Briefing Note 2

Financial health-centric insurance for catalyzing customer wellbeing and business growth

Written by: Mayank Jain and Akshat Garg

Contact for more information:

Jaspreet Singh, Global Lead on Financial Health and Innovation, jaspreet.singh@uncdf.org

Rakhi Sahay, Partnership Specialist, rakhi.sahay@uncdf.org

Tags

© UNCDF/Bhavesh Bhati

© UNCDF/Bhavesh Bhati

As a part of UNCDF's Centre for Financial Health learning series on individual financial health and its relevance to public and private actors, we release our second briefing note for insurance providers. We explain how financial health data can help insurers to pre-empt consumers' financial condition, thereby moving the insurance focus from risk protection to risk prevention and wellbeing. Financial health approach can aid insurers in designing inclusive products while also boosting consumer trust and business growth.

Introduction

Insurance cushions people against a variety of unforeseen risks, builds retirement savings and contributes to inclusive finance development by making credit and investment products viable for financial institutions. Insurance is also a stronger enabler of Sustainable Development Goals (SDGs) including zero poverty, zero hunger, universal health coverage, decent work, and climate action. Moreover, the Covid-19 pandemic has demonstrated that countries lacking insurance provisions and social safety nets stand at higher risks of social and economic crises. Thus, insurance plays a pivotal role in improving people’s financial health and advancing sustainable, resilient, and inclusive societies.

Despite these remarkable benefits, life insurance penetration (premiums/GDP) and consumer trust in insurance is declining globally. This is due to several factors including inadequate risk coverage and retirement savings amid rising health and socio-economic risks, complicated contracts, limited customer engagement, and opaque wellbeing benefits.

There are also parallel demographic challenges: the increased need for old-age security in a population that is rapidly ageing and living longer, and increase in chronic illness among young adults which undermines their productivity and reduces wealth accumulation.

Addressing these challenges require insurers to look beyond traditional business models and focus on a spectrum of dynamic financial needs of consumers including financial literacy, financial behaviour, and aspirations during their life cycle. Financial health (or financial wellbeing) is a potential approach for insurers to fulfill market needs and overcome challenges.

In Briefing Note 1 on the banking sector, we discussed how focusing on customers’ financial health can create new value for bankers and customers alike. The purpose of this briefing note is to help readers gain a better understanding of financial health practices and opportunities in the insurance sector, with focus on life and health insurance. We visit the financial health concept, it’s business case, and approach to building a financial health-centric insurance business.

Understanding financial health

Just like insurance companies, individuals also have financial goals of having sufficient liquidity to manage short-term expenses (i.e. financial security), protection against unforeseen risks (i.e. financial resilience), balancing assets and liabilities (i.e. financial control), and accumulating cash for financing future goals (i.e. financial freedom). All these financial outcomes put together are generally referred to as ‘financial health’ (or financial wellbeing).

Financial health is influenced by a multitude of individual and external factors. Direct drivers of financial health include money use behaviours (such as saving, spending, and borrowing), financial confidence and control, socio-economic variables of income and expenditure changes, and work status. In addition, factors such as money management behaviours (i.e., budgeting and keeping track of money), financial attitudes, knowledge, and experience indirectly impact financial health. Figure 1 below depicts the simplified conceptual model of financial health.

Figure 1: Simplified Conceptual Model of Financial Health

Figure 1: Simplified Conceptual Model of Financial Health

The business case of financial health for insurers

A recent study by The Geneva Association recognises four key drivers that necessitate reimagining the fundamentals of existing insurance business models through financial health:

- Retirement insecurity as a result of increased longevity, rapidly ageing population, and weakened old-age family support.

- Rising healthcare spending due to population ageing, chronic illnesses such as obesity among young adults, and technological and quality advances in medical treatment.

- Economic factors include persistently low-interest rates, which affect returns on long-term savings for retirement and changing working patterns such as gig work resulting in irregular income and savings.

- Increased digital technology adoption resulting in shifting customer expectations and preferences for accessing products and services.

Below we discuss why focussing on customers’ financial health makes a strong business case for insurers.

