Pacific Islands FinTech Innovation Challenge 2022 Wrap-up

Tags

The United Nations Capital Development Fund (UNCDF), under its Pacific Digital Economy Programme, launched the Pacific Islands FinTech Innovation Challenge in May 2022 in partnership with Asian Development Bank (ADB) and Market Development Facility (MDF).

The Challenge aimed to attract local and global FinTechs with market-ready solutions to address identified challenges faced by Pacific Islands countries in adopting digital payments services. The geographical focus of this edition of the Challenge was the Pacific Island Countries of Fiji, Samoa, Tonga, and the Solomon Islands, where five problem statements were identified:

- Improving access to financial products and services

- Digitizing customer service

- Increasing usage of financial products and services

- Streamlining foreign exchange

- Enabling E-Commerce and in-person POS merchant payment services

The story

The initial phase of preparation for the Challenge, which started in September 2021, focussed on bringing together the stakeholders such as sponsors, implementing partners who are the problem statement owners, knowledge partners, and the judges. For this edition of the Challenge, six implementing partners were identified - Tongan Development Bank (TDB), National Bank of Samoa (NBS), Fiji Development Bank (FDB), Vodafone (International Money Transfer (IMT) Hub Concept), and Home Finance Company (HFC) and Solomon Islands National Provident Fund (SINPF). More specifically, the critical elements of the preparation phase were:

- Drafting and refining the problem statements;

- Identifying and collaborating with the implementing partners who will be instrumental in implementing the winning solutions in the focus market and

- Setting the judging criteria.

The actual Innovation Challenge kicked off with the participation applications opening on May 20, 2022. Around 54 applications from FinTechs, predominantly from the Asia-Pacific region, were received between May 20 and July 4, 2022. A panel of judges, including industry experts, implementing partners, UNCDF staff, and sponsors, shortlisted 11 FinTechs in the first phase based on a comprehensive set of evaluation criteria including team structure, methodology suitability, innovativeness, gender and sustainability among others. These FinTechs were sponsored to participate in a 3-day rigorous Bootcamp held in Singapore between July 27 – 29, 2022.

Bootcamp

Before starting the actual Bootcamp, an Innovation tour was organised on July 26 to give the participants an insight into the current work and various methods of innovation of a myriad of service providers ranging from established firms such as Visa and Standard Chartered Ventures as well as younger players such as Singlife and Thunes. The tour was specially curated to help the participants gain knowledge and stay abreast on development in the fintech space.

The Bootcamp organised at the Prudential Tower in Singapore brought together the shortlisted finalists and the problem statement owners/implementing partners to further refine their proposed solution submitted in the first phase. Additionally, one winning solution per problem statement was to be identified and implemented in the Pacific countries to address the identified problem statement.

The Bootcamp kicked off on July 27 in the presence of several dignitaries such as the Australian High Commissioner to Singapore, Mr. Will Hodgman, Honourable Minister of Foreign Affairs, Singapore, Mr. Vivian Balakrishnan, Secretary-General of Pacific Islands Forum, Mr. Henry Puna, Chief FinTech Officer for the Monetary Authority of Singapore, Mr. Sopnendu Mohanty and Executive Secretary of UNCDF, Ms. Preeti Sinha. The dignitaries underlined the importance of and the need for collaboration between ASEAN and the Pacific Islands Countries in the FinTech sector, specifically in knowledge sharing between the two regions, which could immensely benefit the Pacific Islanders. Around 70 people attended the launch of the event.

Over the first two days, ADB, MDF, and Visa sessions were held to give the FinTechs a flavour of their respective work within the region. The two days were also planned to provide ample opportunity for the FinTechs to discuss with implementing partners in both group and one-on-one settings. In preparation for the final pitch, the Fintechs engaged the Implementing partners to sharpen their solution. A session on effective pitching was also facilitated for the FinTechs by the CEO and Founder of Bambu, Mr. Ned Philips.

Solution-pitching, the last component of the Bootcamp, was held on the final day (July 29), where the 11 FinTechs competed against each other for a grant of USD 50,000. Five winning solutions, one for each problem statement, were selected by a panel of expert judges comprising implementing partners, industry leaders, UNCDF staff, and sponsors. The solutions were judged based on four criteria:

