Fiji’s Electronic Welfare Transfer System

Tags

48% of beneficiaries said they were unable to perform transactions without assistance. This number rises to 63.5% of rural women.

Digitizing social welfare payments can be a win-win for all stakeholders involved when done right; the recipients of welfare receive their payments in a more convenient and cost-effective way, the government can streamline services to make them more efficient and reduce illegitimate payment, and the service provider gains more customers.

It was this thinking that motivated the Department of Social Welfare in Fiji to convert their paper-based voucher payments to a digital method of paying out support to families in need of income support.

Before the introduction of digital payments, recipients were required to collect a voucher every six months and visit a bank branch each month to collect their income support. During the transition these recipients were provided with a free bank account and debit card, and were offered financial literacy education and the welfare payments were made into their new accounts through electronic transfer.

In 2018 the project partners decided to assess the impact of digital payments over the last seven years. The result was an extensive study and a detailed report, which can be downloaded here. This was a rare opportunity to look at how this kind of project had impacted stakeholders over the years; research on the impact of digitization efforts is costly and direct linkages to poverty reductions are hard to state, making this assessment amongst stakeholders of digital social welfare payments unique.

The digitization of social welfare payments was led by the Ministry of Women, Children and Poverty Alleviation, together with Westpac Banking Corporation and with support of the Pacific Financial Inclusion Programme (PFIP). As the project was expected to have an impact on all three groups of stakeholders interviews were carried out not just with welfare beneficiaries, but also with representatives of the Department of Social Welfare and the Ministry of Women, Children and Poverty Alleviation.

Key Findings for Welfare Beneficiaries

There were some clear benefits to beneficiaries. They saved time and money collecting their allowance in comparison to the previous voucher system, around 3 hours and 40 minutes every six months and up to 4 hours in urban areas and a saving of FJD 4 transport costs per 6 months. Beneficiaries also have easier access to their funds. They can collect their money at Westpac in-store agents (36.9% of surveyed use this option), bank branches (20.9%) and ATMs (18.1%). However, 23.6% of recipients still only use the same access points they did when receiving the vouchers and do not use EFTPOS machines or ATMs.

For a large majority, this was the first time in their life they gained access to a bank account.

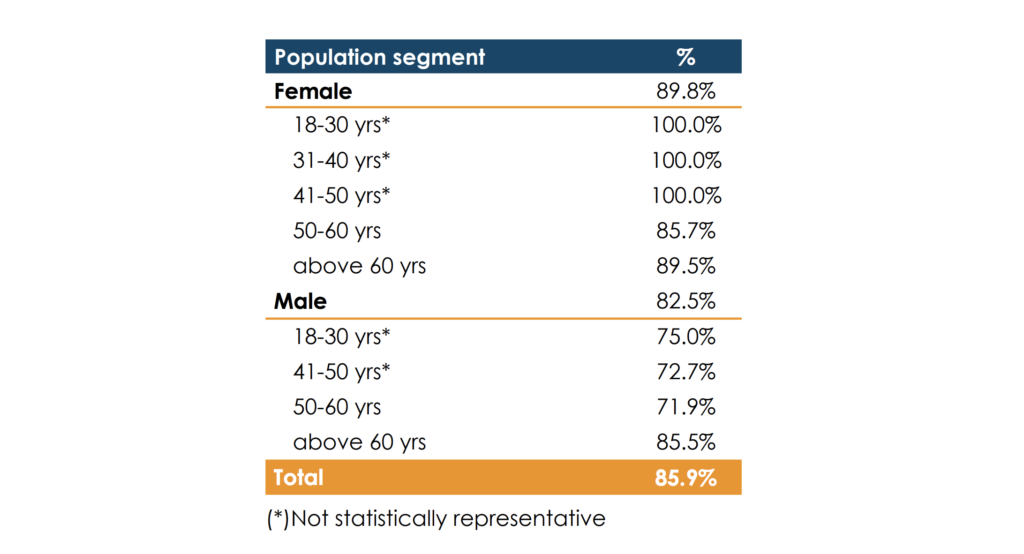

Percentage of beneficiaries who used a bank account for the first time as a consequence of the G2P project, by age and gender.

Percentage of beneficiaries who used a bank account for the first time as a consequence of the G2P project, by age and gender.

However, only a small amount of people reported using this account for other purposes than withdrawals; 9.3% of people use cash deposits, 7.5% of recipients regularly check their balance and 3% of customers use their accounts to pay bills. These results indicate that these services remain largely underused.

The analysis also revealed a limited effect on savings behaviour, with only 18% of beneficiaries using their bank accounts for saving purposes. These beneficiaries were still saving; they just preferred to keep savings at home as they felt this gave them easier access to their money. Nevertheless, the study also showed that beneficiaries who did choose to use their accounts for savings managed to save an average of FJD 4 more and were less likely to spend all their money at once.

The reason why these numbers are low might be revealed by the fact that 48% of beneficiaries said they were unable to perform transactions without assistance. This number rises to 63.5% of rural women.

Percentage of population who can perform certain tasks during a financial transaction without any assistance.

Percentage of population who can perform certain tasks during a financial transaction without any assistance.

The financial literacy training offered as a part of this project might be expected to have had a significant impact on their ability to perform these tasks. However, the training only reached 19% of the total number of beneficiaries. There were geographical disparities in this number, as only 5% of rural beneficiaries received it compared to 28% of urban dwellers. As expected, people that did receive financial training tended to outperform people who didn’t; not cashing out the full received amount (allowing them to manage their money better over time), tending to prefer the bank account as a savings tool, and feeling more confident using financial services.

This will also extend the benefits for the service providers. While the digitization of payment has led to 69,550 more customers for the bank, these customers are not necessarily increasing profits, as they are not using other financial services besides cashing out. As the increased number of customers were unsure about how to carry out transactions it also led to more congested branches as they sought help.

Financial Education key to increased impact for beneficiaries and service provider

The transition from the paper-based voucher system to the digital system with Westpac was to have a great amount of impact on all stakeholders involved. And, years later the majority of welfare recipients prefer the new arrangement over the old.

While people do save money and time accessing their payment and have access to financial services previously unknown to them, it is hard to measure whether or not this new payment modality has enhanced income levels and welfare at a household level. Changes in savings and expenditure behaviour were limited.

The minority of people that did receive training on how to best use this new account showed more promising behavioural changes. This suggests that the benefits of digitizing social welfare payments can be increased by ensuring that the beneficiaries know how to use the new technology they gain access to. By investing in improved and expended financial literacy projects such as these have the potential to impact the overall income and welfare of households at the same time as providing benefits to the Department of Social Welfare and financial service providers.