Did the COVID-19 Pandemic Accelerate Growth of Mobile Money?

Author:

Mike McCaffrey

East and Southern Africa Regional Manager

Tags

The pandemic was difficult for families and businesses across the world, yet many believe it accelerated growth in digital payments as people were less physically mobile during lockdowns and cash was perceived as a vector for COVID-19. Beyond these changes in customer behavior, there were other conducive actions taken by governments and providers to grow the use of digital payments systems.

GSMA’s COVID-19 Response Tracker presents data from 32 countries on mobile money policy responses to COVID-19. Most regulators instituted fee waivers and increased transaction and balance limits. Just under half conducted social and humanitarian transfers, and just under a third allowed for flexible Know Your Customer (KYC) and on-boarding procedures. For example, regulators like the Central Bank of Kenya(CBK) and National Bank of Rwanda (BNR) raised the transaction limits on mobile wallets, and BNR went further to zero-rate transactions on mobile money transfers, transfers between bank accounts and wallets, and merchant transactions. Further, providers like M-PESA in Kenya and Paga in Nigeria offered free transfers up to US$10 and US$15 respectively.

Beyond these facilitating policies, governments and aid agencies have been infusing payments systems with cash transfers. The World Bank estimates that during the pandemic period (between 2020 and May 2021), US$2.9 trillion was devoted to cash transfer programmes, which reached about 1.3 billion people (17% of the world’s population). Individual cash transfer programmes in India and Pakistan alone reached over 200 million and 100 million people respectively.

COVID-19 Created Goldilocks Conditions for Mobile Money

The combination of changing customer behavior, relaxed mobile money regulations, reduced transfer prices, and massive cash transfer programmes seem like the perfect storm to create goldilocks conditions for accelerated growth in mobile money. However, the loss in income and reduced ability to make purchases in countries that did not have developed e-commerce systems also may have played a strong countervailing role. Further, mobile money is a cash-based system that relies on agents to cash people in and out of the system. If COVID-19 affected their ability to operate, mobile money services may have suffered. This article examines the GSMA supply-side data to ascertain the degree to which COVID-19 may have impacted mobile money systems.

Measurement and Methodology Decisions

There does not seem to be a single correct method for conducting this analysis and more work should be done on this topic. While many countries began lockdowns in March 2020, others waited until mid-year and they all varied in severity and length, as do the supportive measures that were instituted to lessen their economic impact. This analysis defines the COVID-19 period from March 2020 through December 2021.

In the previous article, Have We Reached Peak Mobile Money? UNCDF notes that the growth in active customers, and volumes and values of transactions has been decelerating. Therefore, accelerated growth due to COVID-19 may appear as decreased deceleration. However, given the volatility of deceleration over time, it is difficult to isolate the potential effect of COVID-19, given it seems to be small or non-existent for key indicators.

