Closing the Pension Gap in the Pacific

Tags

People are getting older. So many of us are living longer lives that today one in five people is older than sixty. And as demographics are changing all across the globe, so are the ways we care for the older generation.

Traditionally, in most cultures, the elderly are being looked after by their children. People would live with their larger extended families, help out in the garden, do some light household work and look after their grandchildren. And in exchange, they would be cared for themselves. Today however, this is no longer evident. And this also applies in the Pacific, where historically the Wantok system guides family patterns[1]. A growing number of people living in Pacific Islands Countries are aware that their traditional family culture is changing rapidly. They realize this change is being driven by an increased longevity, urbanization and emergence of smaller nuclear families[2]. These changes mean that the older generation can no longer rely on their adult children for support.

In order to deal with these shifting social structures and the impact this transformation has on the financial health of especially people working in the informal sector, Pacific Islanders are encouraged to consider their future. And to start saving for later.

Converting informal savings into smart savings

People have always found informal ways to save. By investing in a home, with a collection of gold bracelets or saving money in a sock hidden under the bed. Many people also save collectively through savings groups, who additionally often give money in case of life emergencies such as funerals.

However, in order to provide substantial financial support across later life, savings need to be invested to yield long term interest. Especially given the scale; more and more people living longer with fewer children to support them. The need for long term financial planning and investments require people to move from informal savings to smart savings. That way a combination of private funds and investments, such as that home, in combination with a state pension (if available in the country) and a personal pension scheme, will ensure the financial well-being of informal workers in the Pacific[3].

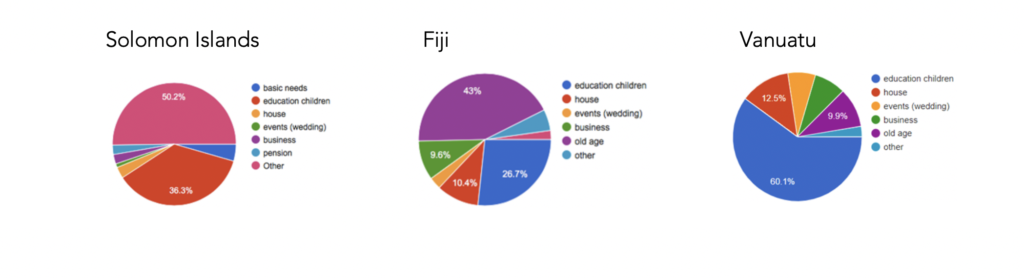

That is exactly why the UN Pacific Financial Inclusion Programme, together with Blueprint Pension Services conducted studies across Fiji, Vanuatu and Solomon Islands; to assess whether or not islanders see the need to financially secure their future. And to then offer them an affordable way to start building their pension fund.

In all three countries, the respondents were not only concerned about their financial situation today, but also about their income in old age. A majority of people expect to receive financial support from their family when old. In Vanuatu this was even more than three quarter of the people interviewed.

Although saving for retirement is not a top priority when asked about the percentage of their income they could or would contribute to a pension scheme, in Fiji about half of the respondents said they could set aside around 5 to 15% of their current earnings. In Vanuatu about 80% of people stated to be able to contribute anywhere up to 5% of their income and in Solomon Islands over 60% of respondents agreed to the same proportions.

Encouraging insights for project partners and that is why immediately after these studies were conducted, an informal savings product was created in Solomon Islands. This successful youSave micropension product developed with the Solomon Island National Provident Fund, also takes into account customers’ preference to access some parts of their savings for short-term needs. Such as the payment of school fees for children.

Digital solutions to bridge distances

In order to reach informal workers, often living in rural areas of the country, the pilot aims to onboard customers using digital technologies. With the usage of digital technologies clients literally save time and money travelling to service points. Customers are also encouraged to make deposits into their pension account by using their mobile phone. And now people can use airtime credit to deposit savings into their pension account.

Lesson learned during the development, testing and scaling of the youSave product are shared here. And experiences from Solomon Islands are now being adopted for the development of a similar micropension product in Vanuatu and explorations are ongoing to improve the voluntary pension product in Fiji as well.

[1] (Wantok can be defined as the set of relationships (or a set of obligations) between individuals characterized by some or all of the following: common language (wantok = one talk), common kinship group, common geographical area of origin, common social associations or religious groups and a common belief in the principle of mutual reciprocity (de Renzio, P.: https://www.qeh.ox.ac.uk/sites/www.odid.ox.ac.uk/files/www3_docs/qehwps27.pdf)

[2] Results from micropension feasibility studies conducted by Blueprint Pension Services on request of the UN Pacific Financial Inclusion Programme in Fiji, Vanuatu and Solomon Islands.

[3] https://www.successfulmicropensiondesign.com/free-e-book-2/