Global Centre of Financial Health

What is Financial Health

Drawing on the work of numerous organizations and research carried out in high, middle and low-income countries1, we hypothesize that financial health encompasses the following three dimensions: financial security, financial freedom and financial control.

Financial Security

Financial security is the ability to meet current and ongoing commitments. Commitments include essential and expected expenses such as food, rent, bills, debt payments, education, and health care. It also includes expected expenses earmarked for the future, such as preparation for old age or education of children.

In addition to expected expenses, financial security also addresses the preparedness needed to manage unexpected or adverse events, such as car breakdowns or sudden health emergencies. This component is often termed as financial resilience or the ability to respond to and recover from shocks.

The following questions help describe the outcomes of financial security.

- Is an individual able to manage his/her financial commitments on a day –to- day basis?

- Can they secure their financial future or do they demonstrate a forward-looking attitude in regards to their financial lives?

- Are they able to handle a small and large financial shocks?

Financial Freedom

Financial freedom represents a financial condition beyond financial security. It is also more subjective than financial security as it emphasizes individual financial goals and things one values.

The following questions help describe outcomes of financial freedom:

- Can an individual stay on track to meet his/her financial goals?

- After paying off essential expenses and earmarking savings, is sufficient money left over for doing things one enjoys?

Financial Control

Financial health also includes the dimension of financial control - the ability to feel in charge of one’s finances and a belief of self-efficacy that one can tide over a situation of financial stress. Financial control is again a subjective measure of financial health, because the ability of feeling in control or stressing little can vary for individuals and households, despite similar financial conditions.

The following questions sum up outcomes of financial control:

- Do I feel confident about my financial situation, now and for the future? Do I believe I have the ability to make changes to my financial life for the better?

- Do I feel in charge of my finances/ Am I confident that I can tide over my financial worries or stress?

Why Financial Health

Why Financial Health

With its focus on outcomes, financial health is arguably a more customer-centric approach, one that offers principles to define impact more holistically, measure it systematically and create it in a sustained and meaningful manner.

Based on evidence, it is an improved approach over financial inclusion as it enables the following:

Defines impact in ways that are more customer-centric:

Financial health accounts for both objective and subjective ways to define impact, embodying the principle that impact can mean different things to different people and is best defined by individuals themselves.

Measures what matters:

While conventional data on the number of registered and active accounts and transaction volumes and values remains relevant, financial health provides a deeper understanding of how financial services impact people’s lives. With a range of perceptive indicators such as ability to come up with liquid funds in a said time period to having money left over after essential expenses, financial health offers a more elaborate approach to measuring impact.

Measuring financial health is not as straightforward as measuring financial inclusion, given the complex nature of people’s lives and the environments they inhabit. As a starting point, it is important to separate the outcomes of financial health (what we’re aiming for) from the drivers of financial health (how we get there). Second, it is important to consider both objective financial conditions such as income, debt to income ratio and net- worth and subjective perceptions such as a person’s confidence in their financial futures and a sense of control and freedom over their finances, in order to get a true picture of people’s financial lives.

What’s in it for the Private Sector, Policymakers and Development Community?

The Private Sector: For financial institutions, fintechs and others working to develop financial solutions for end clients, financial health is a fresh lens with which to examine the end clients’ needs and aspirations, not to mention if interventions are in fact improving their lives. This kind of approach has both a social and commercial benefit, allowing organizations to build more financially healthy customers, and by implication, the financial health of their institutions. Financially healthy customers will save more, borrow responsibly and manage risks better. They could be more financially capable, and possibly use a diverse range of financial products and services that will keep them more than just financially included in the financial system, but rather more financially engaged.

The Private Sector: For financial institutions, fintechs and others working to develop financial solutions for end clients, financial health is a fresh lens with which to examine the end clients’ needs and aspirations, not to mention if interventions are in fact improving their lives. This kind of approach has both a social and commercial benefit, allowing organizations to build more financially healthy customers, and by implication, the financial health of their institutions. Financially healthy customers will save more, borrow responsibly and manage risks better. They could be more financially capable, and possibly use a diverse range of financial products and services that will keep them more than just financially included in the financial system, but rather more financially engaged.

Policymakers and Regulators: For governments and public institutions, financial health is a key objective reflected in their broader mandates to ensure the safety, productivity and welfare of their citizens. A financial health lens is then useful to formulate and enforce financial policies and regulations and drive public initiatives such as responsible financial education, customer protection, decent jobs and social safety mechanisms that improve the financial health of individuals and communities.

Policymakers and Regulators: For governments and public institutions, financial health is a key objective reflected in their broader mandates to ensure the safety, productivity and welfare of their citizens. A financial health lens is then useful to formulate and enforce financial policies and regulations and drive public initiatives such as responsible financial education, customer protection, decent jobs and social safety mechanisms that improve the financial health of individuals and communities.