Minimize risks to promote wellbeing of customers and business sustainability

There is a strong association between financial health and well-being as well as risk factors such as poor financial behaviours, bad health, and socio-economic shocks that indirectly influences well-being. There is also a reverse relationship; financial stress can lead to bad physical and mental health including increased physical pain, lowered pain tolerance, and risk of coronary heart disease. In fact, financial health is the leading cause of poor mental health of employees in the workplace, as per the MetLife 2021 Employee Benefit Trends Study.

Without preventive risk measures in place, individuals can experience financial difficulties and shocks regardless of their income, wealth, education, and or age. Breaking this perpetual cycle of vulnerability and well-being over longer lives is where efforts to improve financial health become critical.

Financial health can be a powerful tool for insurers to pre-empt consumers’ financial status and emotions and move the insurance needle from risk coverage to risk prevention. Data science and technology can then be leveraged to offer tailored solutions that promote individual financial security. Proactive risk management can result in reduced insurance claims and boost profits for insurers and improve the overall well-being of customers.

A few insurers are already redefining their services and strategically taking a more holistic view of consumers' needs in their offerings. For example, Manulife’s MOVE app enables customers to track and improve their health and rewards them with lower premiums for healthier habits. Metlife’s Upwise, a financial wellness app, allows any individual to analyse and track their financial behaviour and make personalized recommendations to achieve good financial habits and financial health.

Design tailored insurance products for different life stages

Most health and life insurance products today focus on risk protection and building retirement savings rather than addressing the financial needs of consumers during different life stages. In a rapidly changing business and socio-economic environment, selling insurance products with fixed premiums is simply not sufficient to meet people’s financial needs and aspirations. Insurance solutions must address changing lifestyles and new market realities such as an ageing population, increased health risks, and deeper technological penetration.

Just as telematics has fundamentally changed motor insurance propositions by tracking and impacting driving behaviour, financial health can be leveraged to make insurance solutions more need-centric and influence better financial behaviours and lifestyles. For example, health insurance can be repurposed to encourage and reward healthy habits, and insurance-linked savings products should aim to fulfil savings goals at various life stages. Moreover, people demonstrating and maintaining good financial health can be rewarded with a lower premium on insurance renewal or new products. Offering financial health-centric solutions has a favourable impact on customer and business KPIs including customer numbers, retention, experience, and engagement, as the global survey of 25 large life insurers finds.

Uplift consumer trust in insurance by demonstrating its impact on people’s financial health.

The insurance industry grapples with trust issues despite protecting people from a variety of risks. Besides complicated product contracts and communication, trust issues can also be attributed to the insurers pivoting focus on products, pricing, and premiums rather than customer experience, needs, and impact. This creates an antagonistic relationship between customer and insurer, rather than a fiduciary one, limiting trust and engagement.

Demonstrating insurance value in achieving financially resilient lives is one way to influence customers' perceptions of insurance. This can be achieved by the measuring financial health of customers and reporting back the realised benefits and avoiding monetary losses, as a result of insurance. We are not advocating that financial health as the panacea to mistrust in insurance. Rather, it can tip the scale in favour of customer-centricity and institutional accountability which can strengthen customer trust in insurers and lead to increased business growth and shareholder value.

Financial health can be a barometer to track and influence customer outcomes.

The concept of financial health is particularly relevant for insurers as it is the primary purpose of insurance, particularly for life and health products, and serves as the intermediate link between financial capability and overall wellbeing. Thus, tracking the drivers of well-being such as financial health, physical and mental health, becomes fundamental to understanding whether insurance positively contributes to people’s lives in addition to the risk protection strategies they already employ. Furthermore, insurers can leverage financial health data to enhance wellbeing through better customization of products, personalised advisory, and seamless insurance delivery via digital means.

Promote inclusive-insurance markets

Inclusive insurance is generally referred to as “appropriate and affordable insurance solutions for the unserved, underserved, vulnerable, or low-income populations”. Inclusive insurance can prevent the vulnerable segments from falling into the vicious cycle of poverty through efficient preventive and coping strategies including building long-term savings.

The need for inclusive insurance arises as conventional insurance may not work effectively for the excluded segments for reasons, inter alia, low financial literacy, lack of risk data, affordability, and remote delivery.

