Key Findings of Fintech Landscape in Rwanda

Tags

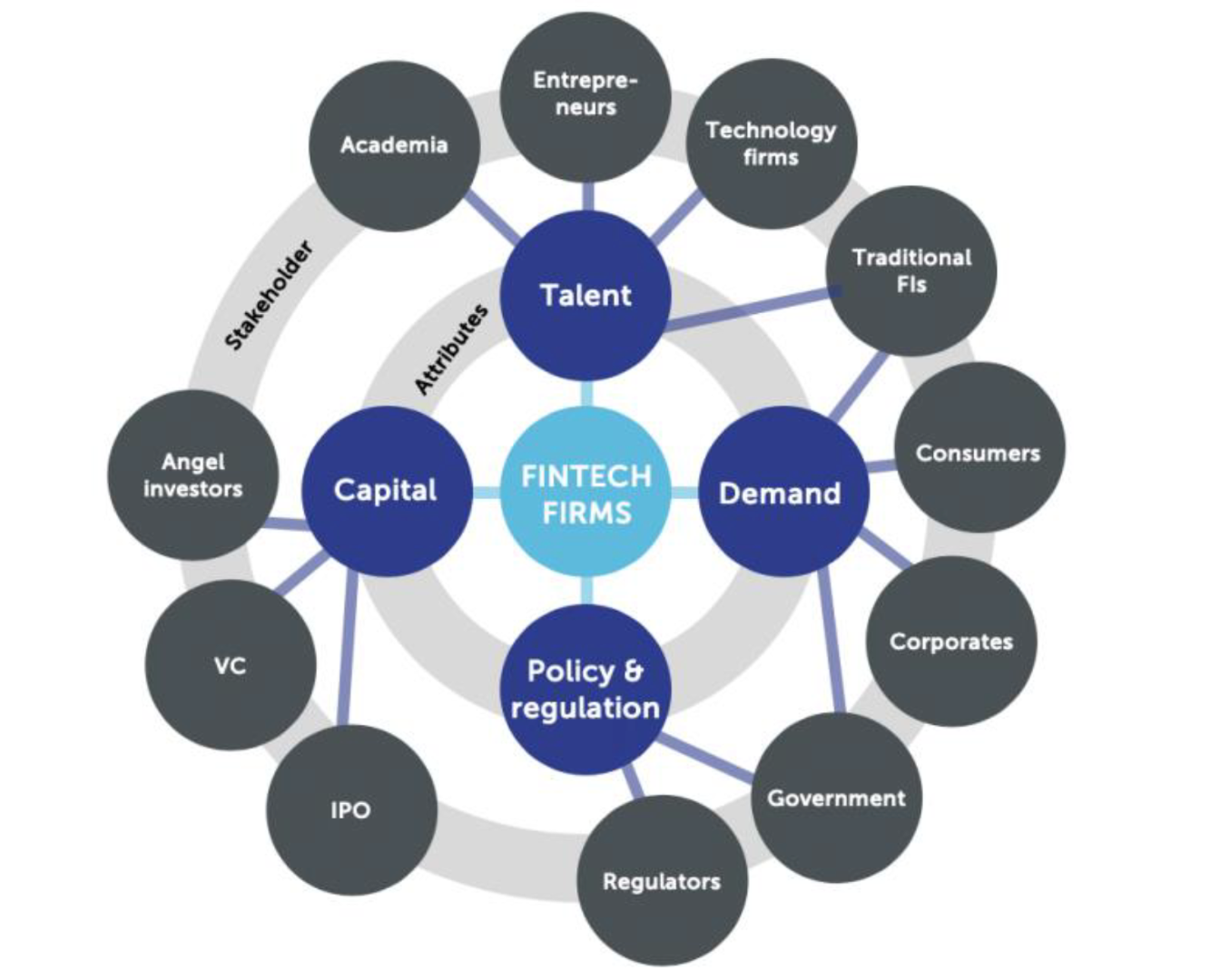

Figure IV: Fintech ecosystem

Source: EYGM Limited, ‘FinTechs in Sub-Saharan Africa: An overview of market developments and investment opportunities,’ figure 5, page 8 (London, 2019). Acronyms: FI, financial institution; IPO, initial public offering; VC, venture capitalist

