Impact Pathways

A tool to measure the intricate role of digital finance in reaching the Sustainable Development Goals

There is a growing body of research that demonstrates the link between access to financial services and improvement in the daily life of low-income populations across a range of Sustainable Development Goals. However, the research has shown that attribution is difficult, manifests over a lengthy period, and is very expensive to measure in a methodologically robust manner. The relationship between financial services and the Goals is direct and clear in some areas and less clear in others. Substantial research remains somewhat inconclusive.

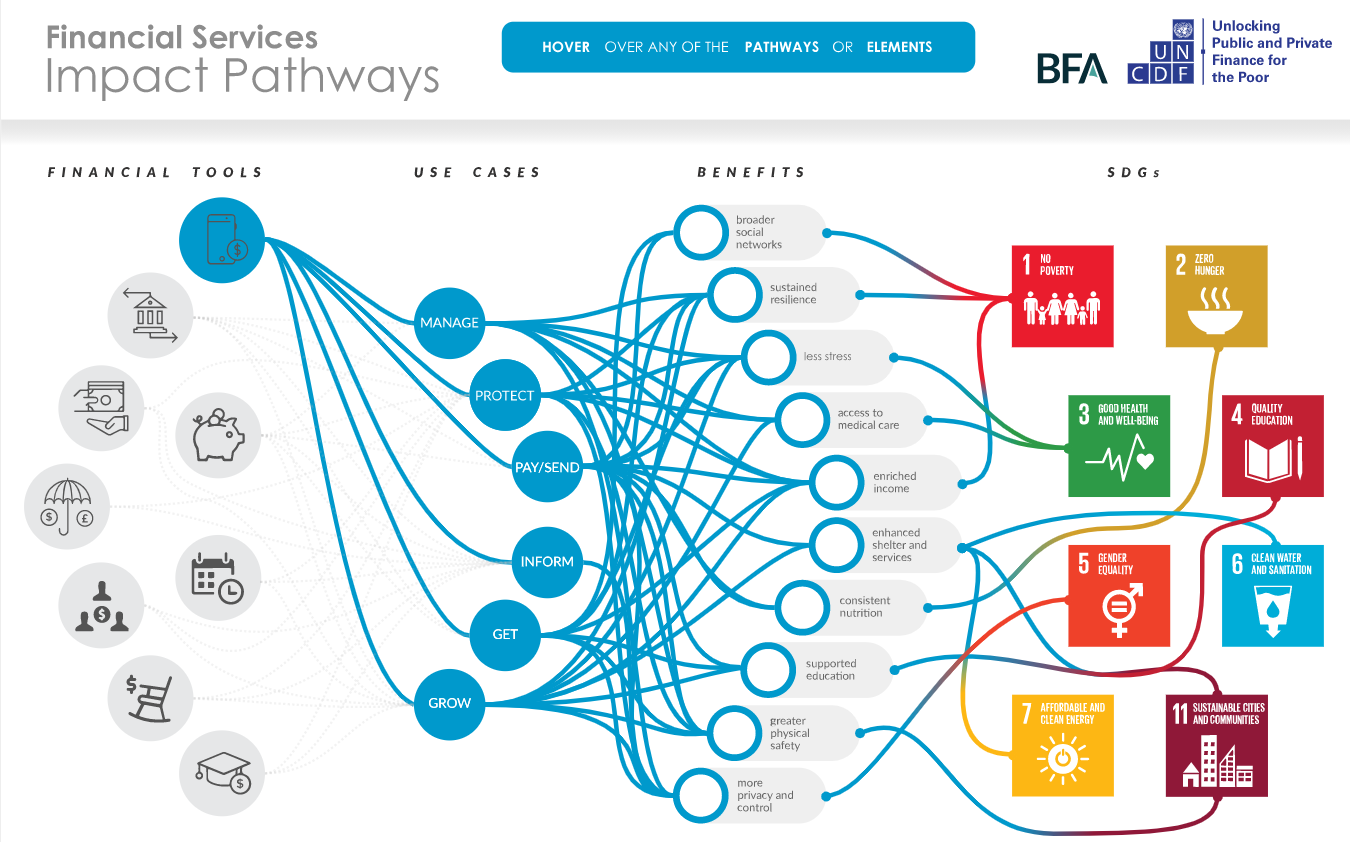

Impact Pathways was therefore designed as a methodology to help illuminate the ‘pathways’ which lead from the use of a particular financial service to the benefits which users experience as a result of that usage, to the potential contribution of the experience of that benefit over time to the SDGs. Many customers experience multiple benefits from a single use-case which in turn leads to positive progress against multiple SDGs. This can be explored using the Impact Pathways Explorer below.

LAUNCH THE IMPACT PATHWAYS EXPLORER

Use the Impact Pathways Explorer to visualize the pathway from digital financial service to SDG. Sources of information and evidence will appear In popups as you hover over each leg of the pathway.

