Effective Regulation as a Precursor for Growth of FinTech Innovations in the Pacific

Tags

Financial regulators from the Pacific are strengthening their capacity and knowledge in anticipation of new innovations and technology-driven business models that are expected to hit the region’s financial markets in the coming years.

As more innovative technologies are introduced to solve key financial services challenges in Pacific and global financial markets, regulators and policymakers must adapt with agile policy responses to harness the benefits.

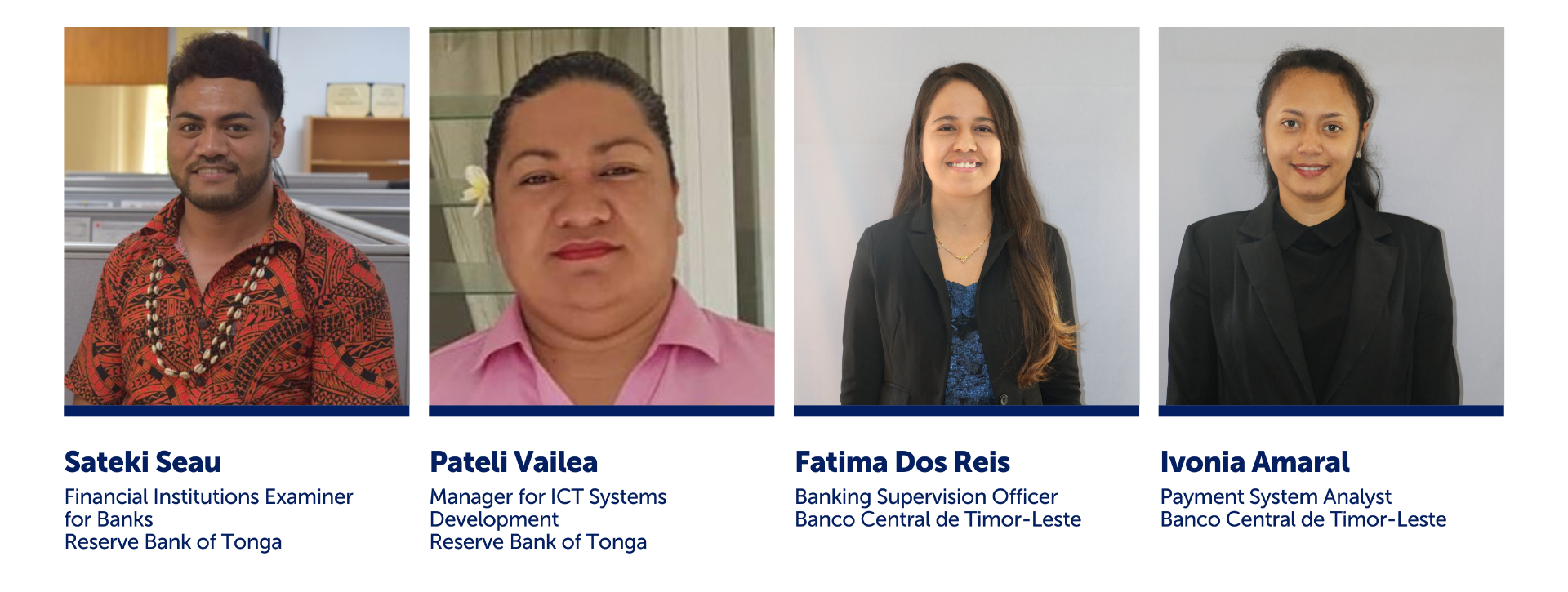

The UN Capital Development Fund (UNCDF) recently supported Sateki Seau and Pateli Vailea from the Reserve Bank of Tonga (RBT), and Fatima dos Reis and Ivonia Pereira Amaral from Banco Central De Timor Leste, to be part of the Cambridge FinTech and Regulatory Innovation Course (CFTRI).

The course explores how digitalisation and technology-enabled business models have re-shaped financial services, such as sending, receiving and storing money, globally and have moved from the exclusive domains of banks to non-bank actors and FinTechs.