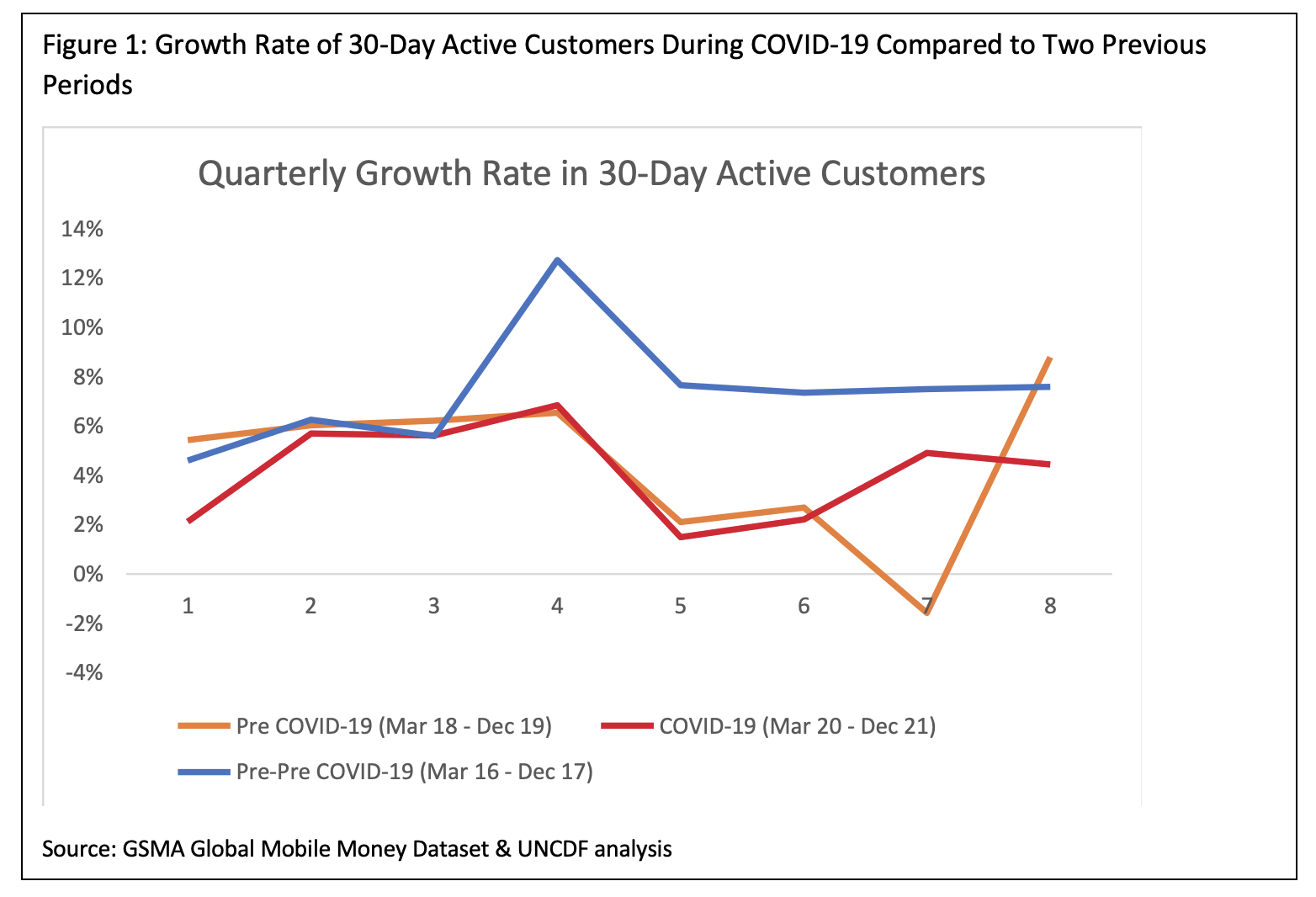

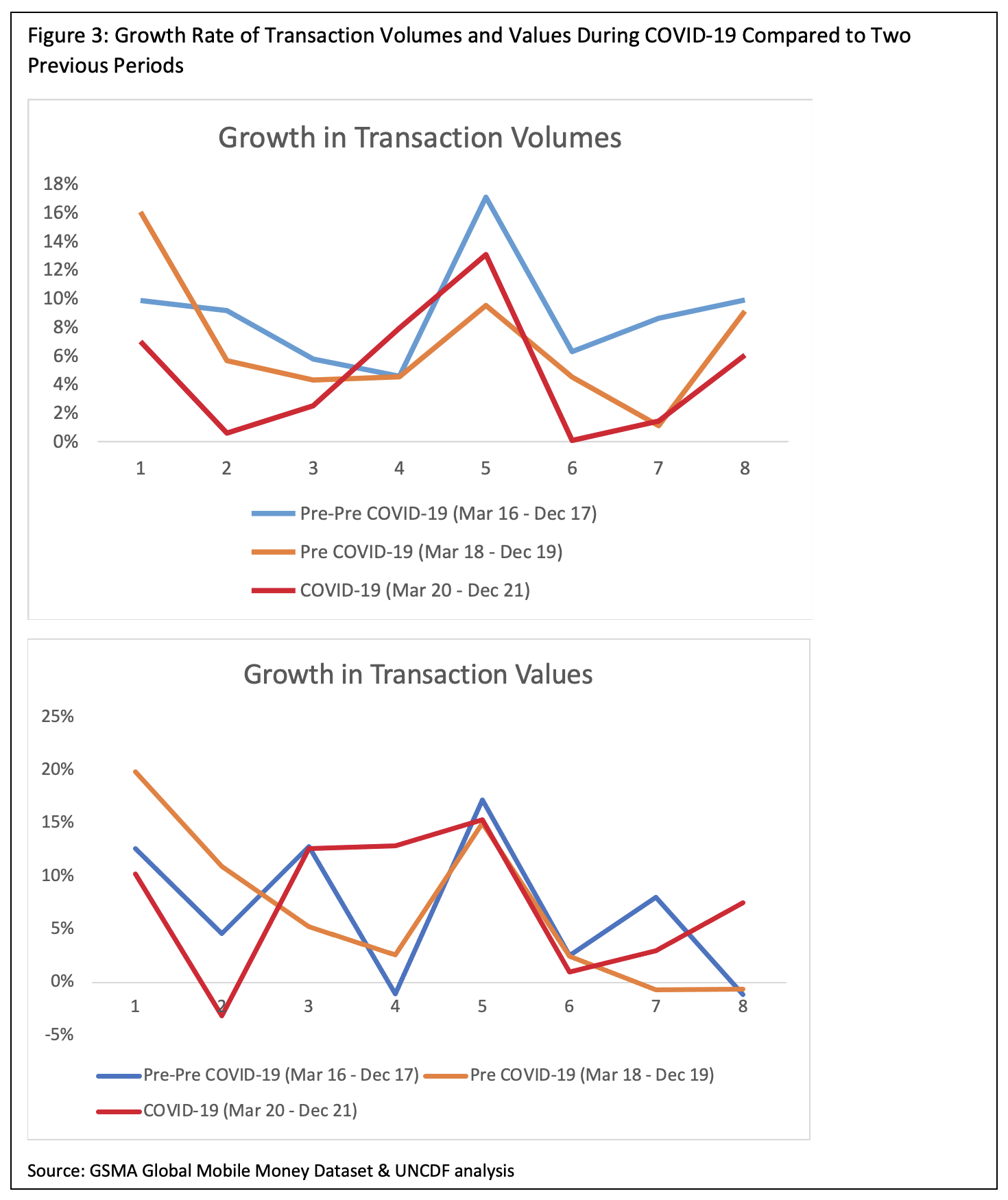

To address this on the global level, UNCDF presents charts mapping the growth of key indicators during the COVID-19 period and compares them to growth over the two proceeding periods. The Pre-COVID-19 period is the period directly preceding COVID-19, and the Pre-Pre-COVID-19 period is the period before that. Beyond these charts we examine the comparative average growth rates over these intervals.

COVID-19 does Not Seem to have Catalyzed Significant Active Customer Growth

The 2020 GSMA Global Adaptation Survey interviews mobile money users in five key markets and finds that 13% of mobile money users in those markets cited COVID-19 as their reason for using the system. Therefore, it is reasonable to assume that active customer growth accelerated during the COVID-19 period. However, the GSMA data does not clearly show this.

The first period from March 2016 to December 2017 had an average quarterly growth rate of active customers of 7.4%. That average growth rate decreased to 4.5% in the subsequent period from March 2018 to December 2019. During the pandemic, active customers grew at an average rate of 4.1% per quarter. Therefore, the deceleration in growth is continuing during the pandemic, but potentially slightly less quickly due to the pandemic. At most it seems like the pandemic may have increased growth by a percentage point or two, but nothing more significant than that.

