Briefing Note 1

Financial Health: The Growth Engine & Imperative for Banks

Written by: Mayank Jain, Akshat Garg and Fang Deng

Contact for more information:

Jaspreet Singh, Global Lead on Financial Health and Innovation, jaspreet.singh@uncdf.org

Rakhi Sahay, Partnership Specialist, rakhi.sahay@uncdf.org

Tags

© UNCDF/Aizuddin Saad

© UNCDF/Aizuddin Saad

UNCDF's Centre for Financial Health is initiating a learning series on individual financial health and its relevance to public and private actors. This first briefing note is for financial service providers and talks about how aligning business strategy with customers' financial health can help them boost their growth, profits, competitive edge, and customer trust.

Introduction

Personal financial health has become more imperative in a pandemic world. Individuals who lost jobs or closed businesses still had bills to pay and families to feed. Financial insecurities were experienced across income strata due to unexpected loss of income, increased medical expenses, and or unpaid bills. Vulnerable segments such as low-income, unemployed, elderly, disabled, and microentrepreneurs were disproportionately affected.

Increasingly, regulators are looking to financial service providers to help customers to maintain sound financial behaviour and stay in control of their finances. Customer expectations from their financial providers are also shifting from merely offering financial services to providing solutions that help customers to improve their financial health.

Aligning business strategy with customers’ financial health is an untapped opportunity and imperative for banks and other financial service providers (FSPs) to boost profits and growth, improve customer engagement and trust, personalize solutions, and create competitive advantages. Financial health can also serve as an objective lens for banks to embed and drive consumer protection in all their business processes.

This article aims to create a better understanding of financial health and present the opportunities for financial service providers, particularly banks. We discuss the financial health concept, its measurement, and emerging evidence and trends that suggest there is a strong business case for banks to focus on customers’ financial health.

What is financial health?

