Testing “Lenga” a New Financial Education Kit in Tanzania

Tags

For the past three years in Tanzania, UNCDF and its partners have been developing and delivering financial education through a wide range of mechanisms, such as SMS (Arifu), tablet-based apps (Jijenge), videos (Noa Ubongo, Shamba Shape-Up), campaigns (Saving is Love), in-person trainings, and using savings groups as inclusive and supportive platforms for learning.

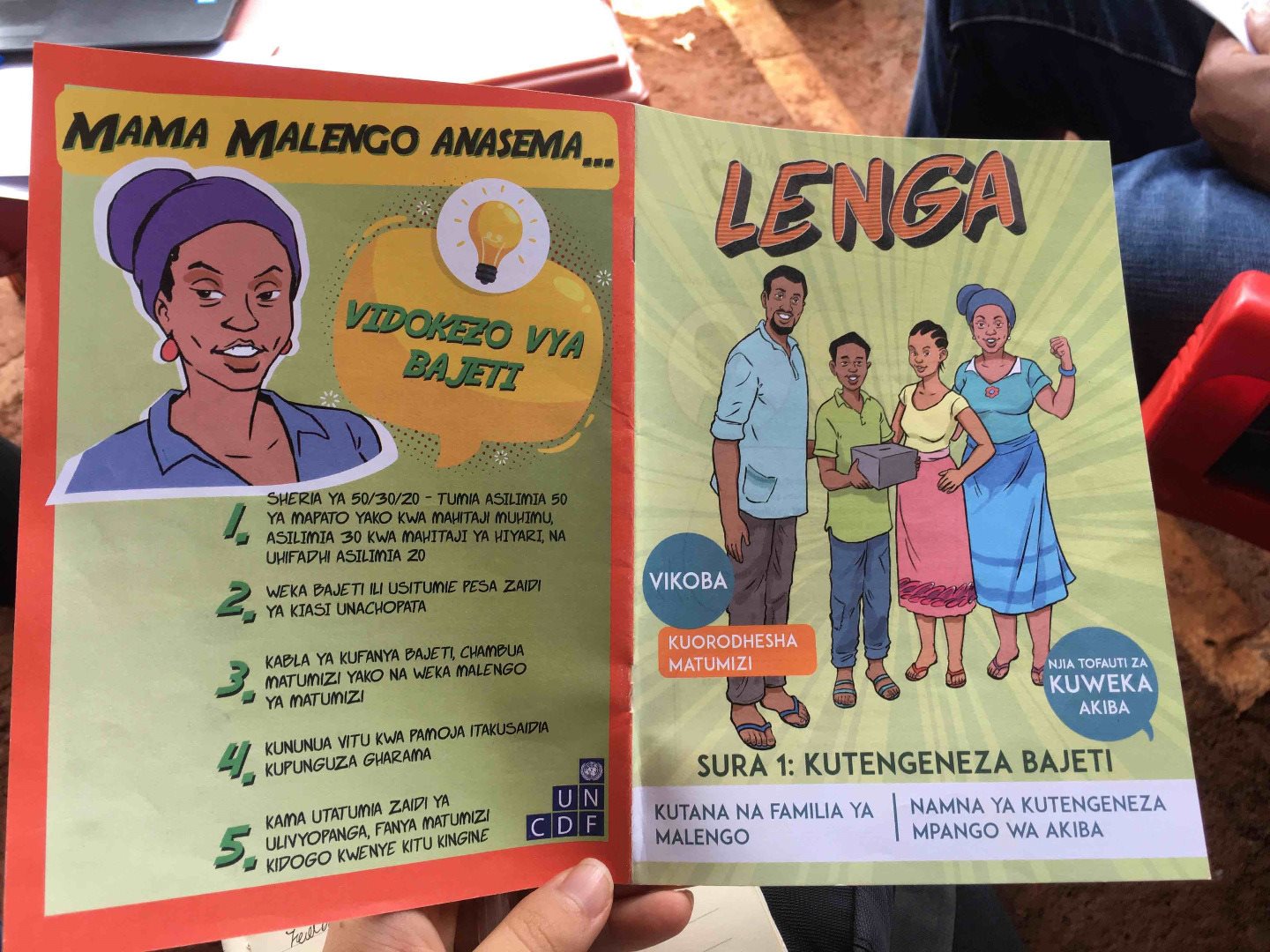

This year, UNCDF Tanzania through its partner KhangaRue Media (KRM) has developed new materials for savings group members in the Kigoma region: a podcast and a comic magazine called ‘Lenga’, which highlight the importance of setting financial goals and making actionable savings plans. These new materials tell the story of the Malengo Family who are working together to track and control their spending, save money properly and plan budgets for the future.

To test these materials before they are put into use, UNCDF and KRM conducted a field test in March 2020 to check their practicality. KRM and UNCDF visited groups near Kibondo to get future beneficiaries’ ideas on various aspects of the new materials, such as the likeability and meaning of the name, relatability of the characters, appropriateness of tone, language, believability, comprehension and relevance of the messages. The new materials were tested with implementing partners working with the target audience and savings group members themselves.

Great ideas were collected during the test. Those interviewed liked the podcast very much, a farmer named Rosalia stated that “This podcast has come at the right time as people need to hear this message. A lot of people we work with don’t know how to make budget for their families. I think it’s high-time now that these people get financial education. People need to understand the importance of sustainable goals and how they can benefit from them.” Rosalia is a member of savings group in Kibondo.

Mama Sarah’s story about her experience with her savings group, which is featured in the podcast, resonated with many interviewees. Alfred from the Danish Refugee Council added, “This story reminded me of when I joined a VICOBA (local savings group) and was able to pay for my twins’ school fees. I used to borrow money from my VICOBA to pay school fees for my twins. I am so happy that now they are in their first year at university.” It also received good feedback from the targeted audience. Two women near Kibondo told their stories about how they decided to join savings groups to be able to take care of their families after their husbands left them and they were tasked to run their households on their own.

Overall, people liked the name ‘Lenga’ and the way that the characters deliver their stories, which is natural and easy to follow. Most of the interviewees reported having life stories which resonate with Mama Sarah’s story. Mama Sarah is an example of women’s economic empowerment and resilience because she stayed strong even after losing her husband – something many female participants related to.

In addition, great suggestions were raised during the field test. Some suggested new content to be developed, such as the registration of savings groups, adding community facilitators as contact personnel, reinforcing that men should be part of savings groups, and the importance of talking about money management to children from an early age. More advice was also given on the design of the comic, such as making text larger and more readable.

UNCDF is working with different implementing partners in Tanzania, such as the Danish Refugee Council, Good Neighbors Tanzania and Kigoma Youth Agricultural Development Association, to form and strengthen savings groups in rural Kigoma and refugee camps.

Just recently, UNCDF carried out a training of trainers on the various material developed on digital and financial literacy (read article here). While COVID19 has urged a general downscaling of field activities, we are prioritizing the finalization and dissemination of the new material via local radio, community leaders and agents, in compliance with WHO guidelines and government directives. The podcasts will be released first and share information on COVID19.

We will be back with more news about building digital and financial capabilities in the last mile!