(Challenge Complete)

Resources related to the challenge

- Pacific Islands Fintech Innovation Challenge Aiming to Boost Financial Inclusion, Digital Payments in the Pacific Region

- 11 Teams Confirmed for the Pacific Islands FinTech Innovation Challenge

- The Pacific Islands FinTech Innovation Challenge Winners Announced

- Pacific Islands FinTech Innovation Challenge 2022 Wrap-up

Background

To help address the challenge of financial inclusion in Pacific Island Countries (PICs), the United Nations Capital Development Fund (UNCDF) is launching the Pacific Islands FinTech Innovation Challenge.

The challenge aims to attract local and global FinTechs with market-ready solutions to address identified problem statements which represent the challenges faced by Pacific Islands Countries in developing the digital payments ecosystem.

Funded by the UNCDF, Market Development Facility (MDF) , and the Asian Development Bank (ADB), the challenge will strengthen cross-sector collaboration by bringing together the financial ecosystem in PICs to support innovation and financial inclusion.

UNCDF invites eligible applicants to submit a proposal for live solutions that addresses one or more of the following challenges. You can also find more information on implementing partners and access some FAQs here:

Entity registration

- The applicant/lead applicant must be a registered entity in any country with at least 2 years of operations as a FinTech company.

- The applicant/lead applicant must have audited financial statements for at least one operating year; if audited financial statements are not available at the time of application, the applicant must provide the latest management accounts.

Relevant operation licenses (when applicable)

- The lead applicant must be legally able to operate as a technology provider and have appropriate regulatory licenses in its home country. If the applicant plans to provide a financial product and/or service directly in the target geography, the applicant should either have licensing or a reasonable plan to partner with a licensed provider in the target country.

Country of operation

- The applicant can be registered and conducting operations anywhere globally.

Consortiums (when applicable)

- Applicants can apply only once under this RFA, whether independently or in a consortium.

- Joint applications between market players in the target country or countries are encouraged if the solution proposed will expand delivery networks and promote rural and/or other last-mile access to market and financial services.

- Applications from consortiums should be attached with the signed consortium agreement.

- The lead applicant and their partners in the consortium must be registered entities with at least two years of operations and must have statutory accounts and audited financial statements for at least one operating year. If audited financial statements are not available at the time of application, the applicant must provide the latest management accounts and provide UNCDF with audited financial statements during the partnership

Solutions to be supported

- Must have a live solution with an active customer and/or user base and should not be in development or testing phase. Active customer/user defined as having transacted with the start-up/solution at least once in the last 90 days.

Winning FinTechs will receive:

