Client Segmentation and Financial Inclusion

Interview with Well Told Story. We’re talking client segmentation with Anastasia Mirzoyants, Head of Knowledge and Learning, and Paul Ekuru, Producer-Kenya, of Well Told Story.

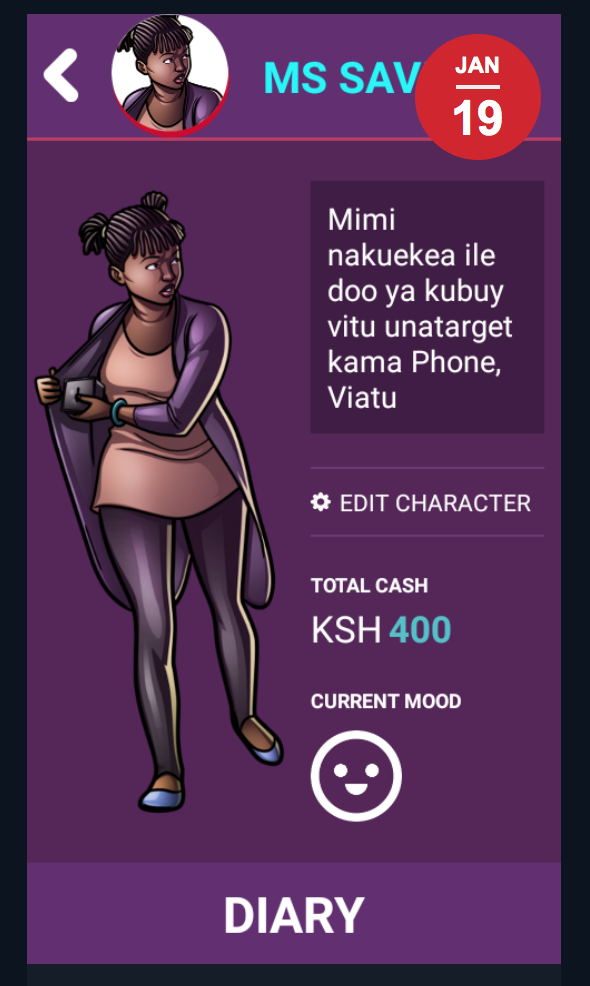

Well Told Story produces the Shujaaz brand, an Emmy Award winning youth communications platform, reaching millions of young people across East Africa with a mix of media delivered across multiple channels. Its mission is to engage young people to change their lives for the better. They told their story in early March at the MicroLead Peer Learning Conference in Dar es Salaam.

Why is client segmentation important for financial institutions?

Anastasia: Segmentation is critical for any type of product or service offering. It's Marketing 101: addressing different potential consumers with different or tailored offers or even different descriptions of the same offer to link each product/service to the needs of particular groups of people.

There is nothing like one-size-fits-all any more in the world of products and services. As a global community, we are past the period of novelties and scarcities – if you go to any grocery shop, there are 15 different types of strawberry jam. The novelty today is the ability to uniquely capture what is most important for a particular group of people and develop and offer a solution for the problem they have now, will have in the future, or might never have but are concerned about. This is where segmentation comes into play, because it is impossible to address one individual at a time – or rather, it is possible but highly inefficient. But addressing groups of people unified by demographics, psychographics, or contextual/personal characteristics allows organizations to create an offer that is relevant and authentic for the consumer without being burdensome for the provider/supplier.

In the financial sector, SACCOs were probably the first to arrive at genuine segmentation of people by financial needs and financial pursuits, and they benefitted greatly from this. We are happy to see that the big players in the financial industry are catching up as well.

Paul: With products and services genuinely matched with user needs, any financial institution has a better chance of growth and increased efficiencies. Banks with one-size-fits-all products, for example, are struggling with account dormancy and defaults, because the initial selling point around the product never hit the core of their users’ needs.

What is Shujazz's experience segmenting youth?

Anastasia: Well Told Story – the company behind Shujaaz media – has been conducting audience segmentation studies since its launch in 2009. Our in-house Knowledge and Learning team is skilful in using existing methods as well as in creating new and patented methodologies aimed at exploring the nuanced lives of youths in Kenya and Tanzania.

