Malaga Global Coalition: Putting together the pieces of a financial ecosystem that works for cities and local governments

Tags

Under the impulsion of UNCDF , UCLG and FMDV, the Malaga coalition reunited on the 16th of June 2022, convening individuals and institutions committed to putting together the pieces of a financial ecosystem that works for cities and local governments.

Please click here to watch the recording of this meeting.

Without changing the current system it will not be possible to transform our economies and meet the triple challenge of human wellbeing, planetary health, and urban growth. The building blocks of the ecosystem for local finance needs to be assembled to meet the needs of the Green, Urban and Productive transition.

Building on the policy agenda put forwards in the first preparatory conference with city leaders and further fleshed out in the UNCDF 2022 publication “Local Government Finance is Development Finance”, this conversation gathered 28 high level speakers , including mayors.

Speakers focused on the importance of the following building blocks ,expansion of local government finance, development of local capital markets, the strengthening of local climate finance mechanisms, the expansion of local fiscal space, the support of multi-level development finance for the full implementation of the Rio Conventions and the New Urban Agenda.

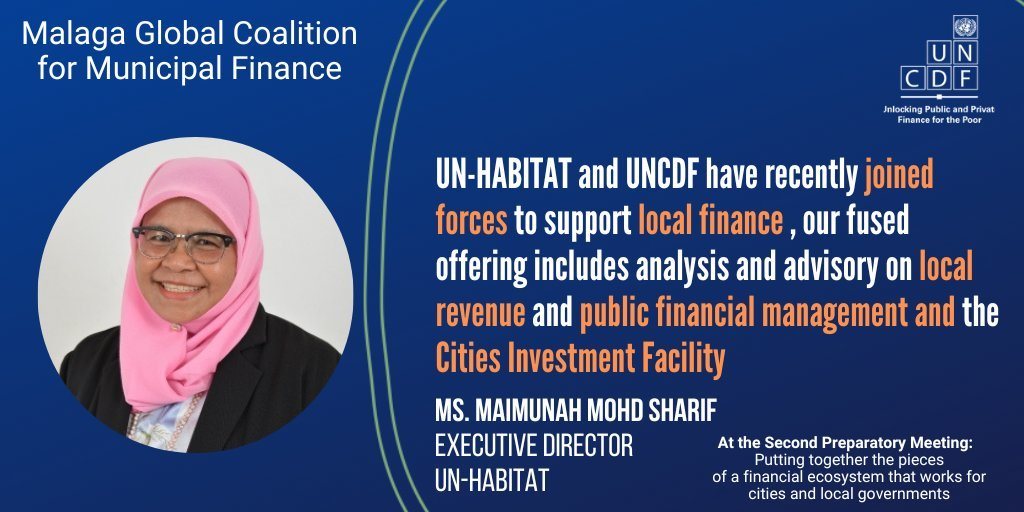

This conversation benefited from the inputs of Ms. Maimunah Mohd Sharif

Executive Director of UN-Habitat the custodian agency of the New Urban Agenda which commented that "we need a more effective financing ecosystem that channel finance to all scales and geography of cities, this include those places that have been left behind for all".She also introduced the UN-Habitat and UNCDF fused-offering for cities ( SDG Cities and Cities Investment Initiative) , as a "solution to bridge the gap between financing needs and sustainable, financeable and transformative projects".

Emilia Saiz Secretary,General of UCLG, stated that "the Malaga Coalition is a coalition of the willing, a coalition of those that believe that we need to change the way we finance local government". She stated that "the ecosystem of the Malaga coalition was progressing , through inter-agency cooperation but also through new tools and mechanisms , like the use of the data of the World Observatory or the creation of The International Municipal Investment Fund that is providing technical assistance but also making sure that we create a pipeline that are financeable and transformative".

Preeti Sinha UNCDF's Executive Secretary of stated that "some of the building blocks for an ecosystem that works for Cities were already being implemented, like the LoCAL approach which aims to become a non market approach under Article 6.8 of the Paris agreement that will enable local access to global climate finance through national systems. Also through the International Municipal Investment Fund as an instrument of this Malaga coalition that shall soon be active and actively investing".Finally,she gave the example of Tanzania that has begun the process of building a domestic market for multiple bonds to recycle local savings and pension funds into transformative infrastructure.

David Jackson,Director of the Local Transformative Finance Practice of UNCDF demonstrated why Local government finance is development finance as illustrated in the book of the same name, he stated that "the climate change crisis and the accelerating urbanization were major disruptions to the achievement of development as there can be no future for any of us without a healthy and livable planet".

He added that "in addition to the productive transition through economic growth we actually need, the green transition and the urban transition to happen but the question is , how do we finance them ?"

Previous meetings of the Malaga coalition have contributed to understanding the type of transformation, we need in our towns and cities, but the current policy on development finance is not making this happen, despite resources being there, but the current arrangements are not able to deliver them at scale because they don't recognize that local government finance is a form of development finance.

Five essential reforms are needed to trigger the required capital flows to make this financial ecosystem work,

- Increased fiscal transfers to local governments, as an effective instruments of a national development, particularly for the deployment of climate finance.

- Enhanced scope for local government taxation fees and asset management to boost local fiscal space

- Expanded domestic capital markets for long term debt, finance and the recycling of domestic savings through local government bonds.