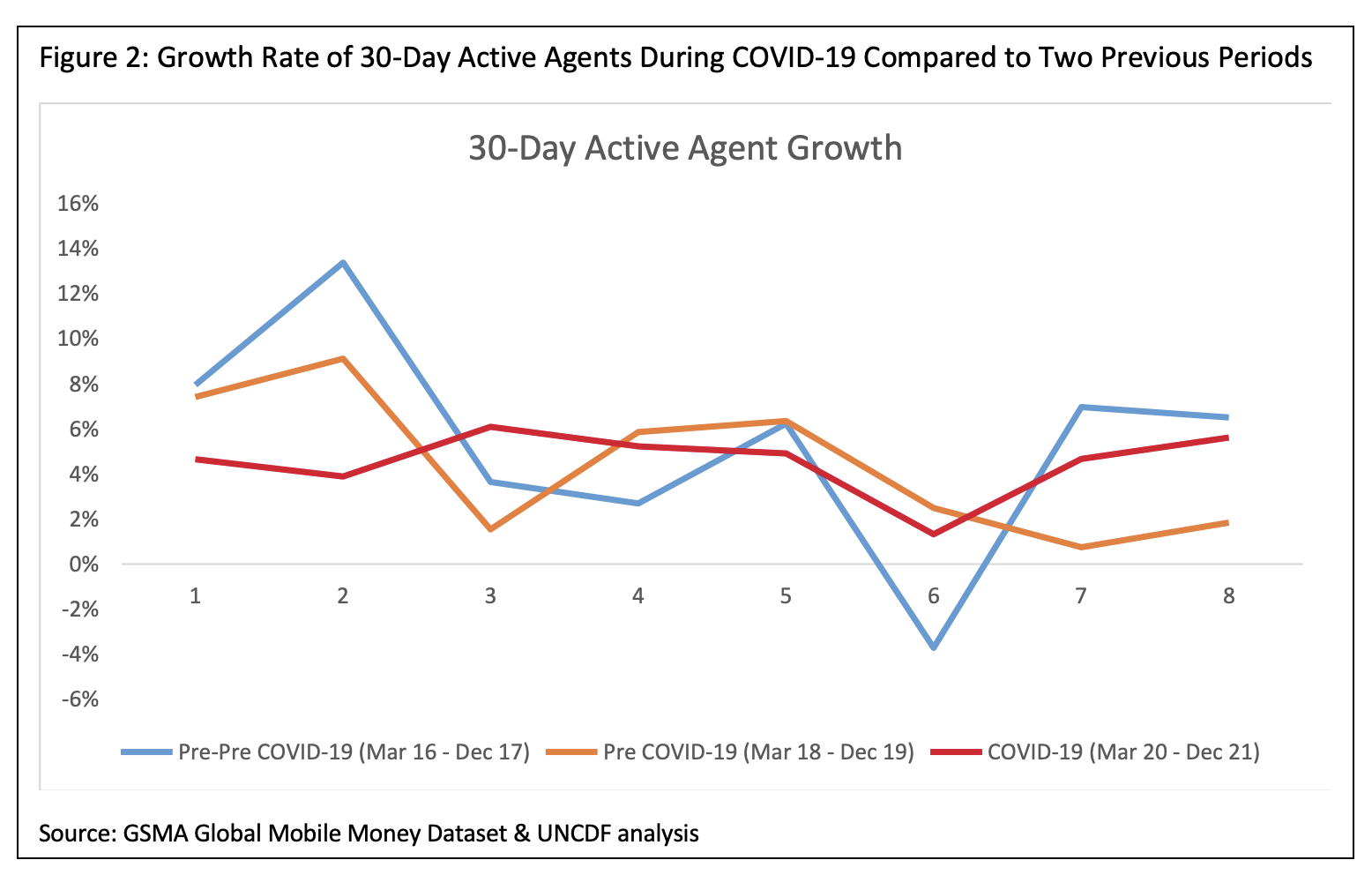

COVID-19 May have Limited Agent Growth During Lockdowns but Growth Recovers

The 2020 GSMA Global Adaptation Survey reported agents struggled during the beginning of the pandemic. During lockdowns, particularly the first ones in the period from March through June of 2020, many agents closed, had significant liquidity issues and witnessed decreases in customers who were cautious of the health risks of cash transactions.

