The SDG500 Platform Investment Opportunity

SDG500 is a groundbreaking impact investment platform dedicated to financing the Sustainable Development Goals (SDGs). The platform’s objective is to raise USD$500 million for six funds to invest in hundreds of businesses in emerging and frontier markets.

SDG500 was launched by a coalition of partners including United Nations Capital Development Fund (CDF), International Trade Centre (ITC), International Fund for Agricultural Development (IFAD), Stop TB Partnership, Smart Africa, CARE USA and impact asset manager Bamboo Capital Partners. Each partner is associated to a specific fund where it brings its deep expertise and extensive presence in the field.

SDG500 offers an exposure to six impact funds targeting businesses in the agriculture, finance, energy, education, and healthcare sectors in Africa, Asia, Latin America and the Caribbean and Pacific regions. The funds will use either debt or equity to bridge the missing middle financing gap between seed and growth stage for businesses in emerging and frontier markets.

Managed by Bamboo Capital Partners, the six funds provide a diversified, first loss protected, sizeable impact investment opportunity at scale to private investors.

SDG500 will build on the expertise and ground experience of the SDG500 partners to create, jointly with Bamboo Capital Partners, a strong pipeline of viable investment cases for the underlying funds. The funds will invest in businesses at Seed, Series A or B stages. The investment themes include:

- SME financing in the Least Developed Countries (BUILD Fund)

- Technology for impact in Africa (BLOC Smart Africa Fund) and in Latin America and the Caribbean region (BLOC Latin America Fund)

- Health tech businesses in emerging and frontier markets (HEAL Fund)

- Smallholder farmers and small and medium agribusinesses in developing countries (ABC Fund)

- Gender justice, businesses empowering and providing jobs for women (CARE-SheTrades Fund)

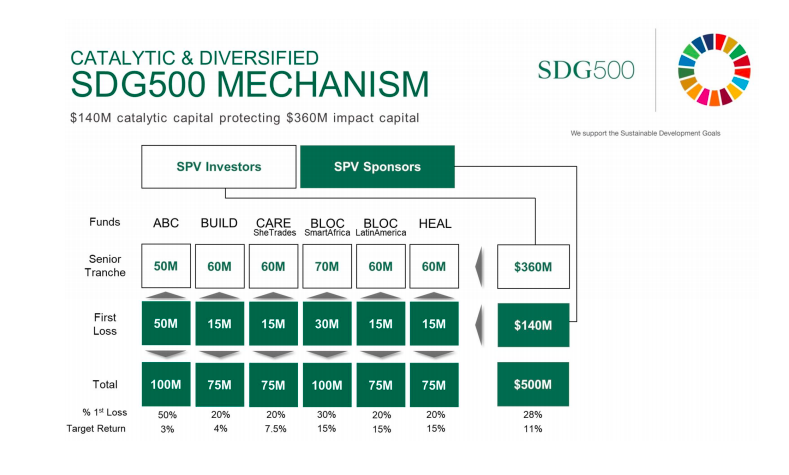

Following a blended finance approach, the six funds will deploy investments with a cumulated catalytic first-loss tranche of $140 million provided by governments, international NGOs, and foundations protecting $360 million of private investment in the senior tranches of the funds. Nearly $90 million of the first loss tranches have already been committed from sponsors including the European Union, the African, Caribbean, and Pacific Group of States, the Alliance for a Green Revolution in Africa (AGRA), CARE USA and the governments of Luxembourg, Germany, Switzerland, Togo, Ivory Coast and Tunisia1.

The platform combining the six funds is targeting a weighted average net return of at least 10% IRR with a hurdle rate of 8.25% for the senior tranche of funding in USD. A lock-up period of 10+2 years is necessary given the nature of the underlying fund investments.

The SDG500 initiative is a landmark opportunity demonstrating a new kind of replicable and scalable public-private partnership whereby multilateral institutions and international NGOs collaborate with governments and leading private investors to drive finance at scale towards the concrete achievement of the SDGs.

For more information, please read the SDG500 Launch Announcement and WEF Article on SDG500 at Davos 2020. To learn more, please contact Jean-Philippe de Schrevel, Founder and Managing Partner of Bamboo Capital Partners (jean-philippe@bamboocp.com).