We are working in a very difficult space, where the complexities of the adolescent age overlap with the complexities and sensitivities of our priority topics (reproductive health, financial fitness, unemployment, governance, and radicalization) as well as the complexities of the developing economies and economies in transition. Hence, for us, it is important to understand the smallest, most subtle nuances about our audience to get the stories right, to make our audience trust us and to accept the value that we are offering them – a better future.

What makes our research work different from many other research agencies is we are truly human–centered. Our segmentation is developed by our audience through an interactive experience during which our researchers nudge conversations and creative expressions among youth to help them discover and describe who they are and what/who they aspire to be. We then analyze the conversation and go back to our audience for validation. As part of creating such research experiences, we do use traditional face-to-face gatherings, but we also actively explore digital conversations and interactions and the Big Data analytics.

Paul: And through this journey, we have learnt that there is deliberate rejection from youthful users once they sense products or services are designed in a way that doesn't align with their immediate and/or important priorities. It calls for more than awareness of a new product or service to emotionally speak to young people. Designing with what they care about in mind is the game changer!

Can you tell us about your use of "archetypes" in segmentation?

Anastasia: Here is a quote from the academic paper that we've submitted for publication this year:

"The insight about the five DFS archetypes were used to develop a media strategy for Shujaaz (a Kenya–based multi–channel media platform) that consisted of creating a four–step vision of the journey towards change, or adoption of, DFS for each archetype. The vision was then translated into a collection of media stories exploring one archetype at a time for a total of six months."[1]

Paul: I’d add that the archetypes are developed off deep research insights and modelled to the user. Then all the users who pick up the behaviour or try the ideas are again modelled back to other users as real case studies.

How can financial institutions use segmentation data?

Anastasia: For any financial institution, the market strategy should start with segmentation – what are the underserved segments in the market? What is their potential as our clients? How can we create an offer that will be relevant to these segments? What are the competitors and alternative offers in the market? How can we outsmart the competition? All of those questions can only be answered by somebody who knows how the market is segmented and what each segment wants.

We believe that through our action research project, we've done a lot of work to demonstrate to the financial industry that youth should be on their radar as an attractive group of clients, but youth is diverse. So they need to understand youth and align their R&D to reach and engage with young people.

Our project also showed that reliance on the segmentation results in extremely high achievements – e.g., our 2016-2017 panel survey of youth in Kenya demonstrated that users of Shujaaz were 1.93 times more likely to become users of mobile money compared to youth not exposed to Shujaaz. The panel also showed that Shujaaz fans were 1.41 times more likely to convince adults in their households to register for digital financial services compared with nonusers of Shujaaz. So, the segmented approach works; we've proven it, and we are open to working with the financial industry to help them understand how they can deliver value to our audience through more targeted/tailored financial offers.

What else would you like to say about Shujazz and segmentation?

Anastasia: We love developing it, and we love using it. We take a lot of pride in having a unique approach to discovering segments, creating unique and relevant value for them, and seeing them respond with what we call "brand love" – trust, reliance and pride in being members of the Shujaaz world.

Review the Shujaaz presentation and others from the MicroLead Peer Learning Conference HERE.

About MicroLead

MicroLead is a UNCDF-managed global initiative challenging regulated FSPs to develop and roll-out deposit services which respond to the rural vacuum of services. With the generous support of the Bill & Melinda Gates Foundation, The MasterCard Foundation and the LIFT Fund in Myanmar, MicroLead works with a variety of FSPs and technical service providers to reach rural markets, particularly women, with demand-driven, responsibly priced products offered via alternative delivery channels such as rural agents, mobile phones, roving agents, point of sales devices and group linkages. This is combined with financial education, so customers not only have access but can effectively use quality services.

Follow us on Twitter @UNCDFMicroLead

For more information, please contact:

Pamela Eser

Financial Inclusion Expert and Global Head, MicroLead

pamela.eser@uncdf.org

[1] "Shujaaz Theory of Change" written by Dr Claudia Aubreu–Lopez (Cambridge University), Dr Janet Gersen (Columbia University), and Dr Anastasia Mirzoyants–McKnight (Well Told Story).