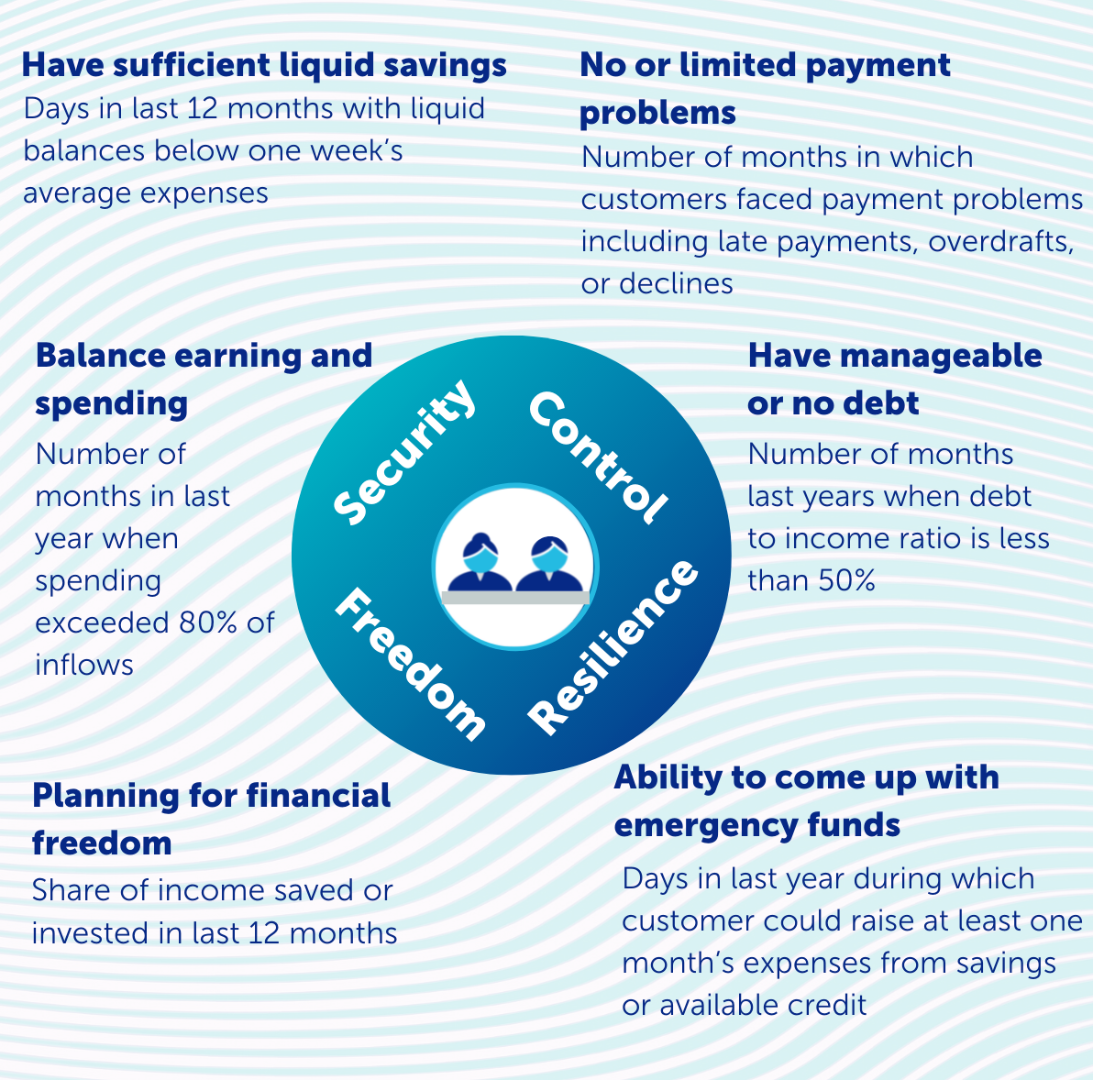

Just like banks, individuals also have financial goals of having sufficient liquidity to manage short-term expenses (i.e. financial security), protection against foreseen risks (i.e. financial resilience), balancing assets and liabilities (i.e. financial control), and accumulating cash for financing future goals (i.e. financial freedom). All these financial outcomes put together are generally referred to as ‘financial health’ (or financial wellbeing).

Financial health is influenced by a variety of individual and external factors. Direct drivers of financial health include money use behaviours (such as saving, spending, and borrowing), financial confidence and control, socio-economic variables of income and expenditure changes, and work status. In addition, factors such as money management behaviours (i.e., budgeting and keeping track of money), financial attitudes, knowledge, and experience indirectly impact financial health. Figure 1 below depicts the simplified conceptual model of financial health.

Figure 1: Simplified Conceptual Model of Financial Health

Why financial health of customers is a growth engine for banks?

Aligning business strategy with the financial health of customers can result in better financial and social returns for financial service providers. Below we discuss how.

A pathway to sustainable financial success for both customers and banks

When customers achieve financial success, it translates to higher customer lifetime value and profits for banks. Financial healthy customers are likely to save more, pay bills on time, and are less likely to default on loans. Financial healthy customers also have higher levels of engagement with providers as they actively access services such as financial planning and budgeting.

Financial health also positively influences customer retention and product cross-sales through improved customer satisfaction. A recent study by the Financial Health Network, shows that customers who believe their financial institution cares about their financial health are three times more likely to be ‘very satisfied’ with their primary financial institution and five times more likely to be interested in purchasing additional products and services.

No wonder ‘ensuring customers' financial success’ is increasingly becoming central to the business strategies of the leading global banks. For example, BBVA USA’s new 5-year Strategic Plan prioritized ‘improving customers’ financial health’ as the number one pillar for ensuring that customers and business achieve their financial goals. ANZ’s growth strategy is not focused on lowering costs but on developing a culture built around delivering better financial outcomes for its customers. Discovery Bank follows a shared-value banking model that encourages customers to enhance their management of money and health and incentivizes positive financial behaviour by giving preferential interest rates on savings and debt. When clients do well financially it creates more value for the bank.

Drives customer-centric innovations

Access and use of financial services is not the end goal of customers. Customers want their primary banking partner to help them better manage money and achieve financial goals through need-centric financial products, services, and advice.

Sadly, the current state of banking is centred around financial products and services that are financially healthy for banks but not necessarily for customers, particularly the vulnerable segments. Practices such as overdraft charges, opaque fees on (cash) transactions and minimum account balance, complex credit terms, and forceful selling can be severely detrimental to the financial health of low-income and vulnerable customers.

Instead, banking should be made simple and be about incentivizing financial behaviour that improves customers' financial health. Research studies suggest that financial health is directly influenced by active saving, manageable borrowing, spending restraint, and financial control and confidence. It is around these elements financial services should be designed.

Designing customer outcomes-centric financial solutions also require developing a deep understanding of customers’ needs, challenges, and goals. Financial health can be a fresh lens for banks to examine customers dynamic financial needs and situations and create solutions that best meet those needs. Combining financial health framework with customer-permissioned financial data from open banking can enable banks to develop targeted solutions and experiences.

Needless to say, banks having a better understanding of consumers’ financial conditions and budgeting behaviours can proactively recommend personalized financial products at fair prices. In fact, global leading banks such as BBVA, Commonwealth Bank of Australia, and DBS Bank Singapore, are already applying financial health metrics and data science to the trove of transactional data in order to offer automated financial planning advice, lending to customers with no credit history, and digital nudging for improving financial behaviour.