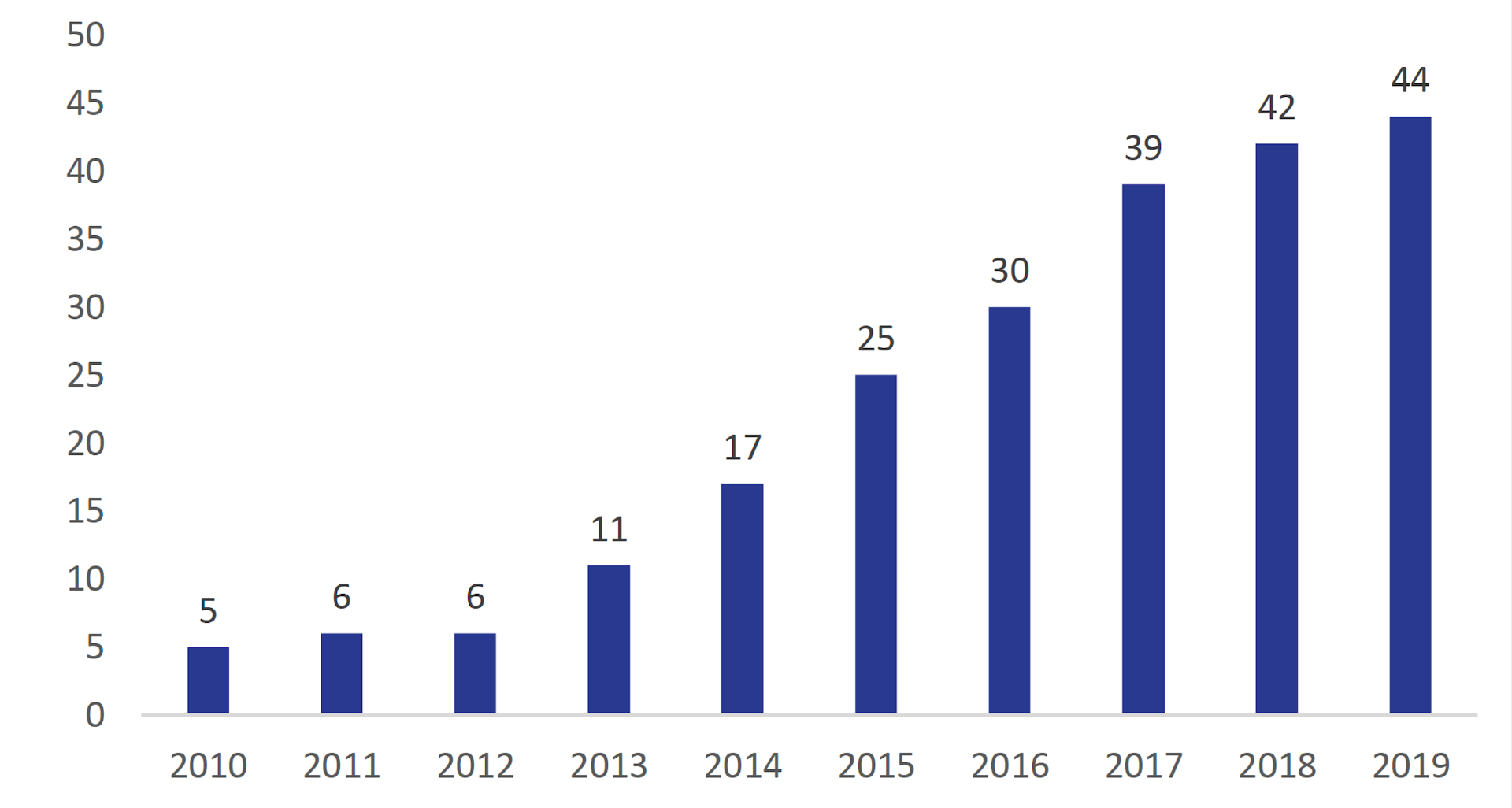

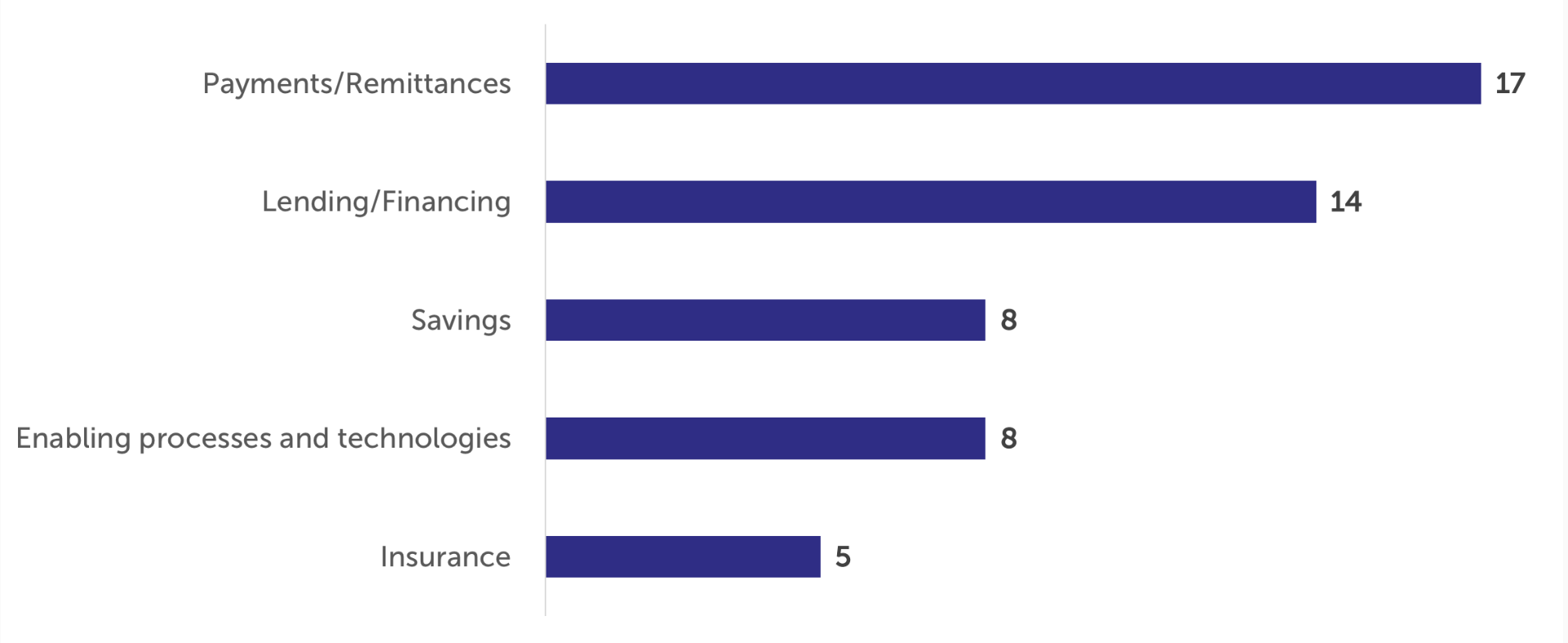

In Rwanda, fintech start-ups have almost tripled in the last five years, from 17 in 2014 to 44 in 2019 (figure I). Most fintech start-ups in Rwanda (75%) focus on “fin” rather than “tech”, with payments and remittances being the most common category of fintech applications (figure II).

Figure I: Number of fintech start-ups in Rwanda at year-end (2009–2019) Source: UNCDF internal

Source: UNCDF internal

Figure II: Number of fintech start-ups in Rwanda by subsector Source: UNCDF internal.

Source: UNCDF internal.

The fintech landscape analysis (figure III) is an attempt to create a centralized repository of information about fintech companies operating in Rwanda. The landscape analysis unearthed insights on the current and projected trends in each of the four core attributes of the fintech ecosystem – talent, demand, capital and policy and regulation (figure IV).

The report highlights some of the finding on each of the four aforementioned attributes. To begin with, fintech startups are heavily dependent on the founders, who may lack practical experience needed for start-ups to thrive. Start-up founders could partner with senior associates to match their technical skillsets with more practically experienced staff.

On the fintech solutions demand, start-ups have not been able to unleash the latent demand for diverse financial products and services. There is high concentration of fintech start-ups offering payment products and services, while demand in other segments such insurance or personal finance management remains unmet. Also, the low levels of financial literacy and trust in digital solutions limits fintech start-ups ability to reach a large proportion of potential customers. Moreover, start-ups trying to focus on business-to-business models are faced with complex procurement processes, particularly when engaging with large entities.