Data on financial condition and risks is particularly crucial as it will aid insurers in understanding the needs and risk profile of the unserved customers, allowing them to design insurance solutions that are affordable and manage risks adequately. Good data is also the key to developing inclusive insurance markets and creating an enabling environment for innovation, as reverberated by a2ii in its note on inclusive insurance.

We believe financial health can be the pathway to accelerating inclusive insurance markets. Country-level financial inclusion and financial health surveys such as Global Findex or those undertaken by the Central Banks provide a good diagnosis of the financial situation of the target segments. Insurers should collaborate with development agencies, banks, and fintechs to develop tools for quick financial health diagnosis of the unserved customers leveraging both survey and transactional data. The financial health data can also assist insurers in obtaining necessary policy and regulatory support from state actors.

Strengthen contribution to SDGs

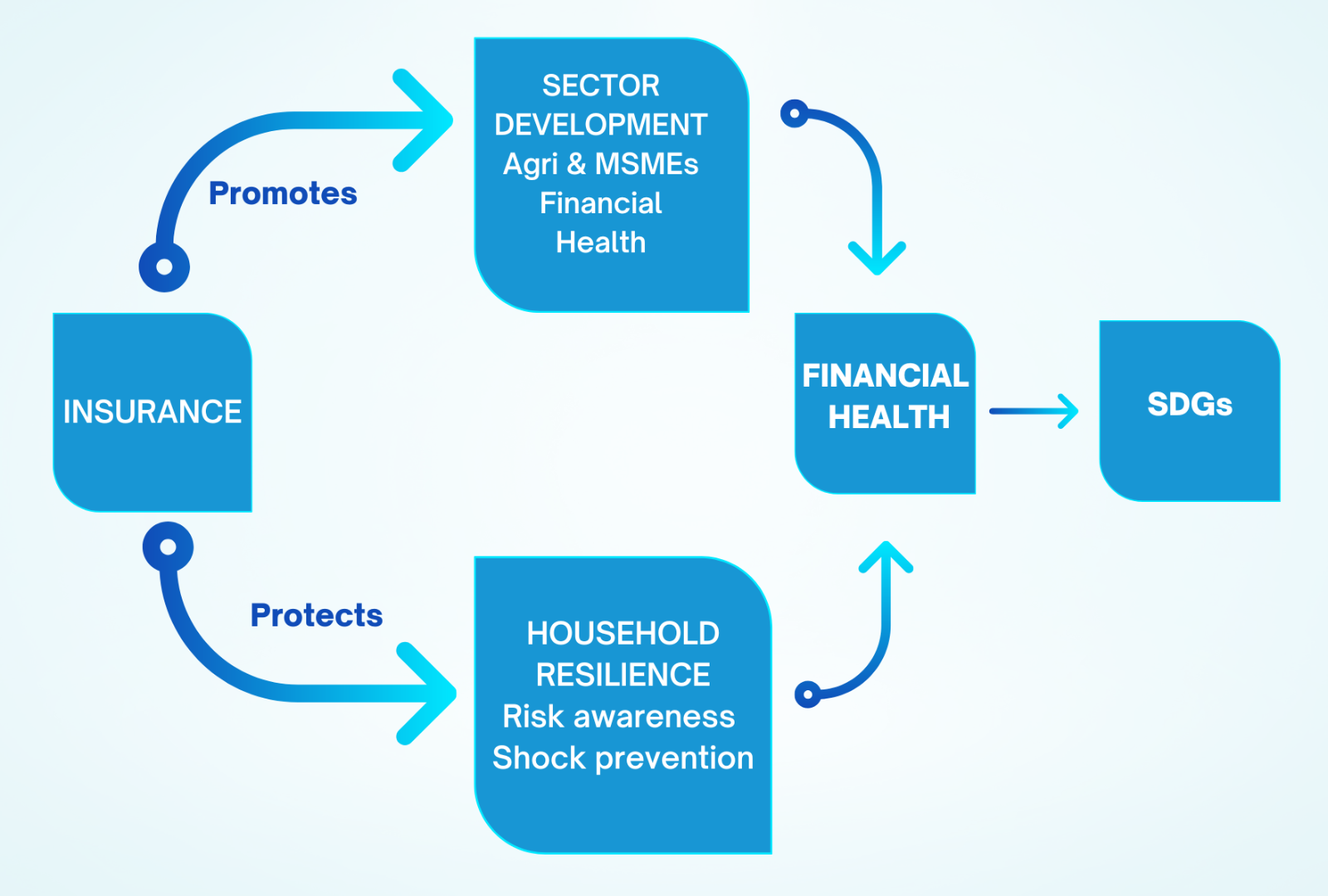

Presently many leading insurers measure and track their contributions to SDGs as part of sustainability/ESG reporting using an exhaustive list of SDG-linked KPIs crafted by a2ii. There is however limited understanding and empirical evidence on how insurance links and contributes to SDGs. Financial health may be the intermediate linkage between insurance and key SDGs, including SDG 1 (No Poverty), SDG 3 (Good Health and Wellbeing), SDG 5 (Gender Equality), SDG 8 (Decent Work and Economic Growth), SDG 10 (Reduced Inequalities).

* Adapted from a2ii promotion and protection pathways from insurance to outcomes

Financial resilience, a dimension of financial health, is increasingly being advocated and pursued as an instrument for sustainable development to keep low-income customers from falling back into poverty as a result of economic shocks. Moreover, countries with strong financial resilience are more likely to have lower levels of wealth inequality. Financial health is also a pathway to good physical and mental health and well-being of customers and strongly influences work productivity.

All in all, financial health is a promising pathway for insurers to increase their contribution to the SDGs.

Steps to promote financial health of customers