- Market Potential and Impact

- Revenue Potential and Commercial Viability

- Partnership and Technology

- Capacity and Implementation

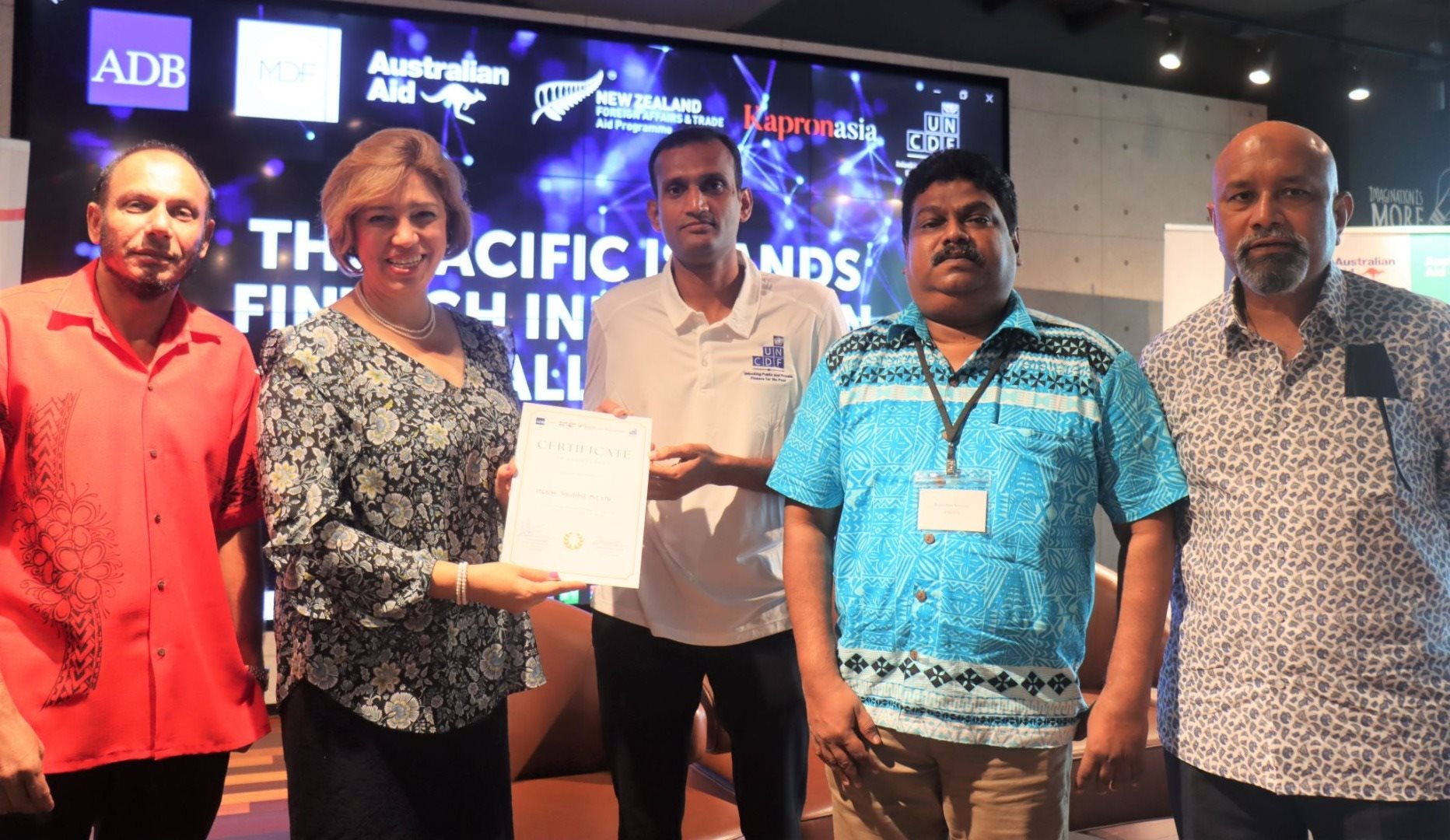

Global Psytech Sdn Bhd, IT Galax Solutions (Fiji) Pte Limited, YABX Technologies, MHITS Limited, and Windcave Pty Limited emerged as the Challenge winners. In the post-Bootcamp phase, these FinTechs will work with their respective implementing partners to pilot and scale their solutions in the focus geographies.

Achievements

The Innovation Challenge received extensive recognition from the FinTech and media community and regulators in the Pacific Islands and Singapore. The event was widely appreciated for its knowledge-sharing, networking and business prospects. The reception and positive feedback received from the participants stands testimony to it.

The event was highly commended, especially for the planning and coordination. The event demanded coordination from the o team comprising UNCDF, MDF and Kapronasia, and it was much appreciated for its planning and organization. This edition of the Challenge built on the feedback received from the previous edition and was planned to devote more time to one-on-one sessions between the FinTechs and the implementing partners to tailor the solutions to their needs.

"It was an intense but well-coordinated event - and should be repeated regularly." - Anonymous participant

The Challenge provided a great networking opportunity for the participants and opened up new business prospects. The event provided a platform for the FinTechs from the Asia-Pacific region to network with experts and other persons of influence in the Pacific Island Countries, especially those from banks, other financial institutions and regulators. For the implementing partners, the event allowed them to weigh the different solutions and hand-pick the ones that were most feasible for implementation. The decision was not easy, with the implementing partners and regulators expressing interest to work with other FinTechs that were not selected but which presented impressive solutions. Few participants felt that the event should be hosted annually.

"Please keep doing more of these! Was great fun." - Anonymous participant

"Hope it will be an annual event" - Anonymous participant

The Innovation Tour improved the knowledge of FinTech products among the participants. It was widely appreciated by the participants from the Pacific Islands as it helped them understand the workings of FinTech products in Singapore and other financial markets.

