Third Time Lucky: How PIN Codes are Inhibiting the Uptake of Mobile Financial Services in Papua New Guinea

As with many other places in the world the first case of COVID-19 was detected in Papua New Guinea (PNG) early this year. This quickly led to the introduction of many measures to slow down the spread of the disease.

These restrictions on the movement of people and temporary closure of businesses also impacted one of the pilot projects from our partner MiBank in Goroka, a town located in the Eastern Highlands province of the country. Here, the bank, with support from the Pacific Financial Inclusion Programme (PFIP) created an Agent Network Innovation Lab to design and test a commercially scalable agent network model to serve low-income Papua New Guineans working and living in the Highlands.

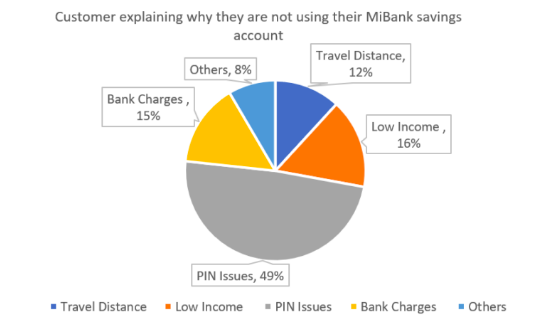

The lockdown imposed all across the country was hindering the onboarding of new customers and had a significant impact on the bank’s agents that were serving these customers. In the months before the COVID-19 pandemic hit PNG, from January to March 2020, activity rates of the services were at around 30 percent. For that reason we decided to find out why the other 70 percent were not actively using their newly opened accounts. Over 1,400 customers were contacted by phone and all 15 pilot agents were interviewed on the challenges they face in making their business a success.

The feedback from these interviews revealed many limitations to the value proposition for rural farmers from in and around Goroka who make up the majority of the customer base. Some farmers mentioned that the distance to the nearest agent was still too far, some found the charges on transactions too high and people indicated they simply did not have enough money to put aside into their savings account. But one striking response that really stood out, was that nearly half of the customers we spoke to said they were not using their account, because they had forgotten their four digit PIN required to access their account.

And agents confirmed this. Kelly Sasuwo, a MiBank agent in a betel nut market in Goroka, where he performs transactions from his small shop, said that nearly half of his customers had forgotten their PIN and after three wrong entries, many accounts got blocked. To some of his customers, this happened several times, after which they give up using their account all together. These insights corroborate earlier reports by GSMA that low digital literacy rates have a significant impact on the adoption of mobile financial services in the country.

Choose your own PIN…

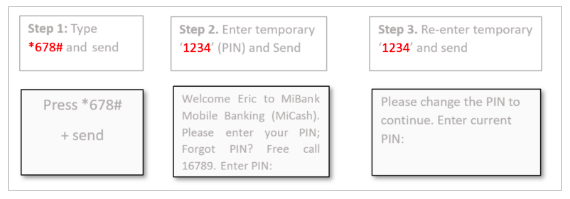

So how to go about this challenge? Customers who sign up for their MiBank mobile savings account receive a temporary PIN that is included in the SMS confirmation message as soon as the account is created. Then, the agent assists the customer with resetting the PIN with a four-digit number that the client can easily remember. Agents play a crucial role at this stage as they educate customers on this essential feature.

…or moving beyond the PIN

PIN codes and passwords are among the oldest method of authentication in history. They remain very popular, and for good reason. They are simple and somewhat effective at deterring fraud.

The problem is that they are also fairly easy for others to steal and as we have seen from our own research, they also hinder the customer experience. They just add more friction to the payment process, especially in the case that a customer forgets their PIN.

Beyond the above mentioned ‘hand holding’ by the MiBank agents to support the customers with the creation of their PIN some alternatives that do not require the use of a PIN should be considered for customers with low digital literacy levels.

For example, a biometric solution could be used to facilitate the authentication of the transactions done by the customer. Biometrics, mainly fingerprint authentication, is regarded as one of the most effective authentication measures in the payments industry and is already successfully used by Women’s Microbank Ltd, another PFIP partner in Papua New Guinea.

Such a biometric identification system will significantly minimize risk for customers as their transactions can only be done using their fingerprint, but more importantly it is a much more convenient way since they do not need to memorize their PIN.

In short, biometrics are seamless. They are fast and do not require any effort on the customer’s part, because they do not need to remember anything.

The Innovation Lab has shown the real value of testing and piloting new agent banking models. Insights, such as the hurdles with the PIN provide directions for how these services can be adapted to create a value proposition for all customers, and not only those that are tech-savvy.