scale up and some are pivoting into other businesses, many others are looking to enter the market.

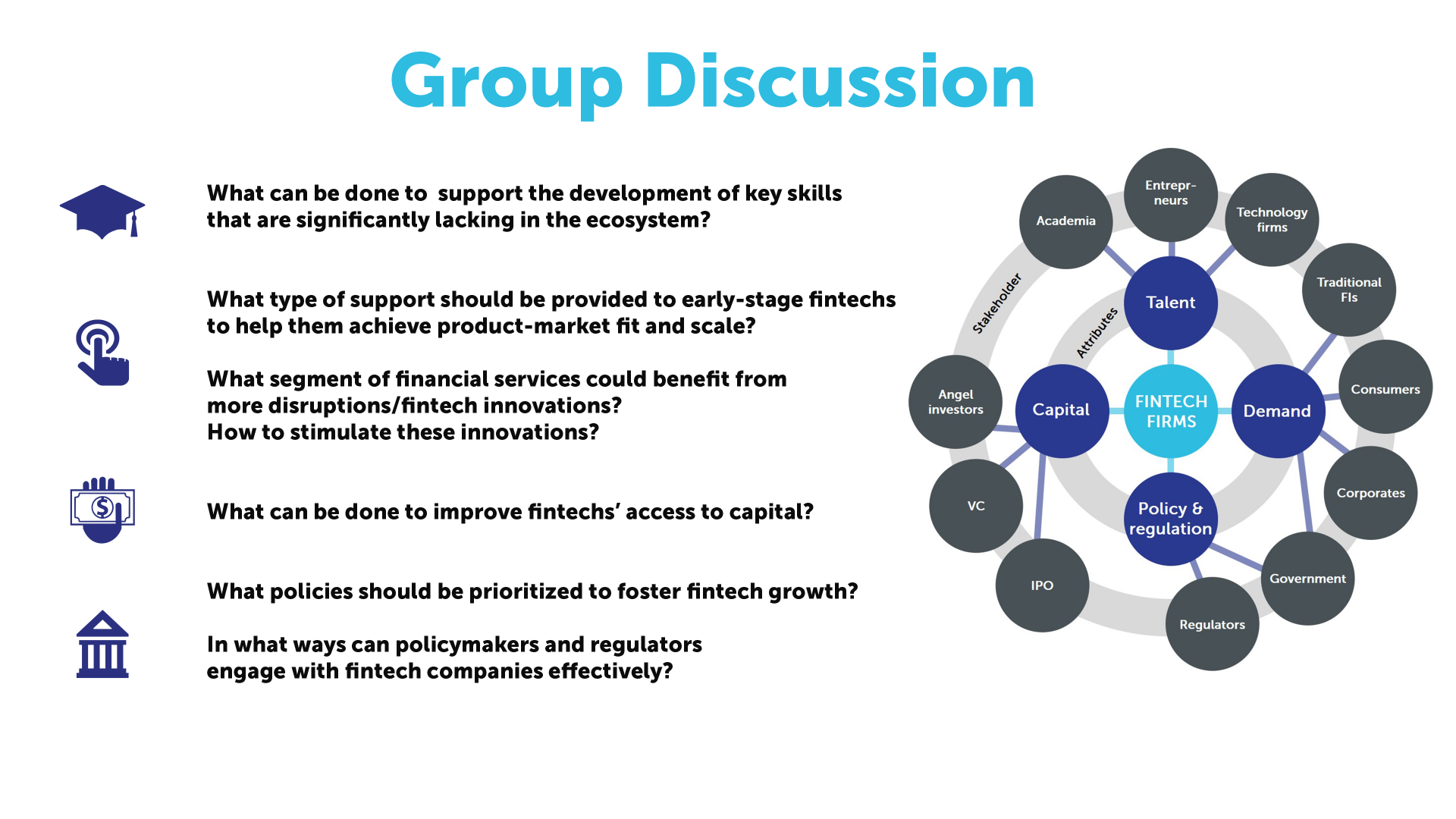

In an attempt to create a centralized repository of information about fintech companies operating in Rwanda, UNCDF conducted a fintech landscape analysis. The landscaping exercise uncovered key findings in four ecosystem attributes - talent, demand, capital and policy & regulation.

In order to share these findings, crowdsource ideas on potential recommendations and prioritize interventions, UNCDF held a workshop in Kigali in November this year. Stakeholders from private sector, public sector and NGOs actively participated and contributed ideas on what needs to be done on each of the four ecosystem attributes to boost fintechs in Rwanda.

Participants generated around 20 recommendations and through a voting process, they narrowed these recommendations to three priorities. The priority that resonated with most participants was to create a fintech-focused incubator or a fintech hub to foster innovation and develop solutions to shape the future of the fintech landscape in Rwanda. Coming next was advice on sustainability of data localization while improving the private-public partnerships mechanism ranked the third. The recommendations are incorporated in the report and used to identify areas of collaboration between UNCDF, regulatory bodies and fintech start-ups to promote innovation in Rwanda.

Participants generated around 20 recommendations and through a voting process, they narrowed these recommendations to three priorities. The priority that resonated with most participants was to create a fintech-focused incubator or a fintech hub to foster innovation and develop solutions to shape the future of the fintech landscape in Rwanda. Coming next was advice on sustainability of data localization while improving the private-public partnerships mechanism ranked the third. The recommendations are incorporated in the report and used to identify areas of collaboration between UNCDF, regulatory bodies and fintech start-ups to promote innovation in Rwanda.

Furthermore, the workshop facilitated dialogue between policymakers, regulators and fintechs. It allowed fintechs to raise questions on some of the key issues, including licensing requirements and entry barriers, access to common infrastructures such as national ID database, data privacy and protection issues, and policy incentives to help the fintech ecosystem grow. Such dialogues are important to ensure concerns raised by the fintech-space stakeholders are reaching the targeted audience. Therefore, this calls for an ongoing and a structured dialogue between the regulators, policymakers and market actors on different topics that they are both grappling with.

Overall, the fintech mapping exercise and the workshop have provided meaningful insights to us on areas of collaboration with different partners in Rwanda. These insights will inform UNCDF programme activities in order to create an enabling environment that drives fintech innovation and harness its potential to promote greater financial inclusion and development in Rwanda.

For the full report, click HERE.