The Future of FinTech is Female: Celebrating and Supporting Women-Run Start-Ups in Tanzania

For more information, please contact:

Caroline Morrow

Research and Insights Specialist

caroline.morrow@uncdf.org

Tags

This International Women’s Day and beyond, UNCDF celebrates the achievements of Tanzania’s female innovators. We commit to supporting their growth, their co-building of Tanzania’s Digital Economy, and the collective journey towards gender equality.

On March 8, International Women’s Day, we celebrate the achievements of women around the world, while recognizing the persistent barriers to gender equality. This year, in line with our global strategies of Leaving No One Behind in the Digital Era and Women as Builders of the Digital Economy, UNCDF Tanzania is paying special attention to Tanzania’s female innovators.

Innovation in financial technology—fintech—is rapidly disrupting the global financial services industry. It is filling gaps left by traditional financial service providers and enabling the development of products and services in various sectors of the economy—from agriculture and energy to health and education—that people use in their everyday lives to become more productive, healthy, and resilient. While many people are paying attention to the ways in which fintech can benefit women, women and girls are not just “beneficiaries” of innovation. They are agents of change with the potential to create sustainable, digitally-enabled businesses that not only serve other women, but their communities and economies at large.

The fintech landscape in Tanzania

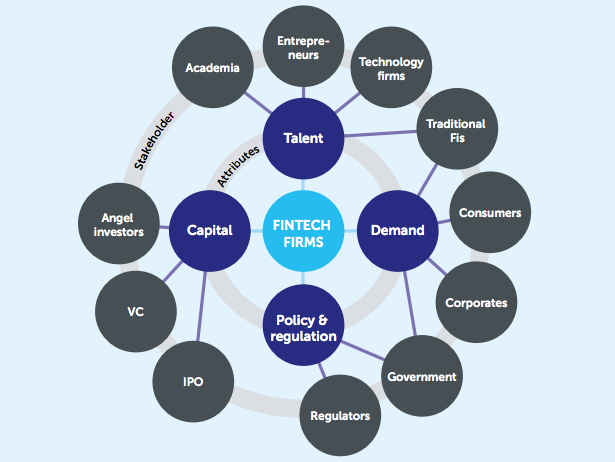

Last year, UNCDF Tanzania together with the Tanzania Information and Communication Technology (ICT) Commission and Sahara Ventures, one of Tanzania’s leading innovation ecosystem facilitators, released a flagship report, The FinTech Start-Up Landscape in Tanzania. With much of the existing information on fintech start-ups in Tanzania fragmented, the report filled an information gap and identified key challenges and opportunities for accelerating growth in the sector. For example:

- There is a small, close-knit community of founders linked through various hubs and accelerators, but generally limited opportunities for mentorship.

- There is a growing pool of local investment actors—including individuals, companies, and development partners looking to provide seed and early-stage funding to fintech start-ups—but many start-ups rely on bootstrapping to support early-stage operations. There is a missing middle and lack of patient capital.

- The government is committed to enabling innovation, but many founders have difficulty navigating the rules of multiple regulatory bodies.

While the challenges identified in the report are felt across the sector, they are particularly acute for female founders. According to a World Bank report, only fifteen percent of founders in Tanzania are female. One of these is self-described serial entrepreneur Lilian Makoi, founder of Jamii Africa, a mobile micro-insurance company, and MipangoApp, a personal finance application. What can we learn from her story?

Women, some of the most focused and passionate people in business

Makoi had been working in the telecom industry when a personal loss inspired an idea. With millions of low-income Tanzanians without health insurance, she saw an opportunity for mobile money to disrupt the health insurance market, as it had banking. She spent time researching and pitching to potential partners before launching Jamii in 2015 in partnership with Jubilee, one of Tanzania’s largest insurance providers, and Vodacom to build a digital policy management platform that facilitates access affordable insurance via USSD. Today, Jamii works with more than 400 hospitals serving over 10,000 customers.*

In July 2020, Makoi launched her latest venture, Mipango, an application that uses artificial intelligence to provide free, personal, mobile-based financial advice. “My co-founders and I had experimented with various personal finance applications, but we saw an opportunity to create a solution tailored to the Tanzanian context—a solution that could serve women like us.” Mipango has seen over 15,000 application installs and is currently focused on securing additional investors and strategic partners that can support them in helping people reach their financial goals.