Differentiate your business and offerings from the competition

The financial services sector is getting crowded with the rise of challenger banks and fintech. When everyone is embracing a better customer experience and digitalisation in the sector, true competitive advantage can emerge for banks aligned with customers’ desired financial goals.

A recent study by Financial Health Network in the USA finds that 80% of customers want their primary financial institution (PFI) to help improve their financial health, yet only 14% of customers agree that their PFI is doing this. These insights point to changing customer expectations as well as a huge untapped business opportunity for financial service providers.

Banks can respond to this challenge and opportunity by building a business strategy around customer financial health to gain a competitive edge in a saturated market. A financial health-centric strategy can also help banks to cement their reputation as an innovator and demonstrate their commitment to fair and responsible banking.

Enhance customer trust and loyalty by demonstrating financial outcomes

Customer trust is the most important currency of a bank because it stimulates customers engagement and produces financial returns. Simply put, any bank’s success will depend on its ability to inspire and maintain trust between itself and its customers.

Yet, customer trust in the banking sector remains low as per Accenture’s 2020 Purpose-Driven Banking study. Furthermore, a recent Financial Conduct Authority study finds that only 42% of UK adults had confidence in the UK financial services industry and people in vulnerable situations trust the industry even less.

Customer trust can be improved by delivering personalized and proactive financial services that help customers to meet their financial goals and build financially secure lives. These include, but not limited to, offering digital tools for budgeting and financial planning, encouraging saving for emergencies, preventing over-indebtedness, and protecting customers against frauds. This is also enough hard evidence to support this narrative. More recently BBVA finds that customers using financial health solutions have reported higher levels of satisfaction, loyalty, and lower attrition.

Customer trust can be further strengthened by objectively assessing and demonstrating that financial solutions offered by your banks are actually advancing, not detracting from customers’ financial health. This can be achieved by embedding financial health into key performance indicators (KPIs) and tracking outcomes that indirectly influence financial health. When customers see their progress towards financial success, the chances are that banks will have more trusting and loyal customers.

Stay ahead of the financial consumer protection regulations

Focussing on customers’ financial outcomes is increasingly important in the digital era where financial providers operate invisibly and products such as peer-to-peer lending and Buy Now Pay Later (BNPL) can both benefit and harm people, particularly vulnerable, financially. Experiences from previous financial crises also suggest that a set of voluntary consumer protection principles alone are always not sufficient for providers to act in consumers’ interest.

As a result, global action on customer protection is shifting regulatory landscapes and markets to make financial providers accountable for their actions. Newly proposed regulatory frameworks are aligning towards putting a significant burden on financial firms to deliver good customer outcomes through good products and services at fair prices, high standards of customer service and clear communications, such as the proposed Consumer Duty in the UK. All this seeks to ensure that consumers build trust and confidence in the financial system and achieve good financial outcomes.

The financial health framework offers a potential approach for providers to assess and track the impact of financial products and services on consumers’ financial outcomes. Early planning to prioritise consumer financial health as a strategic imperative can help financial firms to stay ahead of the regulatory curve and win.

Demonstrate your contribution to SDGs

There is unequivocal evidence that existing leading indicators of prosperity and societal welfare such as GDP per capita, employment rate, and household income do not comprehensively capture people’s economic well-being. Also, it should not be assumed that access and use of existing products and services will necessarily promote, rather than damage, consumer financial health.

Recent data from a few high-income countries suggest that high levels of financial inclusion, financial literacy, and income do not always translate to financial health. For example, the 2021 Coronavirus Financial Impact Survey in UK finds that nearly 27% of households were either struggling to manage or in serious financial difficulties. Financial health pulse 2021 survey in the US finds that 14% of adult Americans are struggling financially, and 52% of them are struggling with some aspects of their financial lives such as spending, saving, borrowing, or planning.

Financial health is the intermediate linkage between financial inclusion and key sustainable development goals (SDGs), including SDG 1(No Poverty), SDG 3(Good Health and Wellbeing), SDG 5 (Gender Equality), SDG 7 (Decent Work and Economic Growth), SDG 10 (Reduced Inequalities).

Financial resilience- a dimension of financial health- has been increasingly advocated and pursued as a sustainable development instrument to guarantee that low-income customers do not fall back into poverty due to economic shocks. Banks can amplify the financial resilience of customers by promoting saving for future and emergencies, responsible borrowing, and where possible lowering the cost of money transfer for vulnerable segments.