For example, agents in Uganda had limited ability to travel to rebalance, and had to use working capital to support their families. In Kenya, agents reported income dropping by over 50% during the initial lockdown in 2020. This would predict a depressed growth rate in active agents during the beginning of the pandemic, and it will be interesting to observe if this growth rate subsequently recovers.

The GSMA data does seem to show decreased growth in the first two quarters of the pandemic, but then it seems to increase to normalize for the overall pandemic period. Average quarterly growth for active agents during the pandemic was 5%, compared to 5% and 4% in the March 2016 - December 2017 and March 2018 to December 2019 periods respectively. Therefore, it is also possible that active agent growth was increased by a couple percentage points, but nothing more significant than that.

Was there Growth in Transaction Volumes or Values?

Even though it does not appear that COVID-19 significantly accelerated growth for active mobile money customers globally, existing customers may have been more active, driving growth in volumes and values of transactions. Reports are mixed, from evidence in Rwanda that both volumes and values of transactions skyrocketed, to the 2020 GSMA Global Adaptation Survey reporting that most customers did not report an increase in the frequency of their transactions. It is very possible that disparate trends developed across countries given unique circumstances, and that would be a fascinating study to compile.

Globally, the GSMA data likely show continued deceleration in transaction volume growth in comparison to a constant growth rate in transaction values. The average quarterly growth rate in volumes decreases consistently over the periods from 10% to 7% and finally to 5% during the COVID-19 period. While the growth rate in values stays fairly constant from 8% to 7% to 7% during the COVID-19 period. This data supports the conclusion that mobile money was not used more frequently during the pandemic, but was likely used differently, which is discussed in the next section.

What Could Explain the Growth in Average Transaction Value?

Given transactions values grew relative to volumes during the pandemic, the average value of a transaction increased. During the subsequent two periods, the average transaction value had been slightly declining, and during the pandemic it increased by an average quarterly growth rate of 2.2%. There are potential explanations for this in the literature, which note that customers shifted to use different mobile money products during the pandemic.

2020 GSMA Global Adaptation Survey states that users reported a slightly decreased number of incoming transactions (i.e. receiving a P2P transaction). For example, in Kenya 34% of users reported receiving transfers less frequently versus the 16% that reported receiving them more frequently. Most significantly, users across the five focal countries reported increases in the usage of the following mobile money services as a direct result of the pandemic:

- 10%-20% of users started receiving salaries

- 4%-24% of users started purchasing products and services

- 17%-22% of users started paying bills

- 2%-16% of users took a mobile money loan

- 3%-15% of users saved

- 4%-11% of users received a pandemic related humanitarian or social transfer.

The increased use of these products during COVID-19 is significant and likely explains the increased average transaction values. If the growth in these product categories continues, or even if gains just remain, this would be an important legacy of the pandemic for mobile money. Especially important are the growth in salary payments and merchant payments, and further research should track their future growth trajectories.

While Many Mobile Money Providers Engaged in G2P, Few Customers Benefited

The above data showing that only 4%-11% of users reported receiving a pandemic-related social or humanitarian transfer in the five focal countries can be confusing and is worth discussing. For clarity these are also referred to as bulk transfers or government to person (G2P) payments in the literature. The 2020 GSMA Global Adaptation Survey concludes, “responses received do not suggest a significant surge of this type of transaction.” At first glance this seems strange given the GSMA 2022 State of the Industry Report (SoTIR) notes that:

“Based on responses to the 2021 Global Adoption Survey, more than half of mobile money providers stated that they helped disburse COVID-19 relief funds and, between September 2020 and June 2021, the number of unique customer accounts receiving government-to-person (G2P) payments grew by more than 50 per cent.”