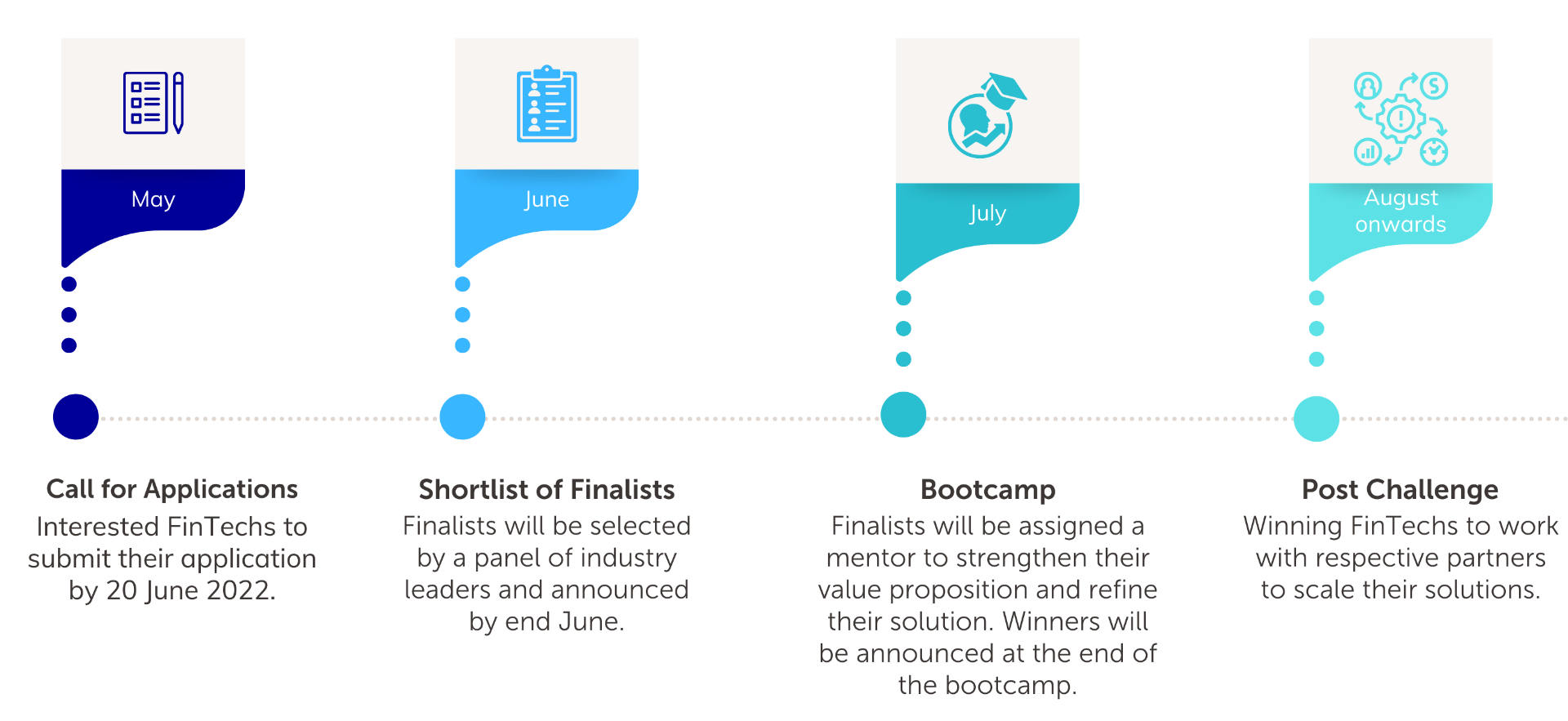

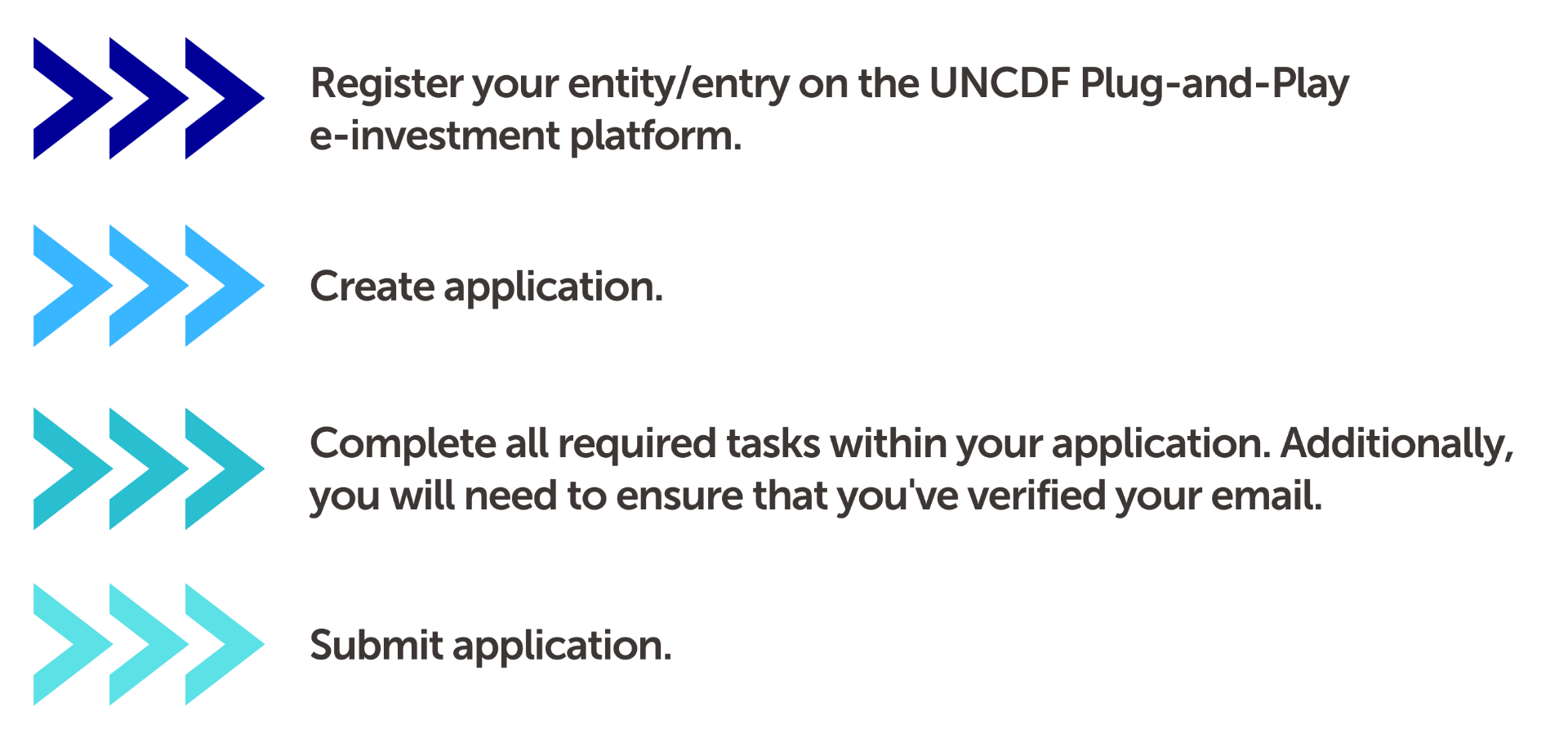

FinTechs are to submit their application, along with the required documents, through our dedicated online UNCDF Plug-and-Play e-investment platform.

Inquiries to applications may be submitted by email to:

ajay.jagannath@uncdf.org cc uncdf.rfa@uncdf.org.

For any email enquiries, please include in your subject line: “The Pacific Islands FinTech Innovation Challenge”

The UN Capital Development Fund (UNCDF) makes public and private finance work for the poor in the world’s 46 least developed countries.

Pacific Digital Economy Programme

The Pacific Digital Economy Programme (PDEP) is one of the successor programmes of the UNCDF Pacific flagship Pacific Financial Inclusion Programme (PFIP). PDEP supports the development of inclusive digital economies in the Pacific by applying digital solutions that meet the needs of vulnerable islanders, narrowing the digital divide.

The initiative is implemented in Fiji, Tonga, Samoa, Vanuatu and Solomon Islands.

PDEP is jointly administered by UNCDF, UN Development Programme (UNDP) and UN Conference for Trade and Development (UNCTAD) and is funded by the Australian government.

Sponsoring Partners:

Supporting Partners:

Implementing Partners:

Knowledge Partner:

Donors:

Stay Connected

GET THE LATEST UPDATES TO YOUR INBOX