Research also suggests that financial health affect, and it is influenced by physical and mental health. Banks can create incentives for employees and customers to stay in good physical and mental health, and nudge towards good financial behaviour. For example, Discovery Bank offers preferential interest rates on savings and credit to customers that demonstrate good health and financial wellbeing.

Financial health is also strongly associated with individuals’ work productivity and social relationships. Specifically, CFSI reported that banks improving their employees’ financial well-being can generate higher productivity, higher retention, better retirement readiness and less expenditure on medical care. Individual and household financial health also has a collective impact on the stability and growth of the broader financial sector and economy.

Thus, financial health can be a helpful tool for the banks to link and evaluate their own efforts- via products, services, and corporate actions- in the realization of SDGs.

Steps to improve customers' financial health

1. Diagnose customers' financial health

Deep customer insights are at the core of how banks refine strategy, products, processes, technology, and delivery channels to improve customers financial health. Overall, banks can use two approaches to understand their customers' financial health. First, by undertaking a financial health survey. Conducting financial health surveys can be a good starting point to generate insights into customers’ financial conditions.

Second, by using readily available financial transactional data to gauge customers' financial health insights by understanding their spending, saving, borrowing, and investing behaviour. This requires investing in technology, data infra and human capital to handle and analyse large volumes of data for generating decision-useful financial health insights.

In both approaches, banks can holistically evaluate financial health and summarize into a single score of financial health. Banks also choose to focus on particular aspects of financial such as financial security and resilience.

Banks can use existing financial health tools designed around the world by experts, including Consumer Financial Protection Bureau, Financial Health Network, Kempon et al, and Commonwealth Bank of Australia. Choices of the financial health tools, and indicators, should be informed by the bank’s financial health definition and measurement purpose in the context of their customers and business.

Based on a review of the various financial health tools, and in line with UNCDF’s financial health framework, we propose some key indicators that banks could use to diagnose customers' financial health, as shown below.

Figure 2: Prospective financial health indicators to measure using surveys

Figure: Prospective financial health indicators to measure using transactional data

Even though leveraging transactional data for financial health insights is a more cumbersome exercise than customer surveys, it has several advantages. It enables banks to understand their customers' near-real-time financial conditions. Under this, banks can automate appropriate product recommendations for their customers. Leveraging transactional data also reduces the need to collect any new data and can be combined for further analysis with other customers and business outcomes. The transactional data-led financial health insights can also be used to nudge customers towards positive financial behaviour, enable responsible lending to credit invisible customers, and help customers to better plan and track financial journeys and outcomes.

However, there are certain shortcomings to using transactional data. First, customers are likely to have relationships with more than one financial service provider, which can impede a complete understanding of customers’ financial condition using transactions. Nevertheless, open banking can resolve this for customers willing to share their aggregated account details with the partner bank. Second, analysing transactional data requires advanced data infrastructure and data analytics capabilities to centralise and analyse customers information on spending, saving, borrowing, and investing.

2. Create a strategy to operationalize financial health

Combine deeper insights into customers financial condition, needs and pain points to create a strategy that addresses customers’ expectations. This is easier said than done. Creating a financial health-centric strategy will demand re-thinking the organization’s vision and purpose, refining products and services, revamping processes and technology, and most importantly having an unwavering executive commitment to improving customers financial health.

Start with low-hanging fruits such as promoting savings products, simplifying product description, and digital tools for budgeting and financial planning. Also, creating strategic partnerships with personal finance fintech and research agencies can accelerate banks progress in ensuring customers financial health.

3. Monitor customers financial health to refine offerings and demonstrate outcomes

The whole financial health approach to banking is about ensuring that financial services deliver the right outcomes for consumers. This means that measuring customers financial health is not a one-off exercise but rather an iterative process to understand the impact of financial services and make appropriate refinements to services.

To start with, financial providers can track a set of financial health indicators, alongside other customer KPIs, to understand the outcomes. Next, bank can analyse and interpret the financial health data in context of specific customers and offer appropriate financial solutions and advice to enhance financial health outcomes. Lastly, banks can analyse financial health data vis-a-via other business metrics such as on sales, profit, sustainability, customer engagement, satisfaction, and churn to understand how financial health can be effectively leveraged to drive better outcomes for both customers and business.

Bottomline

Improving customers financial health is both an opportunity and imperative for banks in light of increased competition from fintechs and rising expectations of regulators on delivering good financial outcomes. These demands shifting business narrative from providing financials services towards customers financial health and placing financial health at the core of their products, people, policies, technology, operations, and business success metrics. Aligning business strategy with customers financial health can help banks to boost their growth, profits, competitive edge, and customer trust.