"Great to get an overview of various partners in the space." - Anonymous participant

"(FinTech Tour) Increased my knowledge greatly on fintech." - Anonymous participant

Lessons learnt

Everything that can go wrong will go wrong. We don’t know what we don’t know. Regardless, it is essential to brainstorm with the team on what are some of the risks and its impact. This will help us plan risk mitigation strategies and at least be prepared for what’s in store. A dry run of the event before can help, especially checking all the AV/Tech settings. This was a crucial lesson for us because one of the FinTechs for problem statement 5 had a team member joining over Zoom to present. Though there were compatibility and audio connection issues, we were able to sort them out right before the presentations started. However, conducting a dry run/AV check the previous day would have reduced the last-minute hassle and should be kept in mind for future events.

Eyes on the prize. For this year’s Challenge, a grant amount of USD 50,000 was announced for the winning solutions. Of course, the cost of most solutions of the scale that the problem statements required was expected to be much higher. The remaining cost would then have been covered by the implementing partner and the fintech. Some applicants had suggested a higher grant amount of up to USD 100,000 for the winning fintechs. More funding helps, but we also need to be conscious of potential risks of market distortion in PIC’s. There is likely no perfect answer for this question, but something certainly to be aware of, be realistic about, and communicate very clearly and straightforwardly to all applicants.

Be practical with the timelines. From our experience organising this year’s FinTech Challenge, we learnt that the timelines could be more stretched, especially between the Request for Applications (RfA) closure, the announcement of shortlisted teams, and the actual Bootcamp dates. This was important given the tremendous amount of work that had to be done to publicise the event to get the right FinTechs to apply and the logistics involved in organising the event. While the RfA received over 50 applications, this was only possible with a significant effort from the UNCDF and Kapronasia team to reaching out to the FinTechs personally and briefing them about the Challenge’s business potential. However, given that the Bootcamp involved logistics around travel, the team worked under a tight timeline to make the event.

Plan and complete tasks as early as possible. Planning is essential when there are multiple stakeholders involved. For example, on day 1 of the Challenge, there was a session dedicated to presentations by the six implementing partners. It was crucial to follow up with each of them to have the presentations ready and to send them to one of the organisers for it to be prepared for presentation. Also, the judging criteria for day 3 had to be finalised and the scoring sheets had to be printed. Planning and completing such tasks in advance ensure that there is less chaos on the actual day of competition, and energy can be directed to new and evolving tasks, helping improve the quality of the event rather than revisiting old tasks that have not been completed.

Check, re-check and check again. Always check the addresses and arrangements multiple times before the event. For example, during the Innovation Tour, we included the old address of Thunes Office, which led to the participants ending up in the wrong place. Additionally, on the second day of our event, we had to share the space with another event, and since the lounge area was occupied, we did not have a holding room for the breakout sessions. This resulted in one of the companies and corresponding implementing partners being moved to another private lounge at the last minute to avoid conflict of interest. Both could have been managed better and time be saved if we had reverified and co-ordinated accordingly.

Make sure a photographer/videographer covers every aspect of the event. When there are so many moving parts to an event, it is quite possible to miss out on documenting every tiny detail. This is where photo/videography helps to revisit all aspects of the event. For example, during this Challenge, we missed to capture and document the meeting between our delegation and Mr. Ravi Menon, Managing Director of Monetary Authority of Singapore through photos. This should be corrected for future events.

Adhere to strict timing during the actual event. It is possible for an event with so many sessions and presentations to over-run the planned schedule. So, it is highly recommended to request for the transcripts and presentations one or two days before the event and make sure that all are within the prescribed time limit.

Keep all the stakeholders in the loop and up-to-date. It is essential to keep all the stakeholders, especially those involved in the organization and planning, updated. Sending regular update emails and scheduling frequent catch-up calls really helps. This will reduce any last-minute surprises and ensure maximum co-ordination and smooth-running of the event.

Plan for ways to distribute leftover food. On day 1 and 3 when we had buffet lunches, we had a lot of leftover food. It is always better to have more food than no food. However, future organizers should think of ways to distribute leftover food to avoid waste.

Be adaptable and think on your feet. Even if everything is planned in detail, we need to accept that few things that might not turn out as expected. In such situations, always be adaptable and specially, think on your feet. Be creative and open to new idea/solutions. On day 1, we had ordered for the food to be delivered half an hour before the scheduled lunch break. However, the morning session ended quite earlier than we expected, and we had to come up with an idea of an ice-breaker session on the spot. Always expect such things and be sure to keep few extra ideas up your sleeve.

Finally, always document the lessons learnt after the event. Documenting all the things that went well and the improvements needed right after the event creates necessary feedback loops to make sure future events are implemented better. From these lessons learnt, a checklist of administrative items can be created for future events.

In summary, the Pacific Islands FinTech Innovation Challenge was a huge success in providing a ground for knowledge sharing, networking, and identifying suitable solutions for the challenges faced by Pacific Islands Countries in adopting digital financial services. There is no doubt that the solutions that emerged will be life-changing to the people of the Pacific Islands. But what remains to be seen is the magnitude of such impact.

“Overall an excellent experience. If I will be another part of this occasion to Singapore I will put my hands up. Thanks for all the organising team and partner.” - Anonymous participant