Development Community: For the development community that has been focused on impacting customers' lives through financial inclusion or the provision of affordable financial services , the approach of financial health can offer a larger and more comprehensive perspective to measure, create and sustain end-customer impact. A financial health lens is needed to revisit and recast our efforts in financial inclusion, and to understand what products, in what bundles and in what settings contribute to the financial health of end customers.

Development Community: For the development community that has been focused on impacting customers' lives through financial inclusion or the provision of affordable financial services , the approach of financial health can offer a larger and more comprehensive perspective to measure, create and sustain end-customer impact. A financial health lens is needed to revisit and recast our efforts in financial inclusion, and to understand what products, in what bundles and in what settings contribute to the financial health of end customers.

Financial Health Working Papers

From Inclusion to Financial Health

Financial inclusion and financial health are fundamentally similar, though with different definitions regarding outcomes. While the ultimate intention of most financial interventions is to improve people’s lives, inclusion and health appear to be on different points of the spectrum, whether intentionally or not. For financial inclusion, the outcome is “to be included” – to have access to (at least one) account, which is being used (with some degree of regularity). Financial health seeks to understand how being “included” (or, not) impacts the financial security, freedom and resilience of individuals and communities. Ultimately, we would hope to learn which products and services, in what bundles, works for whom and in what settings.

A Convener On Financial Health

The Global Centre of Financial Health in Singapore functions as a global impartial financial health convener, innovation supporter, and knowledge hub. It aims to develop a shared understanding of financial health through convenings, cultivation of data and insights, and thought leadership. A financial health lens is more holistic and while it encompasses a deeper focus on end-client outcomes, it also bodes well for the private and public sector, creating not only social impact but also commercial benefits. Initiatives spearheaded by the Centre will enable market players to develop potentially transformative solutions that broaden and deepen financial health outcomes- security, resilience, control and freedom- for all segments of the population, particularly those that have been historically marginalized.

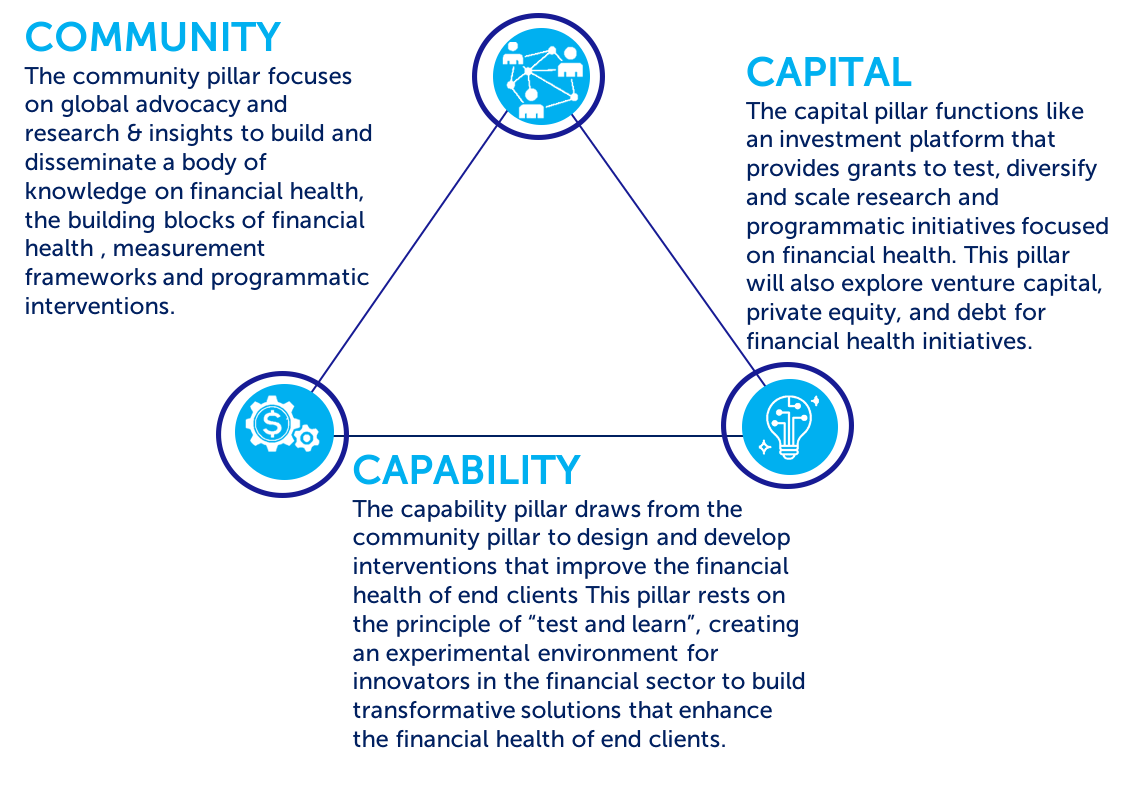

The Centre Encompasses Three Symbiotic Pillars

Stay Connected

GET THE LATEST UPDATES TO YOUR INBOX