Similar to other African markets, funding prospect for fintech start-ups in Rwanda are very limited. In absence of local fintech-focused investors, start-ups heavily rely on foreign investors, who may lack knowledge and contextual understanding of the local market to interpret business risks on the ground. With limited access to seed and early-stage investors, many start-ups cannot afford good talent without raising capital. This is particularly because some specific skill-sets may be harder to find in Rwanda.

Some policies and regulations increase the entry barriers for fintech start-ups. For instance, data localization measures impose high data storage and hosting costs to fintech start-ups. This along with the annual USSD licensing and telcos integration fees raise start-ups’ operational costs and limit their ability to pilot and test products in the market. Besides, given their size and perceived risks, fintech start-ups do not have direct access to the National Identification database and the payment switch. Start-ups rely on partner banks and telcos to fulfill know-your-customer requirements and route money. This presents an opportunity for regulators to provide tiered access to the national ID database to enable efficient verification of fintechs customers. On the issue of access to the payment switch, fortunately, the ongoing Rwanda National Digital Payment System project is implementing a layer for an open application programming interface that would enable fintech start-ups to interact securely with the platform.

The landscaping exercise has highlighted key enablers and inhibitors in the Rwanda fintech ecosystem and proposed recommendations to move the ecosystem forward. The published report has generated insights on potential areas for ecosystem facilitators to collaborate and address some of the identified challenges. UNCDF Rwanda plans to leverage these insights in working with other ecosystem facilitators, including policymakers/regulators and private sector players to create an enabling environment that helps fintech start-ups achieve product-market fit and scale potential.

To see full report, click here.

To know more about the fintech landscape workshop, click here.