1. Diagnose customers’ financial health

Deep customer insights are now at the core of how insurers can redefine their business strategy and value proposition to promote both individual financial health and business sustainability.

Conducting (digital) financial health surveys can be a good starting point for insurers to generate insights into the financial status of customers. Insurers can holistically evaluate all four dimensions of financial health and summarise indicators into a single financial health score. Alternatively, insurers can also choose to focus on specific aspects of finance, such as financial resilience.

Insurers can also develop custom financial health tools or use existing methodologies designed by experts around the world, including the Consumer Financial Protection Bureau, Financial Health Network, Kempon et al, and Commonwealth Bank of Australia. Choices of the financial health tools, and indicators, should be informed by the insurer’s financial health definition and measurement purpose in the context of their customers and business.

Based on a review of the various financial health tools, and in accordance with UNCDF’s financial health framework, we propose the following key indicators that insurers could use to diagnose customers' financial health.

Figure 2: Prospective financial health indicators to measure using surveys

2. Design solutions to address 360° financial needs and goals of customers

The next step is to combine deeper insights into customers' financial conditions with needs and pain points to create consumer-centric financial health solutions that address the full spectrum of financial needs and goals. This will require insurers to invest in data and embed data science at the core of product design. Doing so will enable insurers to better understand the dynamic customer needs and behaviours and shift the insurance focus from risk protection to risk prevention.

We suggest starting with low-hanging fruits such as encouraging promoting financial literacy, insurance-linked savings products, simplifying product descriptions, and providing digital tools for budgeting and financial planning. Also, forming strategic alliances with government, banks, fintech development and research agencies can help accelerate holistic financial health propositions and digital delivery that customers today demand.