Resources

The Impact Pathways approach provides a series of resources:

Focus Note: Pathways To A Better Life Explore the methodology and key features of Impact Pathways in detail.

Focus Note: Mapping The Benefits of Financial Inclusion Explore the methodology and the comparative analysis of four case studies.

Methodology Technical guide to creating your own Impact Pathways analysis.

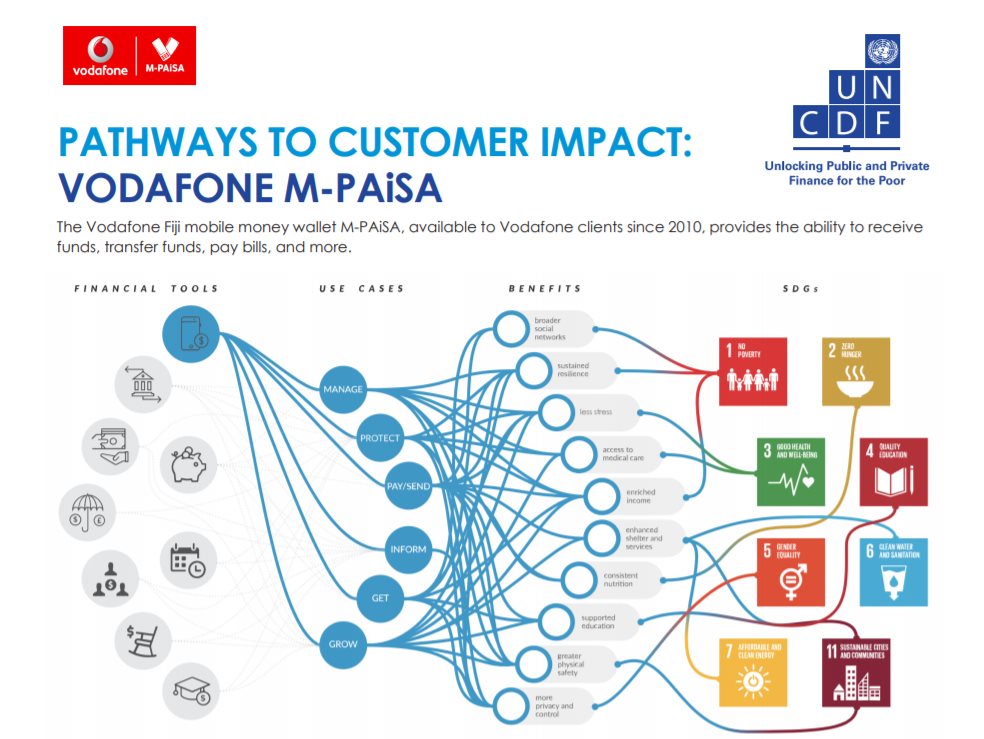

Blog: From Financially Excluded to Entrepreneur with Vodafone Fiji's M-PAiSA

Blog: How new features are changing the way customers use Vodafone’s M-PAiSA

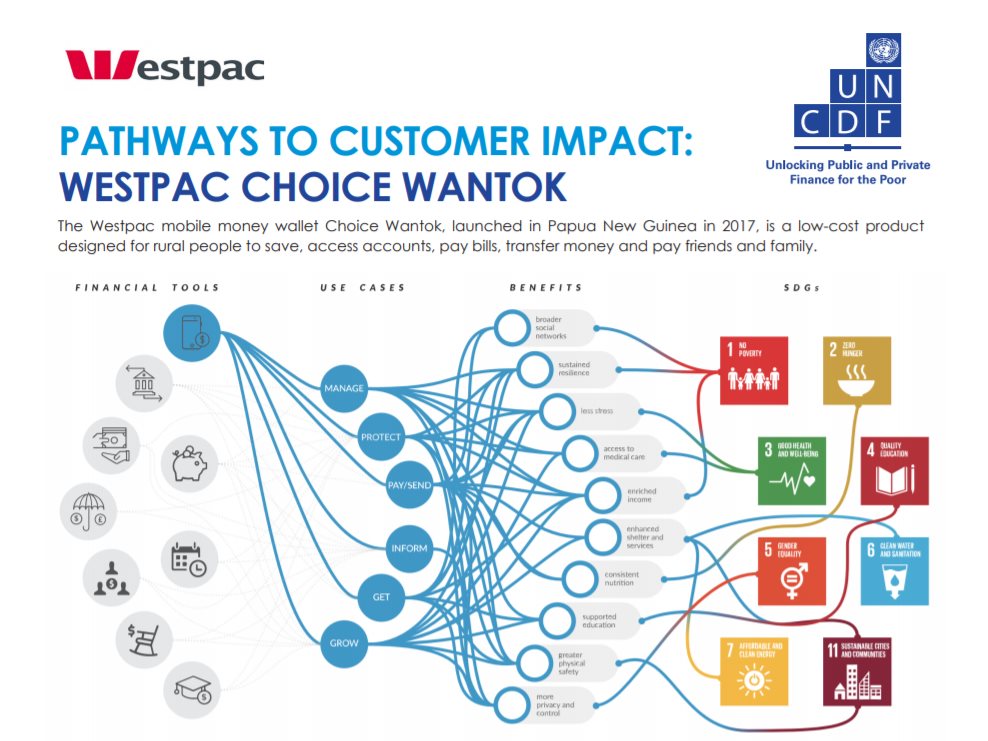

Westpac Choice Wantok Applying the Impact Pathways approach to Westpac’s Choice Wantok account.

ANZ goMoney Applying the Impact Pathways approach to ANZ goMoney.

Vodafone M-PAiSA Applying the Impact Pathways approach to Vodafone M-PAiSA.

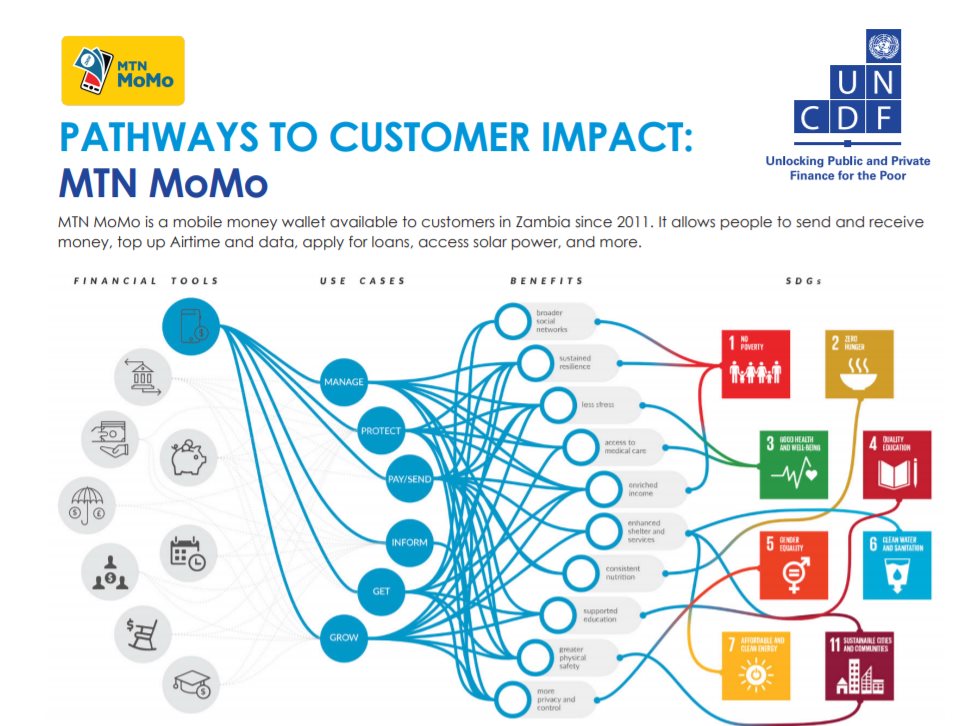

MTN MoMo Applying the Impact Pathways approach to MTN MoMo.

Methodology

The Impact Pathways approach provides a ‘light’ way to measure how investments in the digital economy can benefit individuals and ultimately contribute to meeting the SDGs. The methodology provides to programs and financial institutions a relatively fast and low-cost way of understanding the impact of a range of interventions early on a project lifecycle.

The three stages of the approach are shown below:

Who will find Impact Pathways useful?

Development practitioners can use the insights generated through Impact Pathways to feed into programme design and evaluation. It is particularly useful for pioneering practitioners offering new tools and services in an adaptable way.

Financial institutions can use it to identify how customers are using the service and what benefits they are receiving – critical information to tweak and adapt their value proposition to low-income clients.

Donors can see how and where the interventions they support are making an impact.

About Impact Pathways

Impact Pathways started as an initiative of the Pacific Financial Inclusion Programme. The Pacific Financial Inclusion Programme (PFIP) has helped over two million low-income Pacific Islanders access formal financial services and financial education.

Launched in 2008, PFIP is jointly administered by the UN Capital Development Fund (UNCDF) and the United Nations Development Programme (UNDP) and receives funding from the Australian Government, the European Union and the New Zealand Government. The Programme operates in Fiji, Papua New Guinea, Samoa, Solomon Islands, Timor-Leste, Tonga and Vanuatu. This project was created in close collaboration with BFA. BFA is a global consulting firm specializing in financial services for low income people.

Impact Pathways is supported by:

Stay Connected

GET THE LATEST UPDATES TO YOUR INBOX