However, UNCDF believes that these statements are likely consistent. It is helpful to understand that while globally US$2.9 trillion was devoted to cash transfers during the pandemic, reaching 1.3 billion people, those numbers are heavily skewed away from low-income countries that do not have the funds, experience, or systems for scaling these transfers. Low-income countries are also the only countries where mobile money has proliferated (reaching an average of 18% of adults in 2017 versus 4% of adults globally). Therefore, there is a mismatch between countries that have scaled G2P systems and countries with mature mobile money systems.

Findex (2017) reported that only 6% of adults in low-income countries had received a G2P transfer in the last year. For pandemic-related transfers, the World Bank notes that low-income countries were only able to cover 4.5% of their populations. Further, while the global average spend per capita was $345, it was driven by a value of US$847 in high-income countries and constrained by a value of US$4 in low-income countries. Lastly, the global average duration of transfer is only four months.

Thus, more than 50% of mobile money providers could have helped disburse COVID-19 funds, yet they were limited in value, volume, and population coverage. This could still have produced a 50% growth rate, given UNCDF noted in the article, Does Mobile Money Increase Financial Inclusion?, that bulk payments, which include G2P, only accounted for 6% of mobile money transaction volumes and 11% of values by the end of 2021. Hence, a 50% pandemic growth rate would have increased volumes 3% and values by 5.5% given their small base. This is significant and laudable, yet also puts this robust growth rate in context to explain why most customers do not report receiving transfers.

UNCDF hopes that donors and governments will focus on scaling cash transfers in low-income countries as they have significant developmental impacts and are crucial to achieving the Sustainable Development Goals. One of the crucial lessons from the pandemic is that for mobile money to have a more significant role in delivering those cash transfers, better systems must be built before crisis strikes.

For example, in 2018, an estimated one billion people did not have an official identification, including 50% of women in low-income countries. In most countries this prohibits them from registering for a mobile money service. And further, for most cash transfer programmes, a registry is required to determine the most at risk populations in need of these transfers. Governments generally do not have these prepared. During the pandemic more advanced countries like Brazil and South Africa where able to register millions of people online, while governments in least developed countries like Bangladesh, Myanmar, and Madagascar were forced to send government officials to physically register people. Digital tools for identification and registries, combined with internet connectivity, digital skills and smart devices will ensure governments are more prepared in the future and deserve public sector funding.

Globally Mobile Money Growth Rates Decreased During the Pandemic

The most accurate summary of this data is that if there was accelerated growth in mobile money during the pandemic, it was small and difficult to observe. Overall, growth rates continued to decrease, but at a slightly slower rate than the two subsequent periods, which may be related to the pandemic. The areas for future work are at the country-level and investigating the indicated shift in use cases to understand if they continue over time.

It is somewhat disappointing that many of the Goldilocks factors did not seem to drive more robust growth, but their were countervailing factors as well. Further, the pandemic emphasized the importance of cash transfers, and the divide in the ability to execute them at scale between high-income and low-income countries.

Mobile money is not a perfect delivery mechanism for these payments and a functioning mobile money system will not be sufficient to deliver them. However, in low-income countries, mobile money systems often have the largest population penetration and geographical reach and are therefore the best candidates for customization to deliver humanitarian and social cash transfers. UNCDF looks forward to working with mobile money providers to adapt systems to this need, and better facilitate payments to those that need them most.

Reader’s Note: This article is part of a series which uses the last 15 years of mobile money to reflect on progress in the sector and gauge where we are in answering some of the big questions still being debated.

PLEASE READ THE OTHER ARTICLES IN THE SERIES HERE.