According to Makoi, limited access to networks and capital are the biggest hurdles for women entrepreneurs. While Makoi benefitted from accelerators and corporate partnerships, “few Tanzanian women have the know-how required to engage with large corporates.” And with few female role models, it’s difficult to gain the confidence to even attempt to break-through in two sectors traditionally dominated by men—finance and technology. Women in Tanzania are typically more constrained than men in their ability to access credit for a range of related reasons including high collateral requirements, limited prior experience with financial institutions, and gender biases.

Likewise, in fintech, female founders are less likely to even get to the due-diligence stage of a potential investment. In Makoi’s experience, outdated and misguided assumptions about women play a big role. “Venture Capitalists often think that our responsibilities as wives or mothers will distract us from running a successful business.” In reality, however, “female founders are some of the most committed, focused, and passionate people in the innovation ecosystem.”

While Makoi shared that she is optimistic about the growing number of venture capitalists who want to invest in women and minority founders, this is a relatively recent shift in thinking. Women-founded fintechs have raised only one percent of total fintech investment in the last ten years, and that is at the global level—will we see the same shift in thinking in Africa and, if so, how long will it take for the impact to be felt on the continent?

Makoi’s story is just one example, but it highlights how female founders are disrupting markets to serve people who have not traditionally reaped the benefits of digital technology. At the same time, it makes clear the need to do more to advance gender equality in fintech. So, what next? Four recommendations—adapted from those we put forward in the original fintech start-up landscape report—are below.

A Call to Action

Develop Female Talent. Provide tailored long-term, high-quality mentorship and leadership training opportunities for women-led enterprises. These could include coaching on how to overcome gender biases and engage with corporate partners, as Makoi was able to do. There are a number of players already focusing on supporting women entrepreneurs in some of these ways who can serve as examples, such as Ndoto Hub, SafeSpaceco, SheCodesForChange, and Apps and Girls.

Build Women’s Demand for Digital. Seek investment into hybrid high-touch/high-tech digital and financial literacy solutions (like this financial education toolkit) to address the gender gap in these areas, which constrain women’s trust in and demand for digital services—in turn hindering start-ups’ ability to scale. At the same time, build start-ups’ capacity to leverage data generated by digital solutions to better-understand consumer behavior and develop products and services that meet women’s real needs.

Partner with Policymakers. Work with policy makers to make government more accessible to the innovation community. This could include facilitating stakeholder dialogues or exploring the use of regulatory sandboxes that focus on innovative products and solutions for women. UNCDF’s recently-released Regulatory Playbook for Zambian FinTechs may also serve as a model for helping FinTechs in the Region navigate regulatory landscapes and enter the market safely.

Invest in Gender-Lens Investing. Create a pipeline of investment-ready women-led businesses that meet the growing interest in gender-lens investing. Globally, UNCDF has joined the 2X Collaborative, which recommends criteria for gender-lens investment, and through which we are promoting the use of blended finance solutions to support women-led and gender-responsive businesses. Locally, the newly launched UNDP Tanzania FUNGUO program is creating a portfolio of investment-ready impact ventures, with a focus on women and youth. UNCDF will be exploring ways to support these innovators through a partnership with the program, while continuing to support initiatives that increase women’s access to finance and close the gender gap in capital at the last mile.

While these recommendations are by no means exhaustive, they provide examples for how the innovation ecosystem can support female entrepreneurs. This International Women’s Day and beyond, UNCDF celebrates the achievements of Tanzania’s female innovators. We commit to supporting their growth, their co-building of Tanzania’s Digital Economy, and the collective journey towards gender equality.

---

* Source: Digital Insurance Agenda, ‘Jamii: Bringing affordable health insurance to low-income Tanzanians’, https://www. digitalinsuranceagenda.com/featured-insurtechs/jamii-bringing-affordable-health-insurance-to-low-income-tanzanians/ and UNCDF, The FinTech Start-Up Landscape in Tanzania