For Mr. Seau, the Financial Institutions Examiner for Banks for RBT, and Ms. Vailea, Manager for ICT Systems Development, the course helped them better understand the innovations being deployed to improve financial services in Tonga and around the world.

The course covered the risks, challenges, and benefits of the new technology and how best to retrofit them for Pacific markets to reach financially excluded communities – a key UNCDF objective in the region.

“I am now able to identify areas of the banking sector where FinTech firms have the most disruptive impact, the reasons behind it, and discuss the regulatory and policy implications of the digital transformation of banking services,” said Ms. Vailea.

“These are vital skills needed to address and support such transformative digital solutions in areas such as payments, lending, capital raising, cryptocurrency, assets, innovation offices, and sandboxes.”

UNCDF aims to stimulate the development of digital financial solutions at the scale and speed necessary to strengthen financial inclusion and resilience and accelerate economic recovery from COVID-19 in African, Caribbean, and Pacific countries through the Digital Finance for Resilience Programme (DFS4Res).

Supported by the European Union and the Organization of African, Caribbean and Pacific States (OACPS), the DFS4Res Programme is aiming to equip Pacific regulators with practical skills and knowledge to formulate evidence-based policy responses to harness the rapid development of financial technology for local populations.

Changing perspectives

The four Pacific participants have joined over 1,200 central bankers, security agency staff, and ministry of finance officials from more than 140 jurisdictions to be trained through the course.

They say the course has been an eye-opener given their initial reservations and critical views about the suitability of FinTechs for Pacific financial markets.

Timor-Leste duo, Ms. Dos Reis and Ms. Amaral, said they now recognise the potential digital financial solutions have to enhance competition, empower consumers, democratise access to financial services and stimulate innovation in developing countries.

Tonga’s Ms. Vailea added: “As a regulator, we often view digital financial innovations as disruptive and difficult to regulate. However, this course compelled me to rethink my assumptions and to approach regulating digital innovations and its providers from the view that they are redefining how financial services are provided and consumed.”

The course is taught by leading economists, lawyers, engineers, regulators, and development professionals in interactive online lectures, offering participants a range of perspectives on the role of technology as an enabler in the financial services sector.

Applying lessons at home

The four Pacific participants have already begun applying lessons from the course in their home countries, with an aim to improve regulatory conditions for fintechs and other innovations.

In Timor-Leste, Ms. Dos Reis and Ms. Amaral are using the modules from the course to start conversations within the Central Bank that could potentially lead to the formulation of the country’s first FinTech Regulatory Framework.

Such a framework would open the door for Fintechs to enter the Timor market and test and deploy solutions that bring critical financial services to underserved communities.

According to Ms. Dos Reis and Ms. Amaral, increasing access to innovations, paired with the appropriate financial and digital literacy programmes, especially for people in rural areas, should be the guiding principle for FinTech regulation in developing nations.

In Tonga, Mr. Seau and Ms. Vailea are preparing a document for the Reserve Bank of Tonga with key takeaways and recommendations from the course that could be implemented in the country.

Some recommendations include:

- Training the bank’s IT and Supervision teams to draft procedures to deal with FinTech innovations

- Learning exchanges with regulators from countries already exposed to new innovative financial technologies to discuss the challenges, opportunities, and best way forward

- Appointing a competent committee that can vet, administer and approve new FinTech innovations based on updated regulations

Enabling regulatory environment

“We, as regulators, would not want to be a barrier to digital transformation in financial services,” said Ms. Vailea

“At the same time, regulators must aim to ensure that the best interests of consumers are protected while enhancing confidence and trust in the financial system through effective regulation.”

All four Pacific participants agreed that a sound regulatory framework, with internal risk management mechanisms in place, was a necessary precondition for the growth of FinTech solutions.

Only then can FinTech solutions complement existing efforts to promote financial inclusion, enhance financial sector development, and increase inclusive growth potential, thereby reducing poverty, they said.

The course provides a solid foundation for regulators to address these challenges by enhancing their knowledge on new areas of practice and exposing them to innovations around the world.