What levers to accelerate digital innovation in Senegal?

In November 2019, the Central Bank of West African States (BCEAO) organized, for the second consecutive year, the week of financial inclusion. This regional event is an opportunity for countries in the subregion to take stock of the evolution of digital financial services (NFS).

The various workshops organized during the week allow us to see the state of financial inclusion and the gap that needs to be filled in order to reach the 75% rate targeted by the BCEAO within a five-year horizon.

During this event, UNCDF held the last session of 2019 of the working group on digital finance in Senegal. During the session, UNCDF reviewed the evolution of the digital finance market. The sector is doing quite well: 38% of adults are actively using digital financial services (DFS) at the end of 2018, according to the BCEAO report. And as of November 2019, there are no less than 15 mobile banking offers and 6 mobile money offers on the market. NFS providers are shifted from access to NFS. Everyone's priority is to launch innovative services to improve the use of NFS.

To support this momentum towards innovation, UNCDF presented a new indicator that measures the level of inclusion of digital economies. This indicator and its IDES: Inclusive Digital Economy Scorecard (IDES) for governments and regulators measure and monitor efforts to ensure better inclusion of disadvantaged people.

This indicator and its scoreboard constitute an initial proposal that needs to be refined with the assistance of government and regulators. In this first version, Senegal has a score of 40% for its digital economy and a score of 19% for its digital inclusion level.

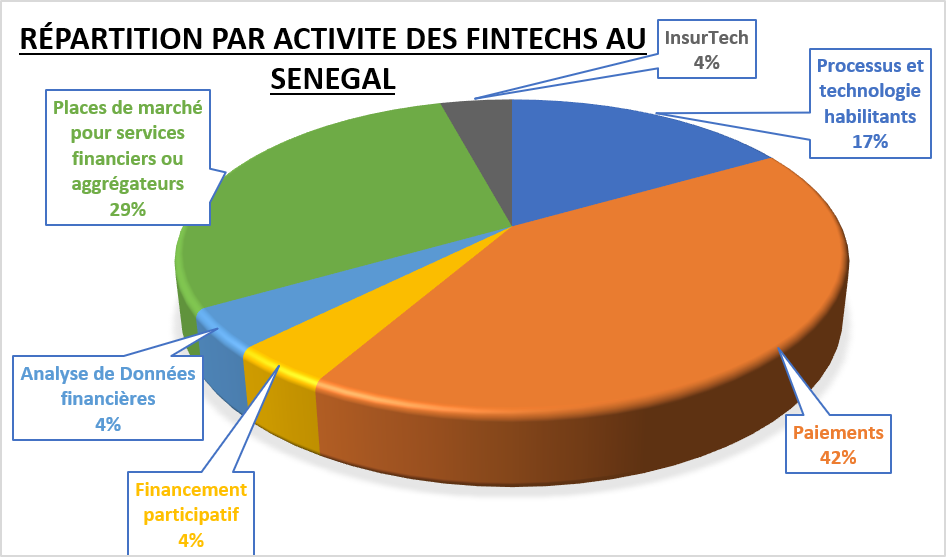

On the other hand, based on our new strategy of “Leave no one behind in the digital age”, we demonstrated to the 106 workshop participants that digital innovation can reduce inequalities, particularly with financial inclusion. In this regard, the Senegalese market can count on Fintech who have made a significant breakthrough: at least 24 Fintech is active, the vast majority of which are in the sector of payments and aggregation of services.

To succeed Fintech must rely on their ability to forge partnerships (commercial/incubation/acquisition/joint venture), talent and knowledge of demand. And in the context of Senegal, these financial technology companies can count on the support of incubators/accelerators, which are highly present and which contribute in particular to the development of partnerships.

In this context, Senegal needs an innovation hub and a regulatory “sandbox”. The sandbox already experienced by UNCDF in countries such as Nepal will address issues such as financial services developed by non-bank operators, data storage (confidentiality, protection), digital identity, and electronic money and cryptocurrencies. The BCEAO has expressed its willingness to facilitate these proposals.

In 2020, UNCDF will work with BCEAO and all stakeholders to better support Fintech in Senegal so that new services that meet the needs of vulnerable populations develop.