- City friendly equity finance to provide stable and city friendly partnership

- Global guarantee funds for cities to defray defray sovereign liability on sub national finance

Mr. Navid Hanif, Assistant Secretary-General for Economic Development -UN DESA stated in his closing remarks that" as a close partner of UNCDF and a member of the Malaga coalition, the Financing for Sustainable development Office will continue to support local governments and ensure that effective local government finance remains a global development imperative".

He mentioned four key policy interventions that support local government,

- The first point is that access to long term finance and local government finance must not exist in a vacuum, it must be rooted in a sound institutional setting, with a clear assignment of functions and revenue generation responsibilities. It must be supported by predictable and transparent intergovernmental transfers.

- The second point is that National governments can provide technical support and guidance for local government finance.

- The third point is that Multilateral national and municipal development bank's can support local governments, by lending more widely and applying innovative credit announcements that lower the cost of financing, both public and private, fourthly there's a need to enhance local capacity for project development.

- Finally programmatic approaches to engage local governments and stakeholders on development finance South south cooperation is crucial

Mr. Jean Pierre Elong Mbassi Secretary General ,UCLG Africa also expressed the need for local finance as a development financing mechanisms,

The full list of panelists and participants can be found below.

Agenda

8-8.20am Welcome and Opening Session

The strategic importance of local government finance to development

• Ms. Preeti Sinha, Executive Secretary, UNCDF

• Ms. Emilia Saiz, Secretary General, UCLG

• Ms. Maimunah Mohd Sharif, Executive Director, UN-Habitat

8.20-8.30am Setting the Scene

The imperative for a global financial ecosystem that works for cities and local governments

• Mr. David Jackson, Director of Local Transformative Finance Practice, UNCDF

8.30-10.10am The Building Blocks

What are the building blocks of a global financial ecosystem that works for cities and local governments? Moderated discussion with contributions from:

• City Friendly Investment Pipeline

Mr. Dyfed Aubrey, Senior Advisor, UN-Habitat

Mr. Mohammad Abbadi, Senior Investment Manager, UNCDF

• City Guarantee Facility

Mr. Lars Gronvald, Team Lead for Urban Development, DG INTPA Unit F4, European Commission

• Direct catalytic lending to local governments

Ms. Charulata Singal, Investment Specialist, Least Developed Countries’ Investment Platform, UNCDF

• Long term city friendly equity

Mr. Salim Bensmail, Executive Director, The Urban Resilience Fund (TURF), Meridiam

• Global mechanisms for fiscal transfers to local governments

Mr. Saidou Halidou, Secretary General, Ministry of Interior and Decentralization, Niger

• Local mobilization of domestic capital

Mr. Alawi Ahmad, Project Resource Mobilization Coordinator, Tanga Urban Water Supply and Sanitation Authority, Tanzania

Mr. Baye Samba Lo, Public Procurement and PPP Consultant, Ministry of Economy, Planning & International Cooperation, Senegal

• Improved own source revenue

Hon. Mrs. Regina Bakitte Nakkazzi Musoke, Mayor of Nansana Municipal Council, Uganda

• Empowered financial intermediaries

Mr. Rajivan Krishnaswamy, former CEO of Tamil Nadu Urban Development Fund, India

Mr. Augustin Nkamleun Fosso, Permanent Secretary, Network of African Institutions for Local Government Financing (RIAFCO)

Prof. Paul Smoke, Professor of Public Finance and Planning; Director of Global EMPA, New York University

Mr. Jean Pierre Elong Mbassi, Secretary General, UCLG Africa

Mr. Jean-Francois Habeau, Executive Director, FMDV

• Subnational lending by International Financial Institutions

Ms. Khomotso Letsatsi, Municipal Finance Consultant, South Africa

• Data for sub-national finance

Ms. Isabelle Chatry, Head of Decentralisation, Subnational Finance and Infrastructure Unit, OECD Centre for Entrepreneurship, SMEs, Regions and Cities

10.10-10.50am Would this work?

Response by some key actors – what difference would these reforms make to your city?

• Hon. Mohamed Sefiani, Mayor of Chefchaouen, Morocco

• Hon. Yvonne Aki-Sawyerr, Mayor of Freetown, Sierra Leone

• Prof. Eugenie L. Birch, Professor of Urban Research & Education, University of Pennsylvania

10.50-11am Next Steps

A consensus around what is desirable in the longer term, what is feasible now and what is the correct sequencing of initiatives

• Mr. Navid Hanif, Assistant Secretary-General for Economic Development, UN Department of Economic and Social Affairs (DESA)

• Mr. David Jackson, Director, Local Transformative Finance, UNCDFEnsure that these are included as a key component of national development strategies. This covers both discretionary fiscal transfers for general use and targeted transfers for issues such as climate change.

About UNCDF

The UN Capital Development Fund makes public and private finance work for the poor in the world’s 46 least developed countries (LDCs). UNCDF offers “last mile” finance models that unlock public and private resources, especially at the domestic level, to reduce poverty and support local economic development. UNCDF’s financing models work through three channels: (1) inclusive digital economies, which connects individuals, households, and small businesses with financial eco-systems that catalyse participation in the local economy, and provide tools to climb out of poverty and manage financial lives; (2) local transformative finance, which capacitates localities through fiscal decentralisation, innovative municipal finance, and structured project finance to drive local economic expansion and sustainable development; and (3) investment finance, which provides catalytic financial structuring, de-risking, and capital deployment to drive SDG impact and domestic resource mobilisation.