3. Track customer and business outcomes to reflect and act

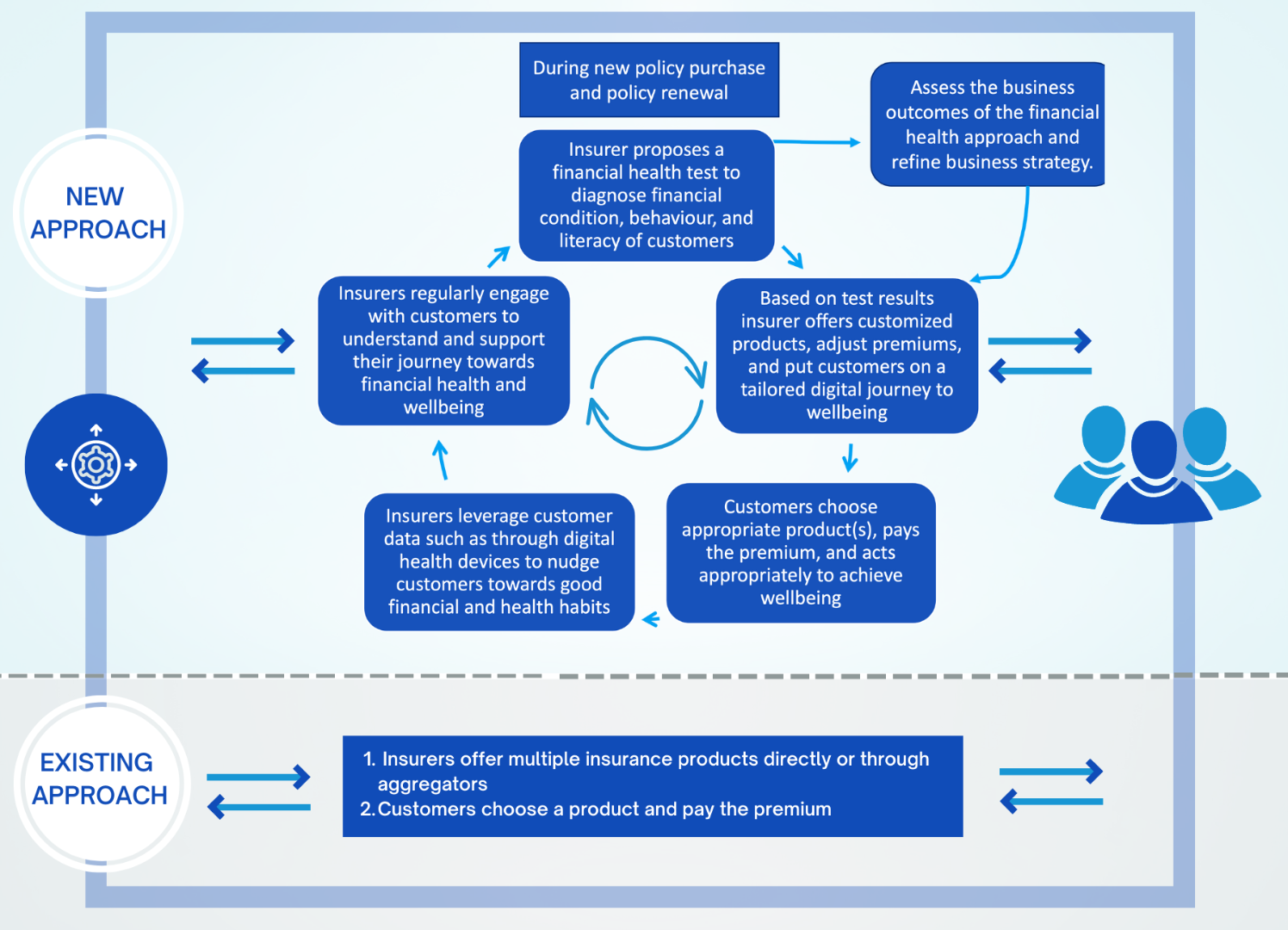

The overall financial health approach is centred on ensuring that insurance helps customers meet their financial needs and goals, while insurers successfully navigate their business future. This means that designing financial health solutions is an iterative process, as described below. The process works in the form of a learning loop, starting with understanding the financial condition of customers, then offering customised products, and putting them on a path to achieve financial goals and wellbeing.

Insurers should also leverage the customer data to assess the impact of a financial health-centric strategy on business outcomes such as sales, profit, customer engagement, satisfaction, and retention. These business metrics, when combined with customer outcomes, should guide insurers to continually refine their business strategy to navigate the market successfully.

Bottomline

Customer expectations from insurers are changing from mere risk protection and retirement savings to ensuring their financial health and wellbeing. This requires insurers to go beyond traditional solutions and place financial health at the very heart of their business models. Building prosperous financial lives will require insurers to thoroughly understand both the drivers and outcomes of financial health and create user-centric pathways to assist customers in achieving their financial goals.